The global economy is showing resilience, despite strong headwinds. Geopolitical uncertainty remains high, while the mounting threats from climate change call for more urgent global action.

Given the turn of world events in 2022, it is little wonder that "permacrisis" was the word of the year according to the editors of the Collins English Dictionary. Meaning “prolonged period of instability and insecurity”, it sets the stage for us to confront the difficulties the world faces in 2023, and most likely even beyond. Russia’s invasion of Ukraine has become the most significant land war in Europe since the end of the Second World War. In addition, it has not only heightened the risk of nuclear escalation to a level that the world has not experienced since the 1962 Cuban Missile Crisis, but also triggered the most comprehensive sanctions regime in recent memory. As if things cannot get worse, soaring commodity prices have driven inflation to its highest across the globe since the 1980s, posing the most substantial macroeconomic challenge in today’s financial landscape.

In this article, I first offer a thumbnail sketch of the global growth picture in 2023, particularly that of Asia, before I elaborate on some major ongoing developments and their effects. China’s post-zero-COVID reopening will support the economy, but the growth rate will decelerate in the medium term. Challenging business conditions in the country, alongside worsening geopolitical anxieties amid rising US-China tensions, will encourage investment diversification among multinationals. Meanwhile, the high cost of borrowing will somewhat deter investment. Finally, I look at how the world addresses complex questions on the green transition, and the major implications it will have for governments, economies, companies, geopolitical alliances, and society at large.

THE WORLD IN THE SECOND HALF OF 2023

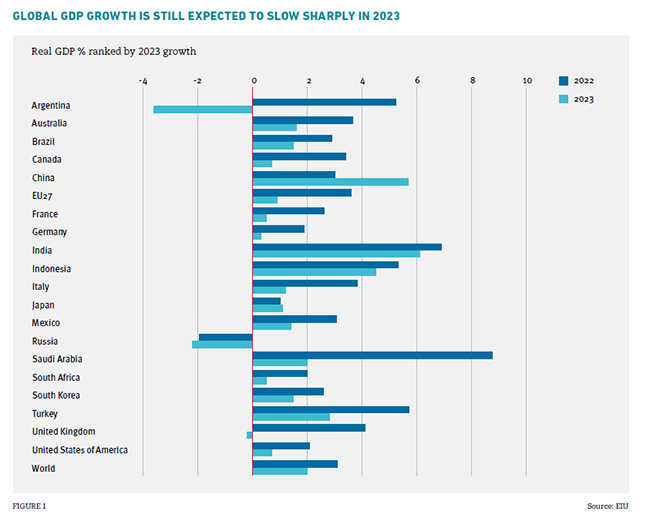

Global economic growth will slow sharply in 2023, reflecting persistent headwinds stemming from the ripple effects of the war in Ukraine, as well as high inflation and rising interest rates. The global economy is expected to grow at around two percent in 2023, measured at market exchange rates, which is substantially higher than that for a typical recession year, yet it is still some way off the three-percent growth experienced in an average year. That said, the world economic outlook is brighter than it was at the end of 2022, owing in large part to China’s post-zero-COVID reopening.

In the Asia Pacific region, India will be the fastest-growing big economy this year, followed by China and Indonesia. Meanwhile, South Korea, Australia, and Japan are also in the top 10 of the Group of Twenty (G20) growth table for the year ahead (refer to Figure 1). Overall, Asia is a relative bright spot in 2023.

However, the overall picture is still weak, and growth in global trade will slow significantly this year, even if this is not universally true across Asia. High interest rates worldwide and low investor sentiment–stemming from geopolitical strains and global economic uncertainty–will depress market confidence. Economic slowdowns in the US and the EU will depress global demand until late 2023 as tighter credit conditions discourage household and business spending. Slowing global demand will also be a constraint on Asia’s growth in 2023. The trade slump would be more significant were it not for the moderate strengthening expected in Chinese demand, which will provide some support for shipments in Asia.

CHINA’S POST-COVID RECOVERY

China is now an upper middle-income economy, especially when looking at its eastern provinces. Its GDP per capita is quite similar to that of many European countries, albeit the slightly poorer ones like those in Eastern Europe. China’s growth story is an important one for the world (especially for the 21-member Asia-Pacific Economic Cooperation), although it is changing. If we ignore the ups and downs related to the COVID-19 pandemic, China’s baseline growth rate is around four to five percent, and by the end of the decade, this will drop to just under three percent.

A three-percent growth rate is what we would expect of a developed market in a fairly good year, and it would not be out of place in countries like the US or Germany. However, when China hits this rate, it will not be as rich, and it will be a big step-down compared to its GDP growth rates in the past decade, which were more than or sometimes even triple of those of developed nations.

This year, China’s economy is projected to grow at 5.7 percent as a result of its reopening, thereafter growth will begin to decline again; this would be a slow rebound compared to that of most other countries coming out of lockdown. The era of China as a high-growth economy is certainly over.

Why China will slow down

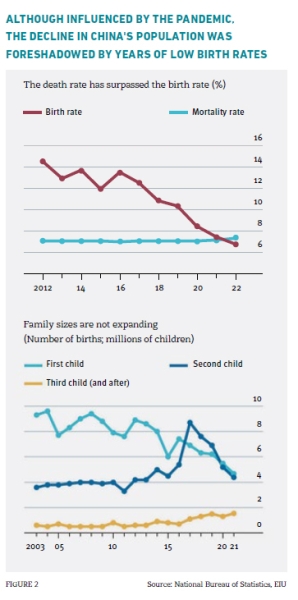

Three main internal factors explain why China’s growth rate will slow in the coming years. First, its population is contracting. Earlier this year, Economist Intelligence Unit (EIU) found data that confirmed the population shrinkage in the country (refer to Figure 2). The workforce age group between 15 and 64 has been shrinking since 2015, and there has been an increase in the number of elderly. The fall in the population came after years of low birth rates, although the figures also reflect the impact of the pandemic–and associated economic downturn–on national fertility rates.

The second key drag on China’s growth rate is falling levels of productivity. Historic evidence tells us that private- sector firms are, overall, much more productive and efficient than government-run firms. However, the Chinese government has been expanding the role of state-owned enterprises in the economy. Capital and workers have been reallocated from private to public firms, which has meant moving resources away from more productive activities towards less productive ones. All of this is reducing the overall productivity of the Chinese economy, as well as the output per worker and per unit of capital.

The third key drag is the end of the construction boom. China in the past needed a lot more houses, roads, and infrastructure, and as a result, the government was actively focused on construction. Despite how much money was going in, there was enough new economic activity to soak that up. However, that period has now ended as China’s economy matures. Property firms are loaded up on bad debt, and there are big bubbles in the construction sector and house prices in the country. The year 2022 witnessed the broadest and steepest deterioration in China’s property sector since 1998, with new home sales shedding RMB 5 trillion (US$744 billion) in value. EIU estimates that the property-related drag totalled 1.6 percentage points of real GDP growth in 2022. Notably, house prices in Beijing and Shanghai, compared to incomes in those cities, are the highest in the world, and that boom has run out of legs. Evergrande is the biggest property developer in trouble, but a lot of its peers are also running out of money, and the government has had to step in to provide support.

Tensions in geopolitical ties and their impact on China’s economy

China’s growth is also affected by the deterioration in its geopolitical relationships. The country is experiencing tensions with Australia, Japan, the Philippines, South Korea, and the US and other nations, too. Russia is the only large country that still maintains close political relations with China. The two countries have planned a pipeline–Power of Siberia 2–to deliver natural gas to China via Mongolia, as Russia pivots away from Europe and re-orients its gas exports to Asia. However, the pipeline is unlikely to come on stream until the early 2030s (if at all). On balance, China’s support of Russia has damaged its relations with several countries, particularly in the West. This has affected inbound and outbound investment opportunities, even if trade had remained resilient.

Semiconductor chips, a crucial input for almost all technology, are the most pertinent example of how the tensions are unfolding. China is reliant on US semiconductor technology, and on South Korean and Taiwanese semiconductor manufacturing, because what China produces domestically is much less sophisticated. At the same time, there has been a renewed push towards reshoring, and much of this is driven by US controls on exports of advanced semiconductor technology to China. This has halted the development and production of advanced chips in China, and the country is unlikely to achieve self- sufficiency in these chips in the foreseeable future.

Still, China is pouring substantial resources into its semiconductor sector, which should entail a degree of self- sufficiency in lower end semiconductor segments. In the next five years, China is likely to achieve cost advantages over international competitors in many mature technologies, including 4G chips used in telecommunications towers and phones, and analogue chips used in automotive and white goods. This will have consequences for global prices (which could fall) and global supply chains. Ultimately, China has a good chance of reaching the frontier of semiconductor technology.

JITTERY FINANCIAL MARKETS

Years of ultra-loose monetary policy by major central banks in the aftermath of the 2007-08 global financial crisis kept the cost of capital close to zero around the world. This in turn forced investors to look elsewhere for attractive returns, and large amounts flowed into speculative assets, fintech start- ups and shaky cryptocurrencies like Bitcoin, among others. However, with the rise in interest rates amid persistently high inflation, the cost of capital has gone up. Investors are back to favouring traditional assets that would produce higher yields, explaining the 2022 cryptocurrency collapse. Stock markets have also been falling; tech stocks and private equity in particular are bearing the brunt. Overall, the high cost of capital is likely to raise the hurdle for investment in new technologies.

The banking sector will have a challenging year ahead because of higher interest rates, resulting in an increasing number of loan defaults. There will be more distress in international debt markets, and countries will face higher costs on their borrowing. A number of countries such as Sri Lanka and Pakistan have already experienced financial crises. Bangladesh and Mongolia are two other countries in Asia that are also facing debt stress in the year ahead.

The recent collapse of three regional US banks, Silicon Valley Bank, Signature Bank, and First Republic Bank, as well as the emergency buyout of Credit Suisse in Switzerland, have triggered heightened investor uncertainty, raising the risk of bank runs and financial sector contagion. However, there are reasons that a financial crisis of the scale of what happened in 2007-08 is still unlikely. This year’s bank failures were probably one-off events that can be attributed to these banks’ overexposure to interest-rate-sensitive bonds or, in the case of Credit Suisse, long-standing management issues. A global liquidity crisis remains unlikely for now, given the commitment by the European Central Bank, the Federal Reserve, and other major central banks to establish liquidity facilities and credit swap lines with at-risk banks. Nevertheless, volatility is likely to persist in the coming months, notably as continued monetary policy tightening is prompting investors to re-evaluate where and how they allocate their assets.

Price pressures are slow to subside

Interest rates have had to rise because of high inflation. Since 2009, price pressures stood at zero to two percent, and most economic difficulties were related to overly low or even negative inflation rates. However, in recent years, supply chain disruptions, higher commodity prices, ultra-loose monetary policy, and recovery from the pandemic have all contributed to a sharp uptick in inflation in the US and the EU. Although central banks have resorted to aggressive interest rate increases to bring inflation down, price pressures have been reluctant to subside. For instance, despite falling headline inflation, core inflation (which excludes energy and food prices) continues to rise in the EU. All of this is likely to bring about a shift in how monetary policy works, and in the mechanisms through which central banks can control inflation. Global inflation is likely to ease from an estimated 9.3 percent in 2022 to 7.0 percent in 2023, losing momentum as global demand softens and commodity prices continue to ease back from their 2022 peaks.

Commodity security takes centre stage

The main driver of high inflation has been Russia’s invasion of Ukraine in early 2022, which caused the prices of all major commodities to rocket, as the two countries have historically been large suppliers of both agricultural and refined commodities. Prices for most commodities are likely to remain high in 2023-24, compared with their 2019 levels. Against this backdrop, commodity security has moved to the centre of economic decision-making in a way not seen before the pandemic. In addition to food security, governments are concerned about gaining access to materials such as copper and lithium that are essential to the global green and digital transition. There is also a desire to enhance the security and resilience of commodity supply chains amid heightened geopolitical uncertainty. High commodity prices will add to the challenges facing green transition, with a major impact on developing countries.

THE GREEN TRANSITION

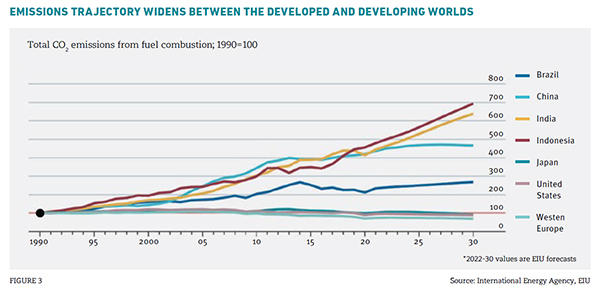

We are seeing quite a strong shift to a low-carbon economy in the developed world over the medium term, particularly in the EU. However, there is little change in the emerging markets. The global economy will approach a crunch point over the next decade where climate policy will either have to shift decisively towards adaptation, or there will be big changes in emerging markets, particularly in Asia.

Since the Kyoto Protocol was signed in 1997, emissions in developed countries have not grown very much at all, and in some cases have fallen. In most cases, they are now lower than they were in 1990, but they need to go even lower if the world is to meet net-zero targets by 2050. Meanwhile, the emerging world has seen quite a lot of emissions growth. By 2020, each of the three big Asian markets–China, India, and Indonesia–had roughly quadrupled their emissions since 1990 (refer to Figure 3). China’s emission levels are just about peaking, but we expect Indonesia and India to increase their emissions very rapidly. Compared to 40 years ago, they now produce a lot more emissions. Net-zero targets are near impossible to achieve unless the big emerging markets start to reduce their emissions soon. However, in the near term, there is no political will in these economies to do so.

Rapid changes in climate policy will be required by the end of this decade if the world is to hit the 2050 goals. Energy systems take a while to transform, but power stations have lifetimes of 20 to 30 years: if we are not on course by 2030, then it is highly unlikely that we will get there by 2050.

THE TIPPING POINT

Geopolitics and trade are closely linked. Businesses need to watch geopolitical relations between major countries, their supply-chain linkages, and their major trade partners. Deteriorating US-China ties constitute one of the biggest fault lines in today’s world. The two countries have been on a collision course for the better part of a decade, and there is little prospect of an improvement in relations. Tensions between China and the US (and the West) will remain high in the foreseeable future, and the pressure for third countries to choose sides between China and the US will emerge as a major trade and geopolitical theme over the 2020s.

As we exit the pandemic and with the ongoing war in Ukraine, we are in a new era of business and the global economy. Many trends, such as China’s demographic shifts and the green transition, were already unfolding even before the COVID-19 pandemic hit the world. However, their pace has accelerated, and has become more salient. China’s dramatic exit from its zero-COVID policy, the reshaping of commodity supply chains, heightened international tensions, and the green transition will be important factors to watch over the next decade.

Dr Simon Baptist

is Global Chief Economist of Economist Intelligence Unit