Opening up a bold new world for Vietnam’s trade and industry may not be so easy.

Vietnam began its journey towards economic reform in 1986 when the government initiated the Doi Moi policy with the intent of establishing a socialist-market oriented economy. Since then, the country has engaged in 15 free trade agreements (most of them bilateral) along with numerous policy changes that have led to the gradual opening up of the economy. The results are evident: Vietnam’s trade increased ten-fold from US$30 billion in 2000 to almost US$300 billion in 2014. The fact that Vietnam moved up from a ranking of 148 to 131 on the Index of Economic Freedom1 in just one year (between 2015 and 2016) illustrates that the nation is poised to push further up the economic liberalisation ladder. Yet, the climb will not be easy.

The Trans-Pacific Partnership (TPP), a trade agreement among 12 Pacific Rim countries—Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the U.S. and Vietnam—is Vietnam’s most ambitious free trade deal to date. Collectively, TPP member countries represent 40 percent of global GDP and one-third of global trade; and their combined population of 800 million makes the TPP the largest regional trade agreement to date.2

Compliance with WTO membership is more achievable than meeting the obligations set by either the ASEAN agreement or the TPP.

Should it come into effect, the TPP will offer a huge opportunity for Vietnam to increase its access to these markets as well as benefit from the seamless flow of trade and investments across the 12 nation states. On the flip side, Vietnam will be subject to extraordinary competitive pressures and policy reform measures—even more so than when it joined the World Trade Organization (WTO) in 2007, or in its preparations for 2018 when the ASEAN Free Trade Agreement is scheduled to remove all import duties for the ten members in the Southeast Asian bloc. Compliance with WTO membership is more achievable than meeting the obligations set by either the ASEAN agreement or the TPP, despite the WTO being a much larger, complex group of countries.

In this article, we discuss the potential opportunities and challenges posed by the TPP for Vietnamese industry and business.

Free trade: Does everyone benefit?

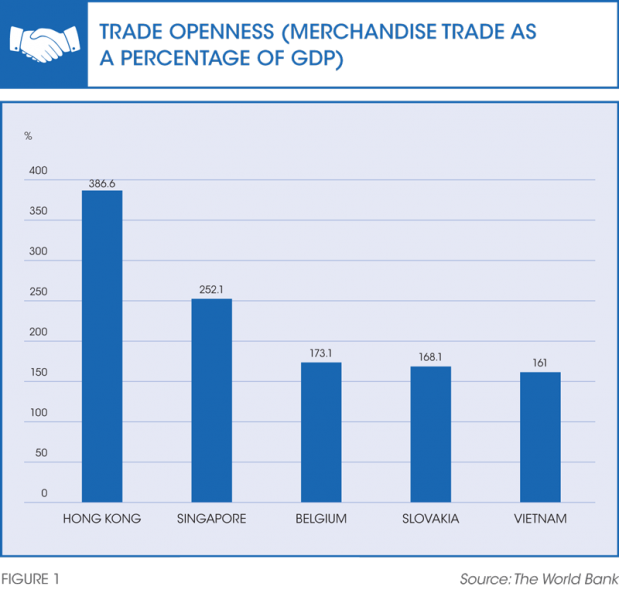

In 1817, David Ricardo first propounded the Theory of Comparative Advantage and explained why a country can benefit from trade even when its labour productivity is higher for all goods produced (that is, it has a higher absolute advantage) than that of other countries. Admittedly, we don’t operate in perfect markets that offer perfect solutions from economic theory. However, the benefits of free trade have been illustrated, time and again, by researchers, policy makers, and multilateral aid organisations. For instance, according to one study by the International Monetary Fund, a one percent increase in a country’s trade openness (measured as merchandise trade as a share of GDP) can result in an increase in GDP per capita in the range of 0.7 to 1.2 percent.3

With a ratio of trade to GDP of 161 percent, the fifth highest in the world in 2014,4 Vietnam’s economy has a lready reaped a lot of benefit from trade liberalisation (refer to Figure 1). The country’s per capita GDP has increased from US$239.4 in 1985 (pre-Doi Moi) to US$2,052.3 in 2014.5 For the past 15 years, its annual GDP growth has hovered between 5.5 and 7.5 percent.6 Taking into account purchasing power parity, Vietnam’s GNI per capita has more than doubled between 2001 and 2014, from US$2,220 to US$5,350.7

It is hoped that Vietnam will get even more benefits if the TPP agreement comes into effect. Overall, improved trade and investment will result in higher economic growth. As the member with the lowest labour cost among TPP countries, Vietnam can potentially attract a lot of foreign investment. With MNCs setting up manufacturing operations in Vietnam, consumers will also have better access to cheaper high-quality branded products.

Nonetheless, there are several factors that make the TPP particularly challenging for Vietnam. The first of course, is that the agreement is among 12 countries with vastly different levels of development and types of government. The contrast between the U.S., Japan and Australia on the one side, and Brunei, Peru, Malaysia or Vietnam on the other, is a case in point.

COMPETITION

Under the TPP, tariffs on most goods and services will be reduced (in the case of Singapore, tarifwerful MNCs, Vietnamese firms will find themselves exposed to competition they had never encountered before. ASEAN-based firms, with perhaps the exception of a few Singaporean companies, do not have the same level of global competency as large American and Japanese firms. This is a frightening prospect for many Vietnamese firms and small business owners, particularly in the anifs on goods will be completely removed), and Vietnam’s market will be gradually opened to foreign competition. Since the TPP contains member countries that are home to pomal husbandry and agricultural sectors, whose scales of operation and automation levels are much lower than those of their peers in North America, Australia and New Zealand. And competition will only grow as more countries join the TPP. For example, Thailand and South Korea have already signalled their intent and interest to apply for TPP membership in the near future.

Regardless, the TPP offers great opportunity for Vietnamese companies. It will provide access to lucrative foreign markets, even though entering these markets will require greater managerial skills and investments in human capital and technology to make higher quality low-cost products.

CAPITAL FLOWS

Foreign investment will also flow unhindered under the TPP. This is another key aspect where the TPP differs from the WTO and ASEAN structures. When the TPP goes into effect, Vietnamese firms will gain access to credit from foreign banks and financial institutions. However, foreign firms will also have the opportunity to invest in local companies, including banks. Thus, although there will be enormous financial benefit for Vietnam, it will however expose the country to the global financial system, and increase its vulnerability to higher risk of capital flight in the event of an economic downturn.

REGULATORY COMPLIANCE

Vietnamese firms must comply with a number of international trade norms and standards relating to intellectual property, labour and the environment in order to participate in the reduced tariff schedule of the TPP. This includes compliance with criteria set by the World Intellectual Property Organization and adherence to child labour and workers’ rights laws, as well as certain guidelines on environmental pollution.

There are two key challenges here. The first is regulatory reform at the government level, which requires political resolve and will be a major force for pushing economic reform. Currently, Vietnam maintains strict laws on information disclosure in the name of national security, meaning that the government’s policies are still quite opaque. Once the TPP goes into effect, Vietnam must openly disclose policy information to investors. This will be a significant culture change for policymakers.

Once the TPP goes into effect, Vietnam must openly disclose policy information to investors. This will be a significant culture change for policy makers.

The second is industry compliance—which is the more difficult challenge—as it will require educating the businesses and bringing about cultural and organisational change across a large number of players that are accustomed to ‘business as usual’. This will be a significant transformation for Vietnamese companies, and will materially add to the complexity of business operations, especially with regard to cross-border input protocols involved in entrepôt trade.

For example, if a Vietnamese company imports a production input from a company in ASEAN that is not a member of the TPP, say yarn from Indonesia, and then uses that yarn to produce T-shirts that are sold in Canada, then those T-shirts would not qualify for the TPP tariff schedule. To be included in the tariff schedule, a product must be completely sourced from, and manufactured in, TPP member countries. This is, in part, beneficial for Vietnam because it can better compete on price against other low-cost manufacturing countries like China (which has not signalled its intention to join the TPP so far).

But there are downsides to the input protocols too. Take the example of pharmaceuticals. Presently, Vietnam is able to supply cheap drugs by manufacturing generics or importing such drugs from India. However, if these drugs are in violation of the intellectual property (IP) rights of TPP member countries, then Vietnam will no longer be allowed to sell generics, thereby substantially increasing the cost of pharmaceuticals. This is a big issue since many generic drugs from both India and Vietnam are currently reverse engineered, which is in violation of the TPP IP regime. If Vietnam is found to be peddling these drugs, the country could face punitive action, such as fines and trade sanctions, from TPP member countries.

IP infringement has been a problem for Vietnam in the past, especially in terms of counterfeit trafficking with China. However, the government has begun cracking down on IP violations and enforcing penalties. This can include up to ten years in prison for severe infractions, such as trafficking, but can also include more minor forms of criminal prosecution and fines.

BUDGETARY IMPACT

Once businesses are compliant with the TPP regime, they will be able to take part in the new tariff structure. While this applies to both importers and exporters, Vietnam exporters will gain more than the importers. For instance, in 2014, Vietnamese exports were subject to US$2.6 billion in tariffs compared to only US$892 million levied on the country’s imports. At zero tariffs, this amounts to an immediate US$1.7 billion in tax savings, which is equivalent to 0.91 percent of Vietnam’s GDP. If the tariff rate is gradually reduced, the country can expect to see a net total tax savings of 4.5 percent of GDP over the next 10 years.8

Of course, this also means that the Vietnamese government will be collecting less in tariffs. Currently, the government earns 9.4 percent of its revenue from tariffs. However, imports from TPP member countries only constitute 2.7 percent of total revenue, which the government will likely offset with increased consumption tax on products like tobacco, alcohol, gasoline and automobiles.

Rebalancing trade partners

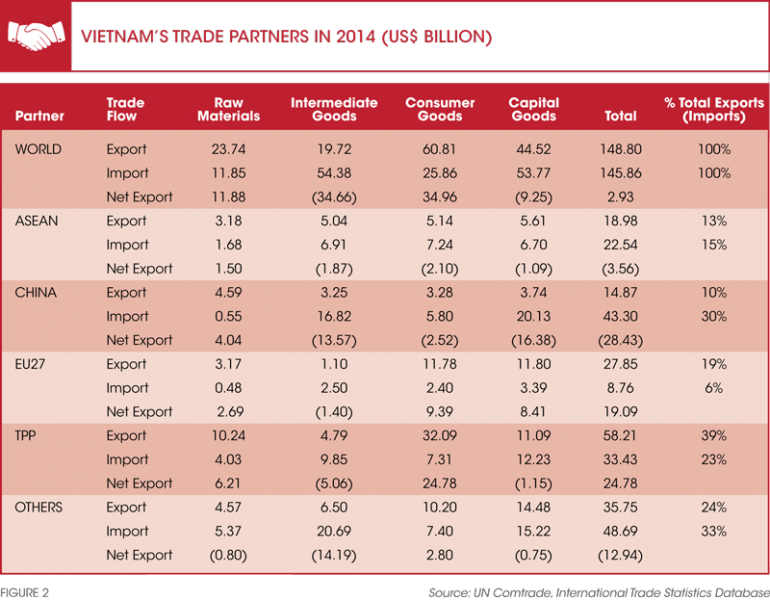

The trade weight of Vietnam’s trading partners will also be impacted by the TPP. Today, China is Vietnam’s largest trading partner, accounting for 30 percent of total imports into Vietnam and 10 percent of Vietnamese exports. While trade between Vietnam and China accounts for 20 percent of Vietnam’s total trade, it adds up to a mere two percent of China’s total trade. This creates an issue of economic security for Vietnam—if there are any disruptions to trade due to the territorial disputes in the South China Sea, for example, Vietnam’s economy will suffer disproportionately more from the setback.

In addition to an unfavourable trade balance, the trade structure also puts Vietnam at a disadvantage. Most of Vietnam’s exports to China are low value-added products (raw materials like crude oil, rice, shrimp, and cashew) while its imports from China consist of higher value-added products such as intermediate and capital goods. In 2014, Vietnam was a net exporter of US$4 billion in raw materials to China, but a net importer of US$16.4 billion in capital goods, US$13.6 billion in intermediate goods, and US$2.5 billion in consumer goods (refer to Figure 2). For example, Vietnam exporters use intermediate goods like fabrics from China as an input for the local textile industry, and export ready-made garments to other countries.

Our further investigation reveals that while Chinese imports are able to easily penetrate the Vietnamese market, Vietnamese exports struggle to establish a footprint in China, despite lower tariffs. In 2014, Vietnam exported only US$3.3 billion of consumer goods to China compared to US$32 billion to the TPP countries, even though the average tax rate is 5.71 percent in China compared to 7.36 percent in the TPP countries. China enjoys favourable access to the ASEAN markets in general and Vietnam, in particular, because of the ASEAN-China Free Trade Area agreement, which is one of the main reasons for Vietnam’s high trade deficit of US$28.4 billion (in 2014) with China. Vietnamese exports to China face direct competition with comparable products produced in China itself, which have the advantage of scale. Furthermore, only five out of Vietnam’s top 20 export products could penetrate the Chinese market compared to 14 that could penetrate well into the TPP markets.

If the TPP comes into effect, imports from China will be impacted on two levels: first, the goods imported from TPP countries will become more affordable for Vietnamese consumers; and second, Vietnam producers are more likely to replace intermediate goods from China with those from TPP markets.

The TPP also gives Vietnam the opportunity to diversify its portfolio of trading partners and enter into potentially more lucrative markets. The trade flows are more advantageous with exports from Vietnam to TPP countries accounting for 39 percent of Vietnamese exports, while imports from TPP countries to Vietnam formed only 23 percent of Vietnam’s total imports. In addition, Vietnam maintains a net export position with the TPP in both consumer and capital goods, industries that are large employers in Vietnam. This rebalancing is supported by Vietnam’s comparative advantage in the production of textiles, shoes, suitcases, and seafood–all of which have high penetration into TPP member countries but do not do well in China and most ASEAN countries. Vietnamese exporters of these products will gain the most by selling to the U.S., Malaysia and Canada.

So, who will benefit?

Producers of consumer and capital goods, particularly from Singapore, Japan and the U.S., will certainly receive more orders from Vietnam when tariffs are significantly reduced on gasoline, machine and equipment, cars, poultry, milk, wine and tobacco. Similarly, Vietnamese producers of textiles, shoes, suitcases, rice, seafood, rubbers, etc. will witness a jump in sales to the American, Malaysian, and Canadian markets.

Some local industries will also have the opportunity to turn around their competitive positions if they can leverage Vietnam’s low labour costs. For instance, the car manufacturing industry in Vietnam had traditionally found it difficult to attract foreign investments, and is deemed to be in a disadvantageous position when Vietnam eliminates automobile tariffs for the ASEAN countries starting 2018. However, if car manufacturers in Vietnam successfully take advantage of having the lowest labour costs among the TPP countries, they will be able to attract foreign investments and become production bases to export to other countries in Asia, or even other TPP countries.

MNCs will be the biggest winners because they will benefit from tax savings on the sides of both imports and exports. It is obvious that the TPP agreement will help these global distributors save tax and increase sales and profits on the products imported from the TPP countries to Vietnam. However, they will also capture most of the tax savings from the products exported from Vietnam to the other TPP countries.

Vietnamese manufacturers will certainly benefit in terms of expanding sales volumes; however, whether the MNCs will pass on the tax savings to Vietnamese manufacturers depends on the negotiation between the two parties. It is highly unlikely that Vietnamese manufacturers will be able to negotiate a significantly favourable price, mainly because of fierce competition among Vietnamese firms. Some Vietnamese businesses will receive a windfall of orders, but order prices are unlikely to increase significantly and workers will likely not experience much, if any, change in their standard of living. Vietnam needs to avoid the trap of being seen only as a labour-abundant country that produces low- quality, cheap products. It must use its preferential relations with TPP countries as a means of climbing up the value chain.

No gain without pain

Of the 12 countries signing the TPP, Vietnam is perhaps the most profoundly impacted. There are both positive and negative aspects to any free trade deal, with some winners and some losers, but what matters most is the net effect on the welfare of society as a whole, and that of the average Vietnamese.

If Vietnam is to become more internationally competitive and enjoy a higher standard of living, like Japan or South Korea, then the country must commit to substantial change at both the government and business levels in order to adapt to the new environment. The rewards are high and there is a strong willingness among the people of Vietnam to step up to these challenges.

The country has certainly already overcome much graver and more difficult challenges in the last 40 years. Yet there is still scope for Vietnam to improve its governance and economy, and in that respect, the TPP should be examined in the context of Vietnam’s history of reform. This will no doubt be a rocky transition.

But consider the alternative of not joining, which is also a risk; the risk of maintaining the status quo. The TPP represents an opportunity to drive Vietnam forward and position itself for longer-term growth. By entering the TPP, Vietnam will be forced to become more competitive, which in turn (hopefully) will lead to greater economic, social and regulatory reform. It will have to be a delicately balanced transition, and smart investments will be needed to guide the country towards greater prosperity. Cautious optimism is needed.