A win-win-win model for the post-pandemic business landscape.

There is one and only one social responsibility of business—to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud. – Milton Friedman 1

Five decades after its publication, Friedman’s doctrine about the purpose of business remains a subject of vigorous debate. Those defending him point to the fact that owing to capitalism, the proportion of people living in extreme poverty has dropped from 42 percent of the global population to under 10 percent today. On the other hand, those opposing his ideas cite the deepening income inequality, rising unemployment, and the inability of lowly-paid frontline workers to work remotely amidst the Covid-19 pandemic as some of the evidence suggesting the failure of shareholder capitalism.2

While opinion about shareholder capitalism remains deeply divided, there is no denying the increasing calls to reject it in favour of a more balanced stakeholder approach. In fact, in 2019, the US Business Roundtable abandoned its long-held position about the primary purpose of the corporation, which stated that “the paramount duty of management and of boards of directors is to the corporation’s stockholders”. Instead, 181 CEOs adopted a new one that commits to delivering value to a wider array of stakeholders, including customers, employees, suppliers, and communities, in addition to shareholders. Elsewhere in the world, including Asia, more CEOs and boards of directors are hard at work transforming their companies into ‘purpose-driven’ organisations.

In the rest of this article, we offer our views on three questions:

1. What is driving this change of stance?

2. Which is the relevant model: shareholder or stakeholder capitalism?

3. What would it take for organisations to enjoy enduring success in today’s transparent world?

Drivers of change

Adding to the list of usual suspects like rising income inequality, uneven economic growth, climate change, pollution, rising global population, and depleting natural resources, there is another powerful force at play in driving change: ordinary customers and consumers. Thanks to technology, they are empowered with easily accessible information and the ability to have their voices heard. In the pre-Internet days, businesses could get away with bad behaviour and hide information from the markets—today, it is nearly impossible for businesses and their leaders to do so. Boeing, Cambridge Analytica, Volkswagen, and Wells Fargo are just some recent examples of companies where unethical behaviours were exposed in record time.

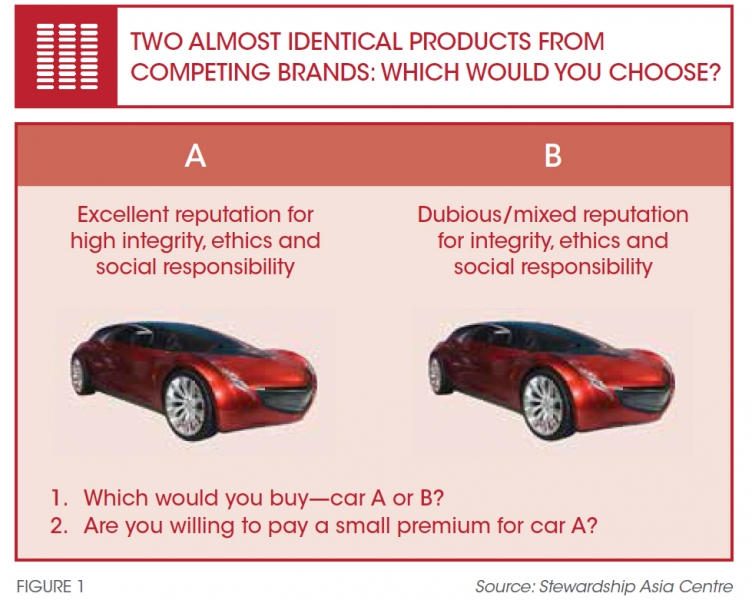

As long as alternatives are available, today’s customers will not buy from companies that do not stand for the right values and purposes. Over the last five years, we have presented a hypothetical question during our seminars and programmes, where we asked participants to decide between buying two competing products that were similar in every way except the ethical reputation of the companies making them, and whether they would be willing to pay a small premium for the product made by the company with a superior ethical reputation (refer to Figure 1). From the hundreds of sessions we have conducted so far, we have yet to meet someone who would buy from the company with an inferior reputation simply because its product was cheaper. This sentiment is also supported by research. An IPSOS MORI opinion poll concluded that consumers are willing to pay up to five percent more for ethically-produced fashion apparel.3 In another study, 34 percent of Generation Z (aged between 16 and 24 years) consumers in the U.K. are willing to pay 20 percent or more for ethically-manufactured products.4 This new breed of consumers is the major driver of change.

Which model is relevant—shareholder or stakeholder capitalism?

Coming back to the debate, what is the relevant model in today’s context? Was Friedman completely wrong? Is there a conflict between shareholder and stakeholder needs?

Friedman argued that corporate executives’ foremost duty was to maximise profits for shareholders, “so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud”. However, both the written and unwritten ‘rules of the game’ have changed in recent years. In the past, it was enough to compete without deception or fraud. Today, consumers and customers not only expect more, they are also able to find out easily what companies actually do and what they stand for. The days of focusing exclusively on maximising shareholder profits at any cost are over. It is in companies’ own interest to build their environmental, social, and (corporate) governance (ESG) reputation. In fact, as consumer expectations of greater transparency increase further, the only way to sustain long-term value for shareholders might be to take care of other stakeholders as well. As such, we do not see any conflict between shareholder and stakeholder needs. They are actually interdependent, and we believe this is what Friedman meant as well.

To remain viable and profitable over time, companies will need to shift their focus from ‘value’ to ‘values’, and their objective from achieving ‘pure profit’ to earning ‘profit based on a higher purpose’. In the next section, we describe these two shifts in greater detail.

Building an enduring organisation: A stewardship approach

How should companies not only remain viable, but also transform to succeed in today’s age vis-à-vis the growing call for greater transparency and empowerment of ordinary people? We believe the answer lies in adopting a stewardship approach to business leadership and governance—an approach that is built around the two shifts.

Stewardship is the mindset and practice of sustaining long- term value creation by balancing the needs of all stakeholders, society, future generations, and the environment.

The keyword in our definition of stewardship is ‘by’. Under this approach, stakeholder needs do not compete or conflict with shareholder needs; rather, the former is a means to achieve the latter. The 21st century business leadership challenge therefore is to do well by doing good. This is where the two shifts come in.

Enabling stewardship in organisations

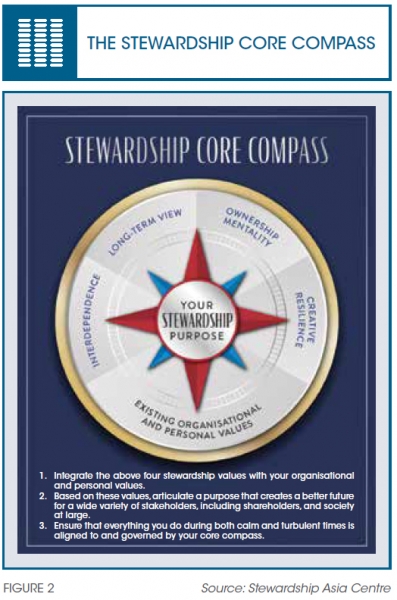

Building an organisation based on the stewardship approach involves defining and activating the organisation’s Stewardship Core Compass©—a process that starts with values (refer to Figure 2):

• Integrate the four stewardship values, which will be discussed below, with the organisation’s existing values.

• Based on these values, articulate the organisation’s stewardship purpose—the better future the organisation aims to create for a wide range of stakeholders, including shareholders, and society at large.

• Ensure that everything the organisation does in both calm and turbulent times is aligned to and governed by the Core Compass.

STEWARDSHIP VALUES

Well-stewarded organisations are led by Steward Leaders who prioritise values over value. This is not to say that profitability and shareholder returns are not important to them. In fact, they believe that value will be more sustainable over the long-term if the right values are deeply embedded in the company’s culture. Steward leaders believe in four core stewardship values: interdependence, a long-term view, ownership mentality, and creative resilience.

Interdependence

A strong belief in the idea of interdependence forms the foundation of stewardship. This emphasis on interdependence is evident in the Eastern culture of collectivism, but given today’s daunting existential challenges, we probably need it to be far more prevalent. Steward leaders understand this, and see the world as an integrated and interconnected web where the success of each constituent is coupled with that of other constituents.5 Looking beyond a zero-sum game, they develop a win-win-win mentality wherein employees, shareholders, and society can thrive together.

A case in point is the Ayala Group, the oldest conglomerate in the Philippines. Since its inception in 1834, the family business has contributed significantly to nation-building, cementing its social commitment to respond to the country’s changing needs over time. It aims to be relevant to the community by upholding the philosophy of inclusiveness, especially in providing critical goods and services at affordable prices for the masses. As the seventh-generation leader Jaime Augusto Zobel de Ayala says, “The capitalist model is vitally important to all of us, and to the world we live in, but it has to adjust to having a greater responsibility for the way the world works. Today, there has been a lot of discussion about the longevity and engagement with society in different ways…the big insight I got was the need for our institution to be far more inclusive than it was.”6

In fact, back in the 1960s, the founders of Ayala Foundation—the philanthropic and development arm of the listed company—were already committed to this higher cause. This dedication to improving people’s quality of life remains evident in current times. We saw that as the current pandemic unfolded, Ayala steadfastly stepped up its efforts in disaster relief work and provided timely assistance to the wider community.7

Such a consistent and persistent focus on creating shared growth, understanding mutual needs, and building reciprocal relationships with stakeholders is what interdependence is about. It is not about winning alone but uplifting the country, communities, organisations, and individuals to create a better shared future collectively. No doubt winning together is harder work, but the best leaders accept the challenge.

Long-term view

Steward leaders are long-term thinkers. They willingly forego short-term gains for enduring returns. By focusing on causes such as environmental sustainability, they also build organisations that make the world a better place for current and future generations.

An exemplar is Vitasoy International Holdings Limited, a leading manufacturer and distributor of plant-based food and beverages based in Hong Kong founded by Dr Lo Kwee-seong in 1940. The company’s mission was to fight malnutrition among Hong Kong’s growing and largely lactose-intolerant immigrant population amid difficult times of soaring commodity prices. Since then, the company has remained committed to providing affordable and healthy plant-based products without causing damage to the environment. Encapsulated in its sustainability framework is the central idea of ‘making the right products and making products the right way’. In 2019, the company introduced its Group Climate Change Policy, which underscored its resolve to institutionalise risk mitigation and adaptation measures to make its value chain more resilient. Significant infrastructure projects were recently completed to support its future growth plans. Additionally, the company has a forward-looking governance structure, where its board-level ESG Committee provides guidance on sustainability goals, strategies, and priorities.8

Clearly, steward leaders are guided by an enduring vision. They are also mindful of the needs of future generations, and do what they can to minimise environmental harm. These multi-pronged approaches allow Vitasoy to continue to harness resources sustainably. In 2020, the company made it to Corporate Knight’s top 100 global list of sustainable companies in the world. Given its conviction to be a role model for sustainability strategy, senior leaders at Vitasoy are cognisant that “the era of just becoming bigger is over” and advocate that companies have a long-term vision of why they exist.9

Ownership mentality

Steward leaders imagine an inclusive better future and take it upon themselves to create it. Driven by the mantra “If it’s to be, it’s up to me”, they take responsibility and make things happen. In business, this means thinking and acting like an owner, even if one is a manager or an employee.10

Netflix exemplifies this mentality. Acting against the grain, the media-streaming titan adopts a no-rule policy, empowering, and trusting employees to make decisions. Only broad parameters such as “Use good judgement” and “Act in Netflix’s best interests” are used. As the company demonstrates, when employees are given freedom and autonomy, it can fuel in them a strong sense of ownership. Reed Hastings, the co-founder of Netflix, writes: “For our employees, transparency has become the biggest symbol of how much we trust them to act responsibly. The trust we demonstrate in them in turn generates feelings of ownership, commitment, and responsibility.”11 Employees in Netflix are well-supported during this empowerment process. The winning formula is to exercise transparency by providing them with accessibility to information. The key, according to Netflix, is to give context, not control. By understanding contexts and matchmaking volition, rather than merely expertise and skills, the 24-year-old company has gained a leg up in employee engagement.

In sum, steward leaders work to connect the heart and mind, as well as create conditions for the ownership mentality to proliferate.

Creative resilience

Unlike a traditional business that seeks to single-mindedly drive shareholder profits, the stewardship approach requires addressing the needs of a much wider variety of stakeholders. As such, doing business using the stewardship approach is full of obstacles. Steward leaders, however, are unafraid of this tougher road. They accept the challenge of driving profitable growth while upholding the spirit of stewardship, and strive to innovate as much as possible. They understand that they will face difficulties and failures, but their strong ambition to contribute something useful to the world through their business keeps them resilient. Creative resilience is therefore about deeply embedding reflection, learning, and renewal into their organisation’s culture.

Singapore-based DBS Bank epitomises these qualities. To combat obsolescence in an industry facing tectonic shifts, DBS embarked on its journey of digital transformation a decade ago. Departing from the piecemeal approach, the bank went through deep radical shifts to ensure it became digital to the core to best serve its customers. CEO Piyush Gupta cautions that it is not enough to just apply digital ‘lipstick’ if one desires real change, saying, “If you want to make change real, and if you really want to make change cohesive, then you have to attack the core.”12 Indeed, the bank has instituted systemic changes, which includes building a culture that embraces technology, encourages innovative experimentations, and cultivates capacity for the profound shift. Institutional support, especially in terms of learning, was given to reskill and upskill all employees to bolster their digital proficiency. By consistently reimagining the bank as a start-up and emphasising the cultural value of innovation, it managed to address the challenges of reform.

In 2019, DBS scored a historic first by holding three global best bank titles concurrently from Euromoney, Global Finance, and The Banker, an unrivalled feat made possible by its pursuit to thrive in spite of disruption. Adding to its string of accolades, the bank was again named the top bank in 2020 according to Global Finance for its resilience during the pandemic in meeting the tremendous demand for digital banking services.13

STEWARDSHIP PURPOSE

Once the four stewardship values are integrated with an organisation’s existing values, the next step in formulating the Core Compass is to articulate a purpose based on the full set of values. Making the organisation purpose-driven has become a fad these days. Consulting firms have set up lucrative ‘purpose practices’ to help organisations become purpose-driven. This raises a couple of questions. First, what does management mean when they say they want to transform their company into a purpose-driven organisation? Did the organisation not have a purpose all along? Every organisation has a purpose; the point is, purpose must stem from an organisation’s stated values, rather than be developed in isolation. Second, what makes a good organisational purpose in the context of today’s changing marketplace? Saying we want to become purpose-driven is not enough. What organisations really need is a stewardship purpose, not just any purpose.

Simply put, based on stewardship values, a stewardship purpose aims to build a better future for a wide array of stakeholders, not just the shareholders. To achieve a larger stewardship purpose, steward leaders sometimes are willing to forego some profit in the short term, though that need not always be the case. Based on their belief in interdependence, they optimise rather than maximise profit. A stewardship purpose clearly articulates two key points: What useful product or service do we provide to the world? (Meaningful Contribution), and Why do we do it? (Emotional Connection).

ACTIVATING THE STEWARDSHIP CORE COMPASS

The first two steps are foundational while the final third step—activating and applying the Core Compass—needs to be ongoing.

One CEO we worked with had his company’s values and purpose posted in every meeting room and across hallways all over the premises. Each time an important decision was discussed in a meeting, he would point to the wall and ask: “How does this situation fit in with our overall purpose? How important is it that we get it right? If we act according to our stated values, how would we decide?” This was his way of ensuring that the company never wavered from the values and purpose enshrined in its Stewardship Core Compass. Additionally, he always walked the talk. Over time, it became clear to everyone that anything that was not aligned to the company’s stated values and purpose would not succeed.

The CEO did not stop there. He demanded that his head of human resources design recruiting, performance management, and reward systems to fully align to these values and purpose, and be governed by them. Once these were established, the company made every effort to recruit people who believed in its shared values and purpose. Furthermore, the annual goal-setting process ensured that group and individual key performance indicators were in line with its values and purpose, and performance was measured and rewarded accordingly. This company was also not shy to terminate staff who neither embraced the values in practice nor believed in its purpose.

Hence, simply developing a Stewardship Core Compass and printing colourful posters will not do the job. Steward leaders must make the Compass a way of life within their organisations. This is hard work, but in today’s transparent world, it is perhaps the only way to safeguard long-term success, and endure crises like the Covid-19 pandemic.

Conclusion

The vignettes we have shared suggest that there is little or no conflict between meeting shareholder needs as articulated by Friedman and those of stakeholders. Even in an immensely difficult macroeconomic environment, Ayala’s performance bounced back during the third quarter of 2020 after an initial slump in earnings.14 Netflix grew from strength to strength with its stock price rising 40 percent.15 Vitasoy continues to solidify its market position.16 At DBS, profits rose a respectable 12 percent to a record of US$3.5 billion from the previous year.17 Given that stewardship is in the DNA of these companies, their solid performance during this ongoing crisis gives us hope, courage, and cautious optimism that we can build profitable and purposeful businesses for an inclusive and sustainable economy.

Voluminous research has already emerged to support the proposition that stakeholder capitalism does pay off. For example, the value of investments that take a company’s ESG performance into consideration (also known as ‘ESG investing’) grew beyond US$30 trillion in 2018, and might reach US$50 trillion over the next two decades.18 In his annual letter to CEOs, BlackRock CEO Larry Fink shared that 81 percent of ESG strategies outperformed regular indices in 2020. In fact, their stellar performance was even more pronounced during the first quarter of the Covid-19 downturn.19

From the mounting evidence and a growing pool of ethics-conscious customers acting as checks and balances for the market, we have strong reason to believe that companies adopting the stewardship approach will do well, do good, and do right. This will create the much-needed win-win-win scenario where individuals, organisations, and humanity can thrive together in the long run.

Rajeev Peshawaria

is CEO of Stewardship Asia Centre

Yancy Toh

is Vice President (Research) at Stewardship Asia Centre

References

1. Milton Friedman, “A Friedman Doctrine–The Social Responsibility of Business Is to Increase Its Profits”, The New York Times, September 13, 1970.

2. Luigi Zingales, Jana Kasperkevic & Asher Schechter, “Milton Friedman 50 Years Later”, Stigler Center for the Study of the Economy and the State, University of Chicago Booth School of Business, 2020.

3. Jennifer Nini, “Are Consumers Really Prepared to Pay More for Ethically Made Fashion? This New Survey Reveals that They Are…”, Eco Warrior Princess, January 21, 2019.

4. Statista, “Consumers’ Willingness to Pay More for Ethical Products in the UK 2017, by Generation”, November 27, 2020.

5. Rajeev Peshawaria, “Stewardship: The Core Compass of Real Leaders”, Forbes, September 22, 2020.

6. “Enduring Principles in Changing Times: Stewardship Asia Roundtable 2017”, Stewardship Asia Centre, 2017.

7. “Ayala Corp. (Philippines)–Recommitting to a Broad Stakeholder Ecosystem during the Pandemic”, Asia Business Council, January 18, 2021.

8. Vitasoy International Holdings Ltd, “Broadening Our Impact (Sustainability Report 2019/20)”, 2020.

9. Wander Meijer, “Recognizing Leaders: Roberto Guidetti and Simeon Cheng, Vitasoy”, Globescan, March 12, 2020.

10. Rajeev Peshawaria, “Stewardship: The Core Compass of Real Leaders”, Forbes, September 22, 2020.

11. Reed Hastings & Erin Meyer, “No Rules Rules: Netflix and the Culture of Reinvention”, Penguin Press, 2020.

12. McKinsey & Company, “The Digital Reinvention of an Asian Bank”, February 13, 2020.

13. Gordon Platt, “World’s Best Banks 2020: DBS Honoured as World’s Best Bank”, Global Finance, October 6, 2020.

14. “Ayala Corp. Earnings Fall 59% as Pandemic Hits Business Units”, BusinessWorld, November 13, 2020.

15. Eben Shapiro, “Netflix’s Reed Hastings on Rejecting Brilliant Jerks, the Power of Big Vacations, and Spending $15 Billion on Content”, Time, September 13, 2020.

16. PR Newswire, “Vitasoy Solidifies Market Position in 1H FY2020/2021”, November 19, 2020.

17. Gordon Platt, “World’s Best Banks 2020: DBS Honoured as World’s Best Bank”, Global Finance, October 6, 2020.

18. Pippa Stevens, “Your Complete Guide to Investing with a Conscience, a $30-Trillion Market Just Getting Started”, CNBC, December 14, 2019.

19. Larry Fink, “Larry Fink CEO Letter”, BlackRock, 2021.