The rise of modern organised retailing and e-commerce has seen India’s traditional retailers, known as ‘kirana’, and other small businesses take a major hit. But while the lack of IT-based systems in current retailer supply chains is impacting their performance, the problem is not insurmountable. One solution is to implement an effective IT-based supply chain innovation system within the traditional retail format. We propose a system that can also be easily adapted to other emerging economies with fragmented retail systems.

Efficient and responsive supply chain management is an essential requirement for any retailer, organised or unorganised. The availability of goods and assurance of their quality are the two basic elements that can enable traditional retailers to win over formidable competition from modern organised retailers. The organised system for management of operations that we propose in the Social Supply Chain Management System (SSCMS) has the potential to significantly benefit India’s traditional grocery retailers, which make up the unorganised market for grocery retailing, despite their lack of access to technology. An effective SSCMS is able to integrate the vast network of retail and wholesale businesses—information serves as the integrator between the supply chain and customers, and allows various processes, departments and organisations to work together and provide a better value proposition to all stakeholders in the community.

Traditional retailers versus organised retailers

Although traditional retailers still dominate the grocery business in India, organised retailers are growing much faster—a 22 percent annual growth for modern retailers compared to 13 percent for traditional retailers in 2013.1 Traditional retailers are slowly losing out to the more efficient modern organised retailers due to the lower number of customers per store and high stock-outs. For instance, the stock turn for global giant 7-Eleven is 50, as against the normal range of four to ten for traditional Indian retailers, and stock-out levels among local retailers range from five to 15 percent, compared to a global average of less than five percent.2

Despite the proliferation of organised grocery retailers in the urban areas of India, the semi-urban and rural population in India continues to prefer traditional vendors due to their familiarity with the channel, favourable pricing, relationships, package sizing and easy accessibility. The availability of credit facility, which is an important contributor to the popularity of a particular kirana store, varies from store to store. In the absence of display shopping at such stores, there is not much to differentiate between a high margin luxury brand and a low margin one. As a result, all brands get equal exposure. Branding is also not the criterion used to attract customers in kirana stores as customers typically prefer low priced products. In addition, the retailer’s suggestions and recommendations regarding any product play a significant role in influencing the customer’s purchase decision.

The consumer to retailer ratio is very low due to the presence of several kirana stores in a given locality, all carrying nearly the same assortment of products.

The semi-urban and rural population in India continues to prefer traditional vendors due to their familiarity with the channel, favourable pricing, relationships, package sizing and easy accessibility.

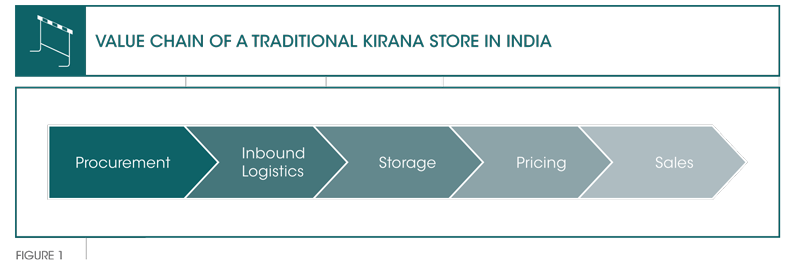

The current value chain

In a typical grocery supply chain, a ‘carry and forward’ agent picks the goods up from the manufacturers and takes them to distributors, who, in turn, sell the goods to wholesalers and retailers via dealers and agents. There are a few independent super-stockists too, as well as individual entrepreneurs, who buy groceries in large quantities to procure higher discounts and then sell it to sub-stockists and wholesalers. Super-stockists, stockists and wholesalers generally keep multiple brands and offer a wide range of products—unlike distributors who are not allowed to operate with competing products. For the purpose of this article, we assume that the super-stockist, stockist, wholesaler and retailer make up the traditional sector. Figure 1 shows the value chain of a typical kirana store in India.

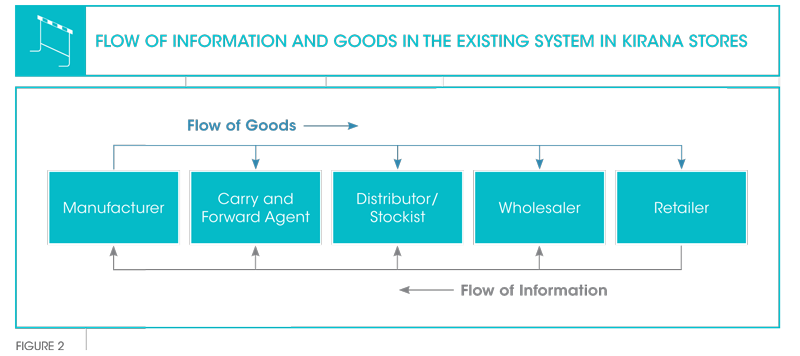

Figure 2 shows the flow of information and goods in existing supply chains of a typical kirana store. Here, the sequential information flow creates a problem for manufacturers and wholesalers because they do not have up-to-date information about the demand, stocks, etc. This creates a major information gap in the system that leads to inherent structural inefficiencies. Information inefficiency has been advanced as one of the major reasons for stock-outs leading to customer dissatisfaction.

An efficient supply chain strategy, based on sharing of high-level information about all the other players in the chain can remove this information asymmetry. The retailer would gain competitive advantage in terms of leaner supply chains, lower costs and the ability to select the right suppliers.

An efficient supply chain strategy, based on sharing of high-level information about all the other players in the chain, can remove this information asymmetry.

Supply Chain Management System

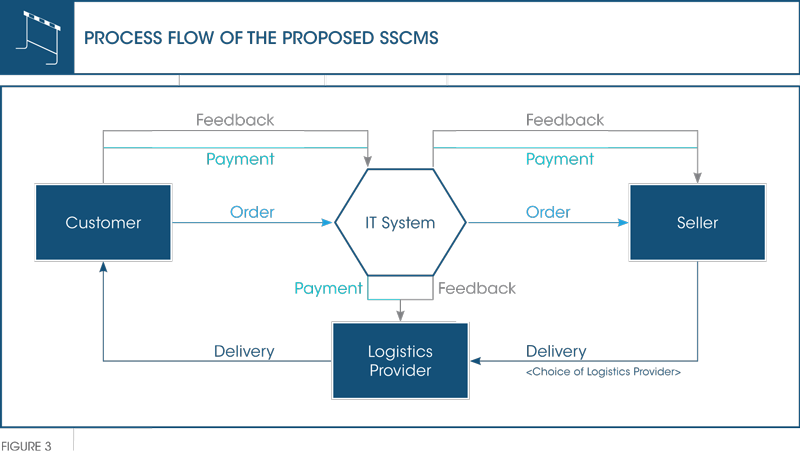

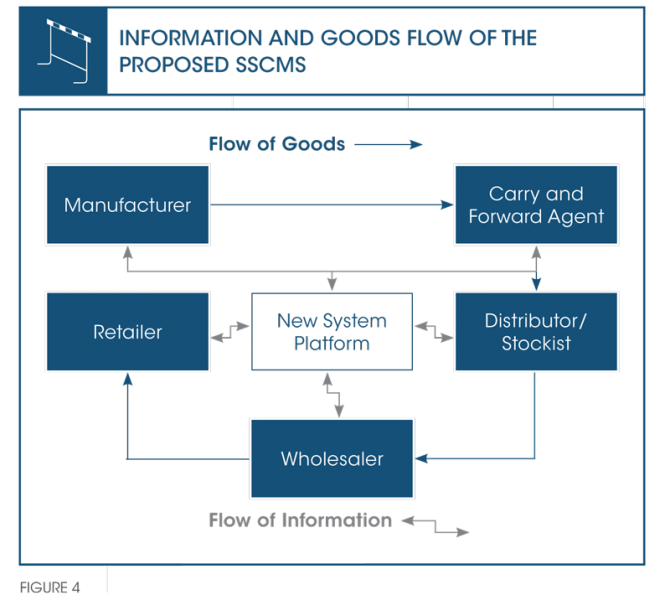

The IT-based system that we propose consists of a trading platform for wholesalers and retailers that seeks to bring information symmetry and transparency to the market—thereby enabling better decision making for all participants, including the producers. Figure 3 shows the proposed model together with the interaction between stakeholders.

The model derives its strength from social interaction and participation in feedback by all parties. The identities of the players revealed in the interaction and negotiation process create a social network layer over the transactional layer, providing greater strength and reliability to the complete system. The success of this business model depends on the volume and variety of products being traded on the exchange, while the network effect encourages participants to register and be a part of the system. There may be a few remaining gaps in the supply chain due to non-participation of some players in certain segments, but the system will be able to accommodate late registrants by keeping their transactions data and relationships up-to-date in the system.

Implementation of the SSCMS is based on an Enterprise Resource Planning (ERP)-like solution provided to the owners of the kirana stores to help them track inventories and sales. The user is able to select from product categories in the central product database, and update the price and inventory status for each product.

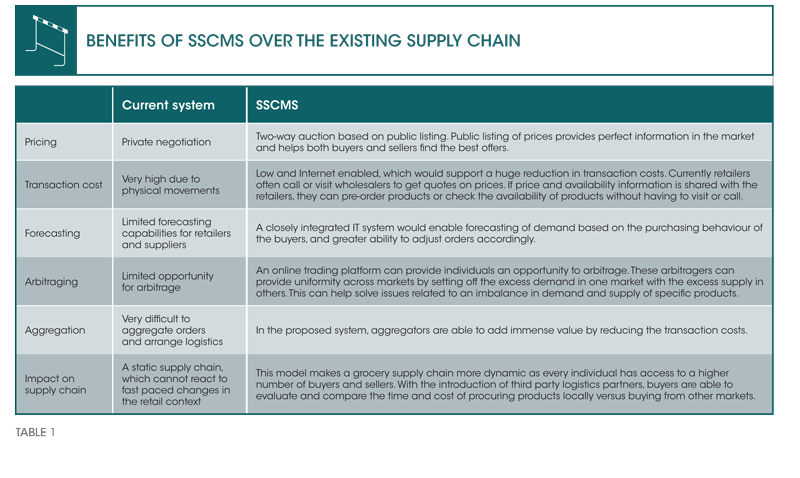

The proposed system uses a double auction system. This is one where the buyers offer bids and sellers enter competitive offers simultaneously, as opposed to the over-the-counter market where trades are negotiated. It is in addition to a price-quantity based matching algorithm that finds the best matches between buyers and suppliers.3

The double auction method also contains a negotiation option to increase similarities with the offline transactions currently prevalent in the market. While the double auction method is followed in a stock trading platform, the difference here is that the identity of all participants is revealed. This is important as the merchants in traditional markets rely on relationships. Trading parties are thus allowed to communicate with others, online as well as offline, to negotiate and bargain iteratively to arrive at a mutually acceptable solution.

Hyperlocal innovations in India

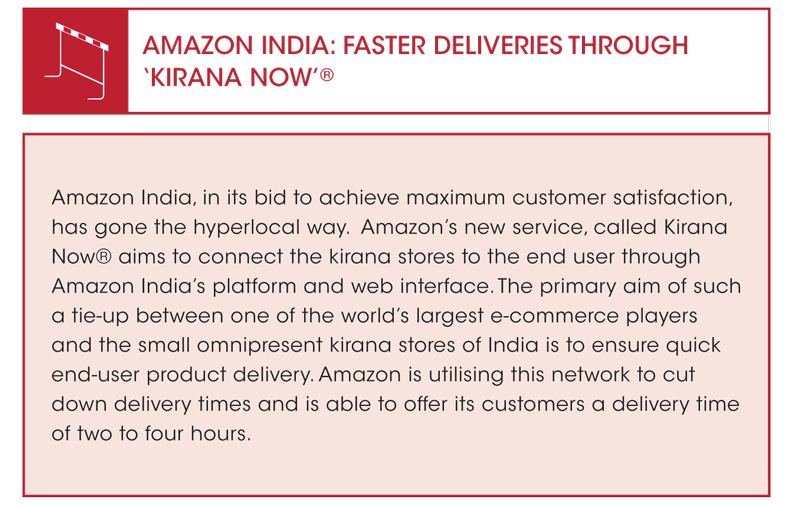

The recent hyperlocal solutions implemented by firms are attempts to solve some of the problems discussed in this article. These content services, offered by both large scale firms as well as start-ups, tap into the immense potential for a truly social and completely linked supply chain. They are small steps in the right direction.

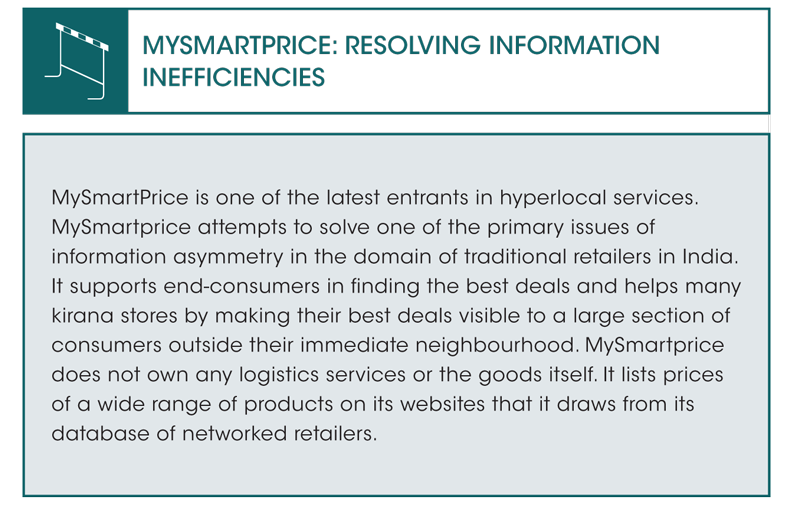

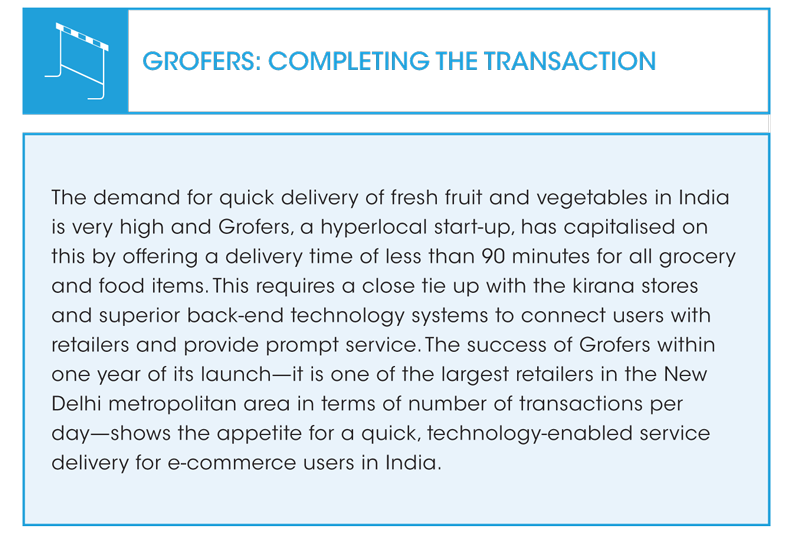

Some of the best known examples in the Indian space are Amazon India’s Kirana Now, Grofers, MySmartPrice and MJunction. Through innovative solutions, these ventures aim to solve one or more of the inefficiencies inherent in the retail system. For example, while MySmartPrice is focused on reducing information asymmetry by comparing prices across websites, Grofers takes it to the next level and completes the transaction. It not only lists the product prices of various retailers but also provides them with IT support as well as delivers the product to the end consumer. Amazon attempts to do the same through the aptly named service Kirana Now.

However all of these services are in the business-to-consumer (B2C) segment. These services primarily try to reduce the information asymmetry between end-consumers and retailers. The level of ubiquity for logistics providers that we have hypothesised in the ideal framework currently does not exist. One firm attempting to do a similar thing in the business-tobusiness (B2B) domain is MJunction, which offers an e-commerce platform for bulk traders; but small kirana stores are not included.

SSCMS: Taking integration to the next level

A key limitation of the retailing innovations introduced so far is that despite the traditional retailers benefitting from a higher number of orders and becoming more accessible to consumers who may not have otherwise visited the store, the power of information does not transfer to the retailer directly. However, in a social supply chain, the traditional retailers can see and analyse for themselves the opportunities in a market, and reduce inefficiencies for their own benefit—thereby lessening any opportunity of arbitrage by third party players.

There are multiple benefits of a SSCMS, such as making the choice of logistics players available to users. In addition, a higher amount of information is provided to all users. Buyers will have the option to place orders with remote sellers if the price offered by them, along with the freight charges, turns out to be lower than that offered in the nearby market.

The major focus of the model we have proposed is to improve supply chain integration by creating a supple and information-efficient supply chain. The large number of kirana stores that are already present in India provide the necessary scale, and therefore make it attractive for players to enter and invest in this segment.

The major objective in supply chain integration has always been the removal of information asymmetry. As can be seen in Figure 4, the SSCMS proposes to separate the information flow and goods flow. While the goods may flow between only two points (parties), all parties will possess up-to-date information about the complete network—making it a more information-symmetric system than any other system that exists at present.

Even though the initial set-up costs of an IT system to support this strategy may seem prohibitive, the high penetration of mobile phones makes it possible for this initiative to become rapidly scalable. As can be expected, most new-age IT-based disruptions in developing economies are designed along mobile technology.4 And although a few players have attempted to use mobile-based IT solutions in the retail space, these are mostly the distributors of fast moving consumer goods (FMCG) brands who use these innovations for maintaining order books.

We propose a more open social supply chain management solution as a framework that would enable the traditional retailers to offer better solutions to consumers.

The high penetration of mobile phones makes it possible for the Social Supply Chain Management System to become rapidly scalable.

WHO BENEFITS AND HOW?

A comparison of Figure 2 and Figure 4 shows the revolutionary capabilities of the new system. The most profound impact is seen in the information domain, where each participant of the system has real time information about the other participants. We compare the benefits of a social supply chain management system with the existing system in Table 1 below.

Where to from here?

The integration of supply chain has been a challenge for a variety of businesses. In this article, we have proposed the basic architecture of an IT-enabled system that can provide traditional retailers with easier access to desirable information. Such an integrated system has huge potential when it comes to transforming the traditional retail landscape of many emerging economies with similar trade supply chains.

The system we propose is a social network of supply chain participants from retailers and wholesalers to manufacturer and logistics providers that can enable transparent transactions and provide greater benefits to multiple stakeholders. An integrated SSCMS helps businesses draw more benefits from the increasing purchasing power of consumers in India and other such economies. Since the technology itself is an ever-evolving phenomenon, it is to be remembered that a framework that may suffice today can become outdated tomorrow. An ideal retail scenario of the future will be one where the traditional and modern retail outlets both move ahead together, and in a seamless fashion. An effective SSCMS can be the first step toward that goal.