Finding the right E-Commerce Intelligence solution for your firm.

2020 had been an extraordinary year as the Covid-19 pandemic struck almost all countries in the world and created an extraordinary impact on businesses worldwide. Singapore and many other Southeast Asian countries were not spared and had to implement lockdowns swiftly. To cope with physical store closures and the increased volume of online transactions, most businesses tried to revamp their business models and set up online stores to capitalise on the rise of the e-commerce wave.

With the growing trend of online transactions, it has become imperative for companies operating in the Fast Moving Consumer Goods (FMCG) industry to track the performance of their brands on the various online platforms. This need has led to the emergence of E-Commerce Intelligence (EI)–a new category of software that enables brand managers to keep track of their stocks and sales in the online space. Over the past year, many start-ups offering data analytics and EI services have emerged and caught the attention of investors and venture capitalists, who are injecting funds to further fuel growth in this sector.1

EI software relies on machine learning technologies and offers user-friendly and personalised dashboards for managers to make better-informed decisions about their products, which could then lead to increased sales and profits. EI matters because in today’s environment, all companies are focused on being customer-oriented, especially when it comes to online shopping. Having the knowledge of customer preferences and spending patterns at their fingertips enables brand managers in the FMCG industry to implement strategies to drive sales and conversion rates.

For fledgling EI solution providers, Southeast Asia offers a promising market. In this article, we discuss why this is so and elaborate on the market segments they should focus on to sharpen their competitive edge. We draw insights based on our field research, which includes a case study of an EI solution provider, Digital Commerce Intelligence Pte Ltd (DCI). Our analysis helps make sense of the demand for EI applications from FMCG firms based in Singapore, and more broadly, in Southeast Asia. We highlight the importance of flexible product offerings to reach out to brand managers, especially those from small and medium enterprises (SMEs), if they are to expand their operations. We also highlight that EI solution providers should build their data storytelling capability and thought leadership as strategies to differentiate themselves from their competitors.

The growing need for EI solutions

The projected growth for the e-commerce sector suggests that prospects are good for EI solution providers. In 2020, over two billion e-commerce customers worldwide pushed total retail commerce sales to reach US$4.28 trillion, and it is projected that e-commerce transactions will account for 21.8 percent of total global retail sales by 2024.2 In Southeast Asia, the e-commerce sector has grown by an impressive 35 percent last year, and is expected to grow by another 14 percent to reach US$45 billion this year.3

There is a myriad of reasons for the continued growth of online retail. These include an overall increase in disposable income, the convenience of online shopping, and various marketing strategies such as promotions, and free shipping or delivery above a certain price point. The rise in transaction volume is also due to higher mobile phone and Internet penetration rates across several developing economies, particularly in Southeast Asia.4 Additionally, retail powerhouses like Walmart and Uniqlo are enhancing their presence online, thereby driving e-commerce demand and sales.5

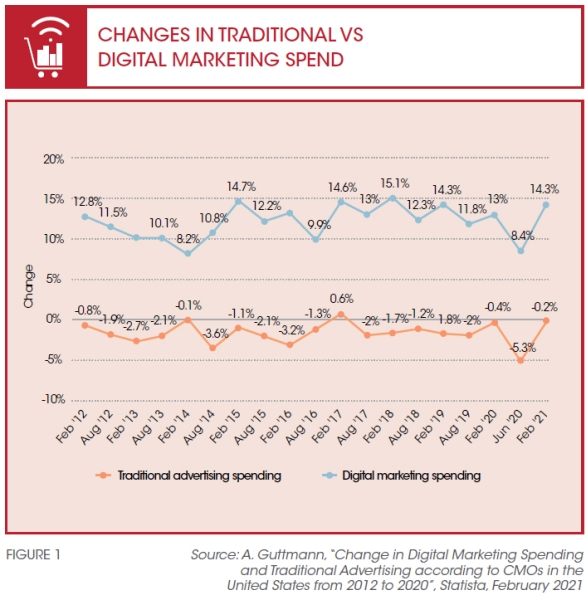

We expect the market for EI software to continue growing at a rapid rate over the next five years due to two key reasons. First, there will be fast growing demand for e-commerce data analytics in Southeast Asia given the rising e-commerce transaction volume. Second, the competition among big brands on digital platforms is expected to intensify, This will also increase their demand for and investment in e-commerce data analytics, as they attempt to gain and sustain an information edge over their rivals. The parallel increase in digital marketing solutions budgets (refer to Figure 1) will drive market growth for EI solution providers. In fact, we argue that EI solution providers have the potential to gain more market share if they continue to invest in real-time analytical capabilities driven by Artificial Intelligence (AI). Being able to offer prompt, accurate, and rich insights is going to be a key value proposition, given how rapidly sales estimates and ratings move in the e-commerce sphere.

|

DIGITAL COMMERCE INTELLIGENCE PTE LTD Compared to larger markets like the U.S. and China, accessibility to market performance data for retailer brands on e-commerce platforms in Southeast Asia like Lazada and Shopee is limited and fragmented. To address this gap, Digital Commerce Intelligence Pte Ltd (DCI), a start-up based in Singapore, built solutions that use advanced data science techniques and AI to provide e-commerce market performance insights and competitive intelligence for consumer goods brands and retailers in Southeast Asia. DCI currently offers two types of data service offerings to its customers. The first offering is a brand-level key performance indicator (KPI) monitoring tool that consolidates and analyses digital shelf data, turning it into insights and actionable recommendations. This brand-level tracker offers real-time monitoring on vital KPIs, stock availability, pricing compliance across all stores, and customer ratings and reviews. The second offering is an e-commerce category-level competitive intelligence dashboard that gives its customers a holistic view of their market size and potential, allowing them to identify areas of improvement. A market-level tracker, it offers features like weekly data refresh, brand category size and market share analytics, sales trends analytics, brand portfolio analytics and price/promo analytics. Currently, DCI offers these two products on an annual subscription basis at price points that vary according to the customisation of its customers’ solutions. |

Potential market segments

We highlight two specific market segments that EI solution providers should focus on. One is smaller FMCG clients such as local or regional brands; the other is the major players, including global firms, such as Unilever. We arrived at this conclusion from our field studies.

SMALLER CLIENTS NEED BRAND-LEVEL EI SOLUTIONS

We define smaller FMCG companies as those that fulfil either one of the following conditions: revenue of not more than S$100 million or not having more than five best-selling product categories.

For these companies, a brand-level KPI monitoring tool that consolidates and provides an analysis of digital shelf data, turning them into insights and actionable recommendations, would be an appropriate product. Digital shelf data comprises retail data, such as inventory availability. In turn, brand-level KPIs based on such digital shelf data can ensure that the company’s products do not go out of stock.

As an example, using this digital shelf data, an FMCG company based in Asia selling beer in the e-commerce space can compare the performance of its product with respect to that of other beers (e.g., Tiger, Heineken, Guinness) on e-commerce platforms like Lazada. The company can then take appropriate actions, such as stocking up more beers on weekends to attract more consumers to buy its products.

In addition, affordability is another factor that firms would consider. The brand manager of a local FMCG firm with online and offline distribution channels, in the business of distributing and selling snacks, such as nuts and dried fruits, commented that smaller firms with relatively few best-selling product categories and a lean marketing team of five simply did not have the budget to purchase feature-rich software that may cost as much as S$25,000 per category or market each year. However, a targeted brand-level tracker (such as the one offered by DCI), which cost about S$8,000, was well within its budget.

Similarly, another firm shared that while a category-level competitive intelligence dashboard would be useful, it too was unable to afford the product due to budget constraints and its small scale. However, it found the brand-level monitoring tool to be more useful at its current business stage. It too had been experiencing excess inventory due to the difficulty of coordinating sales and inventory across its retail, corporate sales, and online channels. This resulted in additional costs from unsold perishable goods and the need to rent warehouse space.

Therefore, the features of a brand-level KPI monitoring tool are more suited to the needs of smaller firms as it is more affordable and can help them achieve greater operational and marketing efficiency. Hence, one recommendation for EI solution providers focusing on smaller players is to build and market brand-level EI software that cater to the latter’s needs.

BIGGER PLAYERS NEED A SUITE OF EI SOFTWARE

While there is no ready definition yet of larger FMCG players (e.g., Unilever), we argue that there would be companies that easily have 30 or more product categories under many different segments, such as beauty, personal care, and food.

During our field studies, we interviewed three brand managers from multinational FMCG firms to understand their needs for EI software in terms of value and cost. Not surprisingly, larger players with scale and reach find market- level trackers useful. Market-level trackers provide information such as the market share of a brand in a particular product category (e.g., beer). Additionally, they provide information such as which beer brands are the top sellers each week. This data helps brand managers decide whether they should offer discounts to boost sales and increase their market share.

For instance, one brand manager affirmed the utility of a category-level competitive intelligence dashboard for e-commerce teams as it provided insights into the competition that were not readily shared by e-retailers. Brand-level trackers were less useful because the existing dashboards provided by e-retailers already allowed brands to analyse their own performance across categories and markets.

A key insight from our interviews was that both market- level trackers (e.g., category-level competitive intelligence dashboards) and brand-level ones (e.g., brand-level KPI monitoring tools) were useful but for different reasons. Market-level EI software, such as category-level competitive intelligence dashboards, was more useful for managers in global roles or category managers requiring top-line insights into product performance, while brand-level monitoring tools and solutions were more useful for local brand managers, managers directly handling sales, or those in charge of executional strategies. Such brand-level software could also be enriched if EI solution providers added value by incorporating bolt-on features that work side-by-side with the core systems to provide supplementary functionality. One example would be data integration from e-retailer platforms, such as Lazada and Shopee, so that local brand managers could track whether their performance is better or worse than their competitors on these platforms.

EI solution providers that target larger players should therefore consider the prospects of cross-selling both types of EI software that cater to the needs of different teams in large FMCG firms.

Data storytelling: a compelling must-have

According to technology consulting firm Forrester, satisfaction with analytics dipped 21 percent between 2014 and 2015, despite investments in big data.6 While 74 percent of firms want to be data-driven, only 29 percent are confident of connecting analytics to action.7 This presents a gap in the market that is still largely unexplored and open for EI solution providers to exploit in order to offer better value to their clients, and fulfil their need for fast and actionable intelligent insights.

A prominent value proposition based on identified customers’ needs would be to offer packaged data that catered to specific job scopes for customers to gain easily understood, readily accessible, and actionable insights. This could help EI solution providers acquire more customers, especially smaller-scale companies that are looking for cost-effective market intelligence solutions.

We argue that compelling, concise, and convenient data storytelling is one way to address their needs. By presenting only the most relevant and contextualised insights to customers based on their roles and needs through data storytelling, EI solution providers can tap on this opportunity and increase customer satisfaction. In turn, their clients also stand to gain from automated data storytelling enabled by AI, as this feature helps reduce workloads while targeting customer needs better.

Data storytelling combines the usage of narrative, visuals, and data to explain, engage, and enlighten customers.8 A narrative is a vital component of communicating the information and insights that an EI solution firm has to offer. Data storytelling capabilities would facilitate the acquisition of adopters by making a more compelling sales pitch, as potential customers would be able to perceive the immediate value EI solution providers can add to their brands and departments, allowing actionable insights to be communicated more easily within their organisation. When such reports are shared or published, this may even boost ‘land-and-expand’ selling to adjacent cross-functional departments or sister brands.

EI solution providers can also consider using data storytelling tools to deliver automated, customised reports to clients to surface key insights in an effortless, enjoyable, and digestible manner. Telling a compelling story with the data will help customers remember an EI solution provider’s products and they are more likely to believe in the value of these products. For instance, in the case of beers, besides presenting the data on the dashboards, the data storytelling solutions can compile the data into a report that shows the sales of the company’s brand with respect to all other beer brands in a week. Additionally, the data could provide interactive stories that show the brand managers what they could change to achieve their desired sales target.

EI solution providers could consider leveraging technologies like natural language generation (NLG), deep learning, and augmented analytics to implement data storytelling tools. For example, NLG is employed by data storytelling company Narrativa to transform data into human knowledge in real time and offer automated products to allow companies to get an immediate response to make data-driven decisions in a timely manner. By blending EI with the data storytelling capabilities that NLG provides, EI solution firms can automate some of the resource- intensive after-sales services they provide on an ad-hoc basis for their clients, such as data exploration and analysis, and report generation. This would also enable these firms to scale successfully by acquiring more customers without hiring more consultants and data analysts.

There are three possible methods to implement such data storytelling products. Firstly, an EI solution provider could act as a middleman and purchase contracts from data storytelling companies for its clients. It also has the option to develop the solution in-house. Alternatively, it could explore potential partnerships or collaborations with data storytelling start-ups.

Based on our estimates, the implementation of self-developed data storytelling products or adoption of the middleman role will not be financially feasible for a start-up like DCI. The contribution margin ratio for a bundled package of a category-level competitive intelligence dashboard and an additional data storytelling tool will be very low, due to the high fixed costs involved in either of the first two options, which will result in a much higher break-even figure. Therefore, we recommend that new and smaller EI solution providers should seek other start-ups that provide such services. This way, both parties stand to benefit from mutual collaboration. A successful partnership would allow both companies to gain greater reach and publicity, thus freeing up resources to focus on their own specialty technology and grow their client bases.

The need to establish thought leadership

In addition to data storytelling, thought leadership is the other area that EI solution providers should build up their capabilities in to differentiate themselves from the competition.

Becoming a thought leader is about establishing yourself as an expert in the industry and being recognised as the go-to person for advice.9 Thought leadership marketing leverages the depth and richness of industry knowledge and experience in answering questions from the audience. Doing so creates a professional image that boosts the credibility of your company. Apart from creating value, 45 percent of decision-makers mentioned that thought leadership compelled them to invite an organisation to bid for a project when it had not been considered previously.10

As the business of EI solution providers is highly specialised and technical, the ability to convey thought leadership helps build the brand and enables customers to differentiate them from competitors. Furthermore, it provides a sense of assurance to their target customers that will be beneficial in driving conversions, giving them an advantage when customers are deciding which company to seek for EI advice.

EI solution providers should be active and create their own posts on social media. For example, they can highlight why EI matters for brand managers, or even repost articles related to EI and share it on their LinkedIn pages. However, they must ensure that the content shared is educational, value-adding, and is aligned with the EI solution provider’s brand perspective. Content provided has to be engaging to be effective.

Conclusion

The Southeast Asia market for EI solutions is still in its nascent stage. This implies that the market is not only fragmented, but also lacks clear standardisation across the industries. Players are offering variations of the same service. At the same time, customers too have not formed a finalised, complete idea of the products that they are looking for. While having no clear industry leader in this early development stage can be beneficial for fledging providers like DCI, it also means that they must communicate clearly and constantly with potential clients to refine their value propositions and product offerings in order to capture a larger market share.

Within the FMCG space, EI solution providers have a good chance of capturing the growing market in Southeast Asia. They just have to be clear about which market segment (i.e., local, regional, or global players) to target with which blend of offerings (e.g., brand-level tracker only or a suite of brand and market-level monitoring solutions). Along with that, they would need to pay attention to data storytelling and play the long game by building up their thought leadership.

Yuanto Kusnadi

is Associate Professor of Accounting (Education) at Singapore Management University

Gary Pan

is Professor of Accounting (Education), Associate Dean (Student Matters), and Academic Director of SMU-X at Singapore Management University

References

1. Taylor Soper, “E- Commerce Intelligence Platform Stackline Raises $50M from Goldman Sachs as Online Retail Booms”, Geek Wire, November 20, 2020.

2. David Coppola, “E-commerce Worldwide–Statistics & Facts”, Statista, July 14, 2021.

3. Ethan Cramer-Flood, “Southeast Asia Ecommerce 2021: Public Health Uncertainty Clouds Outlook”, Insider Intelligence, July 6, 2021.

4. Eric Ng, “Uniqlo Parent Fast Retailing to Strengthen Online Sales after Beating Retail Gloom to Report Better-than-Expected First-Half Profit”, South China Morning Post, April 9, 2021.

5. Bain & Company, “e-Conomy SEA 2020–Resilient and Racing Ahead: Southeast Asia at Full Velocity”, 2020.

6. Brian Hopkins, “Think You Want to be ‘Data-Driven’? Insight Is the New Data”, Forrester, March 9, 2016.

7. Ibid.

8. Brent Dykes, “10 Ways to Make Your Dashboards More Actionable”, Forbes, September 12, 2019.

9. Rebecca Riserbato, “The Content Marketer’s Guide to Thought Leadership”, November 4, 2019.

10. Alex Rynne, “How to Create Impactful Thought Leadership Marketing”, November 13, 2019.