Seven steps to achieve market entry based on lessons from recent market exits.

1. New entrants need to tailor their trucks for India's geography, infrastructure, and conditions to improve acceptability and market share. 2. Boost demand by building an export-driven business model in India to counter the threat from inadequate and stagnant domestic demand. 3. Align service offerings with customer expectations to gain greater vehicle acceptability. |

In 2023, the Indian automotive industry accounted for half of the country’s manufacturing GDP and more than seven percent of its total GDP, making it one of the top contributors to the nation’s economy.1 Furthermore, the industry provides employment to over 30.7 million people.2 India is also a manufacturing powerhouse in commercial vehicles (CV), emerging as the world’s largest manufacturer of buses, and third largest manufacturer of trucks globally in the year 2023.3 Besides, India became the third largest automobile market worldwide in 2023.4 In the financial year ending March 31, 2023, CV sales in India reached almost a million units, out of which 359,004 were medium and heavy commercial vehicles (M&HCV).5 Mordor Intelligence predicts the CV segment is set to grow at a compound annual growth rate (CAGR) of 5.15 percent between 2024 and 2030.6 About 70 percent of all goods transported in India is via road transportation in comparison to EU countries where the road freight share in 2022 stands at 53 percent.7,8 The growing market size and India’s strong production capabilities make a compelling case for the entry of prominent global original equipment manufacturers (OEMs) seeking to diversify their supply chains and establish multi-country dependencies.

Following its 1991 economic reforms, India opened its automobile market to foreign players with the Auto Policy of 2002 that allowed 100-percent automatic FDI (foreign direct investment) for automotive manufacturing. Numerous foreign players entered the Indian CV market between 2002 and 2015, starting with German automaker MAN Truck and Bus in 2003. The Indian CV market grew at a CAGR of 12.7 percent between 2000 and 2010. However, the next decade witnessed a CAGR of just three percent.9 By 2020, several foreign players had exited the market, giving India the moniker of the ‘graveyard’ of global automotive players (refer to Table 1).

In this article, we explore the key reasons behind the exit of foreign OEMs and the persistent challenges hindering their success. We derive insights from numerous field visits, interactions with fleet operators and top executives from OEMs, and a primary survey on truck-buying behaviour. We then present a seven-step market entry strategy for foreign entrants to achieve success in the Indian CV segment.

WHY DO FOREIGN ENTRANTS STRUGGLE?

Apart from industry-wide challenges faced by all players such as supplier unreliability, semiconductor chip shortages, as well as high raw material prices and taxes on auto components, foreign entrants face three additional challenges.

1. Duopoly in the Indian truck business

Tata Motors and Ashok Leyland were among the first OEMs in the Indian CV space, and they have consolidated their positions over the last few decades. As of 2023, they hold 47 percent and 32 percent of the M&HCV market share respectively, leaving other companies to jostle for the remaining 20 percent.10 One prominent tool the two companies used is deep discounts. Numerous reports emerged about Tata Motors and Ashok Leyland offering discounts of up to INR 800,000 (US$11,360)11 on 40-42T truck variants in the wake of sluggish sales in 2019.12,13

Deep discounting adversely affects other players who struggle to match their discount levels, so they consequently sell less.14 From our field research, truck owners have also indicated that their preference for Tata Motors and Ashok Leyland stems from their timely, attractive discounts, and easily accessible financing options. Furthermore, new players face resistance from dealers and financiers who prefer the status quo as they have established comfortable relationships with the existing market leaders.

2. Low margins with highly variable demand

The annual demand for M&HCVs in India has remained subdued, contrary to the high growth market expectations during the late 2000s. Numerous companies have highlighted India’s small and saturated market. MAN Truck and Bus, which exited the Indian market in 2018 to focus on the global premium vehicle market, was producing only 3,500 to 4,000 trucks annually at its Pithampur plant despite the factory’s production capacity of 12,000 trucks per annum.15 While the company sold 25,000 units in India between 2006 and 2018, it sold 20,242 units in Brazil in 2018 alone.16,17 Similarly, Scania, the Swedish premium CV manufacturer, also shut down its bus body manufacturing plant in 2018 as it struggled to achieve profitability, owing to low demand.18

Low profit margins in India are another problem. They are estimated to remain at three percent till 2030.19 The margins for OEMs in Asia are generally lower than in North America or Europe, owing to hypercompetitiveness, deep discounting, and price sensitivity. For instance, Daimler Truck’s margin was 2.6 percent in Asia, compared to 10 percent in Europe and North America in 2022. When US truck manufacturer Navistar (now International Motors) announced its market exit in 2012, it had flagged underwhelming sales and aspiration to pivot to a high return on invested market capital in its press release.20 With low sales volume, thin margins, and little space for market share expansion, foreign players find it incredibly difficult to remain invested in the Indian M&HCV market.

3. Preference for an extensive service network

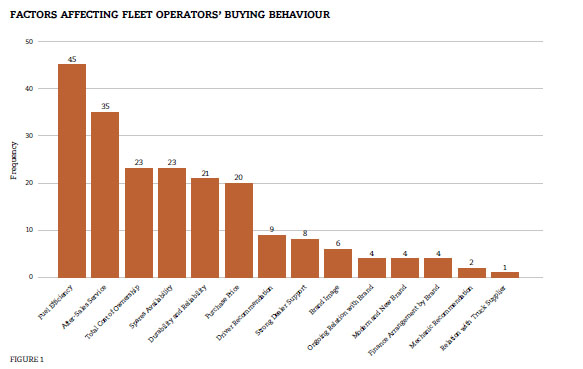

Each day lost from vehicle breakdowns and the associated maintenance required leads to revenue loss for a fleet operator. This compels fleet owners to evaluate the coverage of an OEM’s service network and response time to vehicle breakdown calls while making a purchase decision. Our fleet owner survey results align with these decision-making attributes (refer to Figure 1). Timely maintenance with a sprawling service network presence and spare part availability can enhance the fuel efficiency of vehicles, increase vehicle reliability, and reduce the total cost of ownership. However, setting up service centres along major highways in India requires huge investments ranging from INR 7 million (US$82,233)21 for an authorised service centre to INR 25 million (US$293,688) to set up a car dealership.

Companies recognise the significant role of service networks in sales conversion. Tata Motors, with customer touchpoints in 90 percent of Indian districts, and Ashok Leyland, backed by its 1,700-odd exclusive service outlets, have established a robust service network leading to an immense competitive advantage over other players in the industry. During its decade-long presence in India, BharatBenz has also aggressively expanded its service network, boasting 330 customer touchpoints by December 2023. In stark contrast, MAN Truck and Bus could only establish 64 customer touchpoints between 2006 and 2017.

SEVEN STEPS TO STRATEGISE FOREIGN PLAYERS’ ENTRY INTO INDIA’S M&HCV MARKET

While many foreign players have faced challenges in serving the Indian market, companies like Daimler Truck and Scania posted their first ever profit from the Indian market in FY2023. How can foreign OEMs achieve profitability in India? This section presents a seven-step strategy for a foreign player planning to make a successful entry into India.

1. Tailoring the product to local conditions: redesign and redevelopment of variants

Successful market entry for any firm requires a carefully developed product portfolio tailored to the host country’s market conditions. The Indian trucking environment differs from the Western trucking environment according to multiple factors like customer preferences, vehicle operating conditions, road network and quality, climatic conditions, topography, and domestic regulations. In-depth discussions with top OEM executives suggest that market entry should begin with a study of the road and vehicle operating conditions of the target/new market.

A prominent trans-continental OEM with a presence across 60 countries classifies roads as ‘smooth’ or ‘rough’ based on the percentage of unpaved and dirt roads on a truck’s projected journey. Countries classified as having ‘rough’ roads are characterised by unpaved and dirt roads making up more than 30 percent of their road networks; India was classified as such. Our evidence suggests the same. Data from the government’s Mission Antyodaya22 reveals more than 26 percent of Indian villages were not connected via paved roads in 2019. According to World Economic Forum’s Global Competitiveness Index 2019, the road connectivity score for India was 75.83, significantly lower than that of other truck manufacturing countries such as Germany (95.05), Sweden (95.9), and the US (100).23

Therefore, OEMs would have to make changes in their models to suit India’s rough roads. For instance, OEMs use three leaf springs in their suspension system for trucks with smooth road applications, while an additional spring is required for application on rough roads. Similarly, OEMs use 8mm-thick axles for rough roads against 7mm for smooth roads.

Customisation is another key difference. For instance, Japanese CV provider UD Trucks customises its models for different countries based on road conditions, emission standards, climatic conditions, and purchasing power, among other factors. Hence, while its Croner PK variant in New Zealand comes with only automatic transmission, the Croner PKE variant in Malaysia comes with both manual and automatic transmission options. Additionally, the variant in New Zealand is fitted with a Euro 5 GH8E engine that provides a high torque for heavy (building and construction), medium (waste and cargo), and light (local distribution) duty applications. On the other hand, the Croner PKE in Malaysia is fitted with another Euro engine variant that generates a lower range of torque meant only for medium and light duty applications.

Such customisation is possible due to modular manufacturing and standardised components that bring interoperability. For modularity, a steady supply of high quality components is required. However, in the absence of a localised supply chain, importing such components drives up costs. But a high level of price sensitivity puts intense pressure on OEMs to minimise costs and adopt a model-based approach. Consequently, foreign players may avoid designing new models and enter the Indian market with fewer models and minor tweaks.

Indian regulations also necessitate changes to vehicle configuration, as they permit higher load capacities compared to Western markets. For instance, the permissible truck axle load for a tandem axle truck is 21 tonnes in India while that for the US is 15.5 tonnes. Overloading, estimated at 33 percent by Indian policy think tank NITI Aayog, coupled with low and ineffective enforcement of load norms, requires truck manufacturers to modify their cross-sectional design, as well as increase the axle diameter and wall thickness.24

Perceived product superiority and a small Indian market offer little incentive for foreign OEMs to redesign their products and reorient their supply chains. However, India-specific truck variants are critical to achieving success in the Indian market. German truck maker Daimler Truck has succeeded in capturing six to nine percent in market share across different categories within 10 years due to its India-specific product designs. It created a corpus of INR 12 billion (US$140 million) for India-specific design and development, and constructed a 47-acre test-track in Chennai to develop truck variants suited for Indian road conditions. Understanding the preference of Indian truck owners for fuel-efficient and low-maintenance trucks, Daimler India Commercial Vehicles (DICV), a wholly-owned subsidiary of Daimler Truck, has rolled out trucks under the BharatBenz brand name with a 20-percent longer service interval which reduces maintenance cost by six percent.25

2. Delivering clear product positioning for strategic brand-building

A new entrant needs to identify gaps in the host country’s market to strongly position its product in the segment that aligns with its inherent strengths. German truck maker Volvo, globally renowned for heavy duty, special application premium trucks, has created a niche market for its premium segment truck models FM and FMX, commanding a market share of 85 percent in the premium truck segment.26 Its heavy duty mining trucks deliver superior performance on unpaved and dirt roads, and this supremacy comes from its highly sophisticated technology that domestic OEMs do not possess. Similarly, Daimler Truck is expanding in the tipper segment by building a 20-percent deeper steel chassis, heavyweight gearbox, and robust vehicle for Indian markets. As mentioned, it also launched BharatBenz to position itself as an Indian-centric brand and build customer trust. Foreign players can therefore enter the Indian market by identifying underserved niche segments and optimising variants, and improving their product’s core strength.

3. Stabilising demand through export-driven business model

The cost of manufacturing trucks in India consists of material cost, process/factor cost, competition expenses (price discounting), salaries, spending on marketing, and the cost of capital tied to inventory and logistics. Material, inventory, and salary costs are similar for all firms. However, market challengers have to follow market leaders in providing deep discounts. An executive of a prominent company referred to this practice as ‘competition cost’. For new OEMs, the cost of discounting can reach up to 25 percent. It has been observed that process cost is higher by three to five percent for emerging and new players. As plants age, overall costs can decline due to depreciation, scale, and debt repayments. In the case of Mahindra & Mahindra, a Mumbai-based Indian automotive company, the process costs in its Kandivali plant (established in 1964) are 30 percent lower than those for its Chakan plant (established in 2010). Therefore, optimisation measures to reduce process costs are critical for any new player to achieve parity with market leaders in the medium term. Marketing is another cost head where new players have to spend more than the established old players by one to two percent.

Achieving scale is important for a new player to reduce the per-unit cost of manufacturing a truck. However, the Indian M&HCV market is considerably smaller as compared to that of the US and China.27 Hence, India can be used as a manufacturing base by global automakers to build scale based on an export-driven strategy. This can help foreign players in scaling up their production, utilising their capacities, diversifying their markets, stabilising their revenue, and improving their profitability while building upon the cost-related benefits of manufacturing in India. For instance, BharatBenz registered sales of 29,470 vehicles in 2022, which included exports of 11,000 units, amounting to almost 60 percent of the total vehicles sold in the Indian market and around 40 percent of the total vehicles produced.28

4. Devising an innovative demand management strategy

India’s truck demand is influenced by macroeconomic factors like the GDP growth rate, inflation, and government projects, as well as customer buying behaviour which is affected by festive and quarter/ year-end discounts, which leads to large seasonal demand variations and challenges in demand forecasting. A truck manufacturer must therefore maintain a flexible production and sales target that accounts for such variations to minimise inventory costs.

Artificial intelligence (AI) can potentially lower demand forecasting errors by 30 to 50 percent, thus reducing inventories by up to 50 percent in the automotive industry.29 The industry can learn from the quick commerce industry,30 which uses advanced data analytics for demand forecasting and strategic management of its inventories in its dark stores or distribution centres. Truck manufacturers can follow a similar strategy for their inventory management of components, finished trucks, and aftermarket spares. For instance, Mahindra & Mahindra categorises its variants into runners (highly frequent sales), repeaters (frequent sales), and strangers (low sales) for its sales management based on market demand. However, this requires real-time data sharing across the company’s internal functional divisions and its strategic suppliers, which remains hindered due to data confidentiality concerns. Since each supplier caters to multiple OEMs, there is a high risk of data breaches for critical data like daily enquiries, as well as manufacturing, inventory, and sales data. A potential solution lies in creating a sourcing hub wherein the OEM plays a greater role in creating critical technological and financial capabilities of its Tier-1 and Tier-2 suppliers to improve upstream demand management by creating supplier dependency on OEMs.31

5. Sourcing localisation for resilient supply chains

An internal combustion engine truck requires more than 20,000 components, and the procurement of these components involves navigating through a complex multi-tiered supplier network spanning across different countries. Global supply chain disruption events such as pandemics and geopolitical tensions escalate the manufacturer’s sourcing costs (which constitute 65 percent of the total cost), leading to a strong focus on building a reliable localised supplier base. In the Indian context, localisation can help OEMs attain a 10- to 25-percent operational cost benefit vis-à-vis that for Western markets, and also leverage the government’s localisation-based programmes like Production-Linked Incentive Scheme and public procurement guidelines. Localisation efforts further improve cost management because India has a high import duty, such as a 25-percent duty on completely knocked down preassembled units of auto parts for commercial vehicles.32

Localisation significantly enhances foreign OEMs’ ability to incorporate modularity into their product development approach. OEMs such as DICV, SANY India, and Ashok Leyland India have percentages of 95, 40, and 98 respectively.33, 34, 35

6. Leveraging telematics and dealer incentive mechanisms to maximise service coverage

While most OEMs provide road assistance guarantees and compensation programmes for vehicle downtime, our interactions with fleet operators revealed that their primary concern is vehicle uptime. A fleet operator explained, “Existing compensatory programmes offer little solace to us since we work on strict deadlines. Often, we have to keep a truck on stand-by to ensure delivery schedules are not hit by vehicle breakdowns. This means additional cost and lost revenue from the idle truck kept on stand-by.”

OEMs are now leveraging AI and the Internet of Things to minimise the maintenance needs of a vehicle. The development of telematics has led to the generation of vast amounts of vehicle data that can be used to predict vehicle breakdowns and failures. The service brochure of a prominent OEM claims it has achieved a 75-percent reduction in powertrain breakdowns, a 10- to 15-percent reduction in warranty costs, and a seven- to 15-percent improvement in fuel efficiency due to its telematics systems’ predictive analytics. Such subscription-based systems are deployed by new OEMs to compensate for their limited service network.

However, offering digital technology tools should not detract new OEMs from expanding the geographical reach of their service network by adding more dealerships, service centres, and roadside assistance units. New players must devise innovative incentive schemes to attract potential dealers. A common practice in the industry involves establishing an operational cost and profit-sharing agreement with dealers for a predetermined period to generate dealership interest. This puts an additional cost burden on market challengers, which every new player must also plan for. Importantly, service networks also generate revenue for OEMs through repeat purchases and referrals, sales of aftermarket spares, warranties, and service contracts. The key lies in ensuring that the revenue generated from the service network exceeds the cost of incentives provided to dealers in the long run. Physical service networks can also be expanded by creating strategic tie-ups with existing players in the market. However, the efficacy of the partner’s service network reach is a critical determinant in attracting customer interest.

7. Maintaining perseverance for market pursuit endeavours

In India, CV buyer behaviour is mainly driven by price sensitivity and word of mouth. Furthermore, the domination of Tata Motors and Ashok Leyland over the last few decades has generated intense brand loyalty and customer hesitancy towards new players. New entrants must be prepared to tolerate a longer time horizon before generating a positive return on capital. Many firms like MAN Truck and Bus, Scania, and Navistar exited India due to continued losses in their early stages of operations. However, a long-term business value proposition and commitment to the Indian M&HCV market are key to attaining success. Daimler Truck and Scania finally attained profit in 2023 after almost a decade of operating in India due to their continued commitment to the Indian market.

CONCLUSION

A foreign player can taste success in the rapidly growing Indian truck market through a carefully driven sustenance strategy. This requires developing India-centric truck variants, identifying niche areas for market expansion, creating an export-driven business model, and devising innovative demand management strategies. Furthermore, localisation can help OEMs incorporate modularity into their manufacturing activities while minimising costs. Emerging technologies can also be leveraged to improve service coverage. However, OEMs must continue to aggressively expand their network of physical service touchpoints. Finally, long-term commitment to the Indian market is essential for building customer trust and generating market demand.

Dr Debjit Roy

is Institute Chair Professor and Professor of Operations Management, Operations and Decision Sciences Area at Indian Institute of Management Ahmedabad

Shubham

is Research Associate at Indian Institute of Management Ahmedabad

For a list of endnotes to this article, please click here.