Carl Firth built ASLAN Pharmaceuticals thanks to Big Pharma, investment banking…and beer

The pharmaceutical industry has become the Big Tobacco of the 21st century. While tobacco companies were slammed for deliberately hiding research that showed smoking causes cancer, public ire towards drug companies stems from price gouging. From 500 percent price hikes (EpiPens) to eye-watering 5,000 percent jumps (Daraprim), accusations of amoral exploitation are levelled at perceived greedy pharmaceutical executives.

To make matters worse, these drugs are key to treating AIDS patients and potentially life-threatening allergic reactions.

“The way [former Turing Pharmaceuticals CEO] Martin Shkreli defended his position [in raising the price of Daraprim to US$750] did a tremendous amount of damage to the industry,” concedes Dr. Carl Firth, CEO of ASLAN Pharmaceuticals. While Daraprim and EpiPens are no longer protected by patents – they were both developed in the 1950’s – “because of how the markets shaped out, [these drugs] took on dominant market positions. That becomes much more difficult to justify when we talk about some of the crazy price increases we’ve seen.”

He adds: “Having said that, I think we should be focused on trying to lower the cost of generic drugs and low-innovation drugs. But for the drugs that are new, we have to make sure that we provide an incentive to companies such as ASLAN that invest money to create them.

“If I’m going to an investor to ask for $20 million to develop a drug, if he doesn’t see a good price at the end he won’t invest the money.”

Big pharma, big money

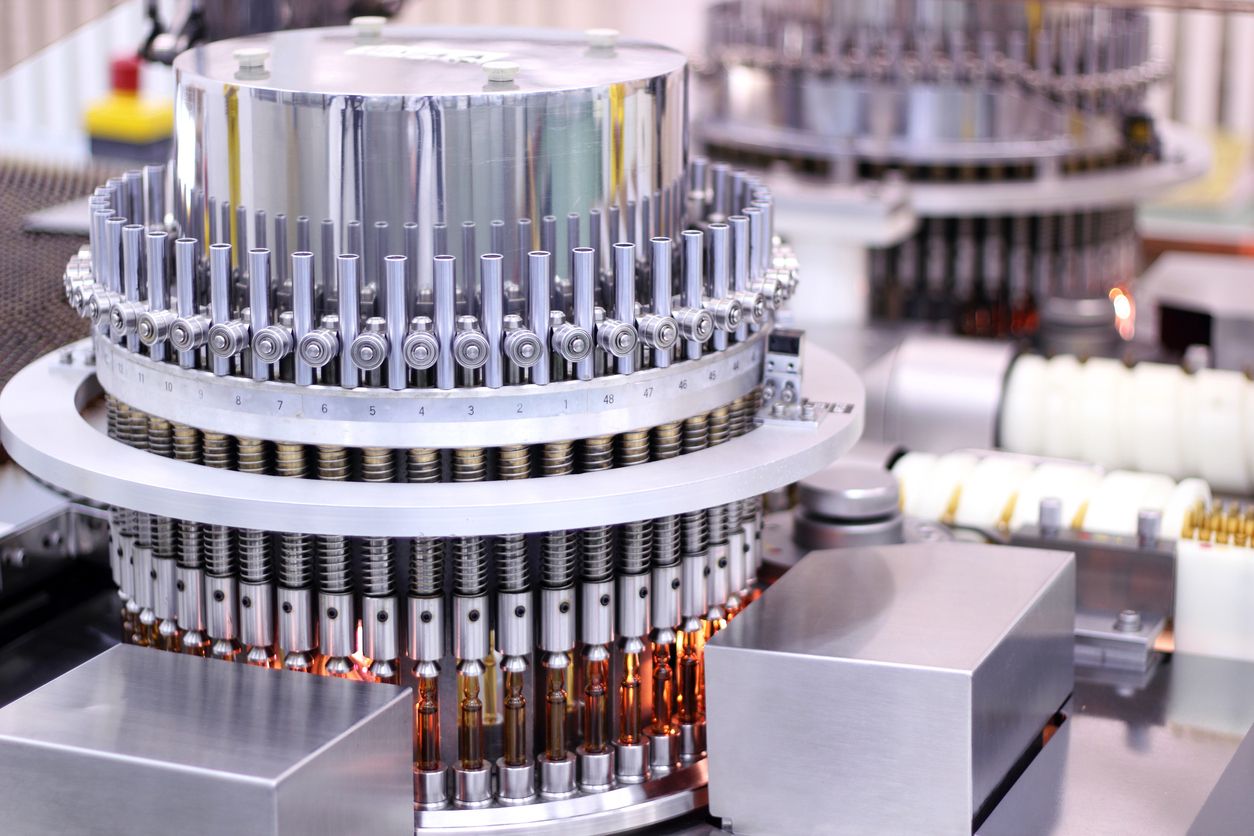

ASLAN, which only last month gained approval to list on the Taipei Exchange, is “a biotech company focused on the development of immunotherapies and targeted agents for Asia prevalent tumour types” as per its website. While a public listing opens up a major source of funding for developing potential blockbuster drugs, Firth describes how profits margins are narrowing despite seemingly ever-rising prices.

“As an industry, the profitability has been coming down quite significantly,” Firth elaborates. “Especially in the U.S., while the prices have been going up, the discounts have also been going up.

“The way it works in the U.S. is: if I’m selling to a hospital or a distributor at $100 per box of drugs, and they want to get a good deal by bargaining the price down, I don’t want my headline price to go down because everyone else will hear about it.

“So I’ll say, ‘You pay $100 for this box, and I’ll give you a $20 discount on your next order.’ Those discounts for certain type of drugs now reach 40 to 50 percent of the price in the U.S., and the discounts are climbing faster than the price increases. That has hurt profitability.”

Speaking at a recent SMU Wee Kim Wee Centre CEO Talk entitled “From a garage to IPO in 6 years – Building Singapore’s largest biotech”, Firth described how he went from being a molecular biologist to an investment banker and eventually an entrepreneur in the high stakes pharmaceuticals industry.

While his stint at Merrill Lynch taught him the ins and outs of finance – “Working in a bank helped me understand how investors think” – his decade spent at pharmaceuticals giant AstraZeneca provided the framework of how he wanted to run operations.

“When you’re working in an MNC,” Firth recounts his time at AstraZeneca, “we have a set budget for the year, say, $100 million. At an MNC, the incentive is trying to spend that $100 million.

“If your projects are going badly, and you realise, ‘Oh, I’m only going to spend $50 million,’ you’ll find a crappy project just to spend the rest of the money. Because if you don’t spend that $100 million by the end of the year, management will cut your budget for next year.

“At a smaller company, if we can save a million dollars, we’ll do that. It’s quite different from working in an MNC.”

Of beer and (going) bust

Firth also bemoaned the excessive number of meetings at big pharmaceutical companies, saying “I spent 90 percent of my time in meetings, so we wanted none of that [at ASLAN]”. When he recruited former AstraZeneca colleague who felt the same way about corporate life, building a core team was easy. Finding the right people thereafter proved more difficult.

“When I recruit for someone in a senior position, I always take them out for a beer,” Firth reveals. “I want to see what they are like after three or four beers. It’s not because I want to get them drunk, it’s because people let their guard down when they drink. You start to see a side of them you wouldn’t otherwise see.

“I ask myself after dinner: ‘Would I actually want to hang out with this person?’ We can get skillset assessment wrong, and maybe they can’t do some things we thought they could. But if they are fun to be with and we can get along with them, it makes things easier.”

He adds: “And if you really have to let people go, then you do so when you realise it’s best for everyone involved.”

As ASLAN prepares to become a publicly-listed company, Firth recalls the many close shaves the business has had in the six years since he became an entrepreneur.

“Many years ago, we nearly couldn’t pay our bills,” Firth says. “My head of finance was calling up our suppliers, saying, ‘If you really make us pay now, you’ll force us out of business. Why don’t you wait another month or two, and you’ll at least see some of your money?’ Finance is like that, you could go close to the ground one day, but once the money comes in it gets easier.

“Not everyone is meant to be an entrepreneur. Always project three to five years ahead, and then look back and say, ‘What would I like to have done in that time?’ But you’ll learn so much more in a startup than if you stay in an MNC.”

Follow us on Twitter (@sgsmuperspectiv) or like us on Facebook (https://www.facebook.com/PerspectivesAtSMU)