Can blockchain address non-performing loan-related issues in the Indian banking system?

Indian banks are currently experiencing poor performance when it comes to debt risk. Burdened with high non-performing loans (NPL), they are putting at risk the funds of investors as well as India’s industrial and economic growth. In addition, the loan management process itself is riddled with inefficiencies. To overcome them, we propose to use blockchain technology.

Loan quality-related issues in the Indian banking system

Recently, several high profile loan defaulters have rocked the Indian media, bringing to the fore one of the burning issues that has been brewing in the Indian banking sector for quite some time. This is the issue of NPL, which are also known as non-performing assets (NPA). Indian Public Sector Undertaking (PSU) banks currently have an estimated INR4 trillion (US$60 billion) in bad loans as of December 2015. Should all these loans turn into NPA, the overall financial risk of Indian banks would exceed their market value. Investors carry the burden of this risk, and the industry suffers while the economy bears the brunt.

The International Monetary Fund Financial Stability report released in April 2015 estimates that 37 percent of total debt issued by Indian banks is at risk, which is high compared to other emerging economies. The debt at risk far outweighs the buffer maintained by banks. Indian banks reported gross NPA of only 4.45 percent in March 2015; pushing bad loan cases to restructured loans, thereby sweeping the dust under the carpet. Reserve Bank of India Deputy Governor, S. S. Mundra, identified asset quality management as the number one priority for Indian banking.

Asset quality is not just an Indian issue; the governance of asset quality has shown a downward trend across several other ASEAN banks as well. Most ASEAN countries are plagued by rising corporate debt and mismatches in debt repayment capability. Singapore, Thailand and Malaysia have reported faster growth of loans compared to their GDP, with Thailand reporting NPL of over three percent. NPL are fuelled by poor quality underwriting and a lackadaisical approach in aligning changes in credit rating to loan repayment terms.

A slowdown of Indian industrial growth and the increase in interest rates, compounded by economic volatility across the world, has accentuated the risk of default. Similar to India, other growing economies like China, Thailand, Brazil and Argentina have a significant share of debt owed by firms with constrained repayment capacity. Addressing asset management issues for this segment can significantly reduce the magnitude of risk.

New technologies offer an alternate or perhaps a complementary approach to monitoring asset quality. We propose the blockchain-based distributed ledger, information sharing, smart identity, smart contract, smart collateral and smart property applications as possible technology solutions to eliminate inefficiencies in the loan management process in the Indian banking system. They will also help to usher in transparency, trust and inter-bank collaboration.

Introduction to blockchain

Blockchain forms the technology backbone of the popular crypto-currency ‘bitcoin’, which is a virtual currency used for digital payments in many countries across the world. While the success of bitcoin is widely debated, the blockchain technology has generated widespread interest in contracts and financial applications. This technology is expected to be the next biggest disruptor in business. Just like the Internet is a medium for exchange of information, blockchain is a medium for exchange of value.

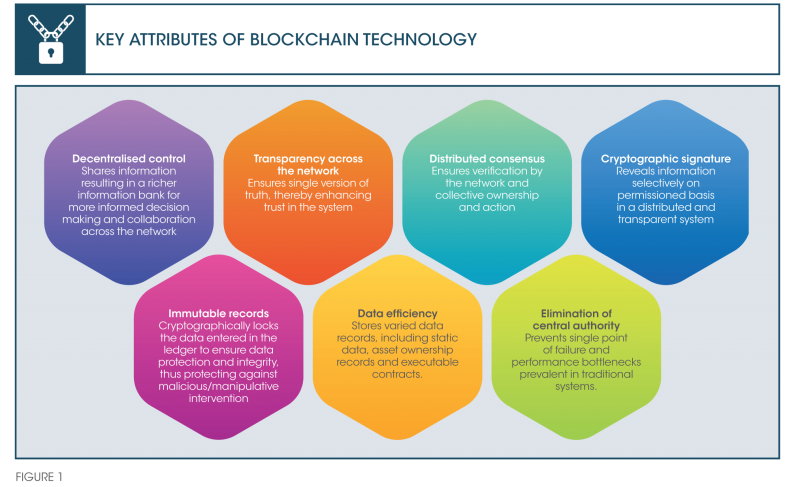

Blockchain technology offers open and transparent processing and recording of information, establishes trust in the absence of a mediator, encompasses collaboration across the network, and ensures information integrity. The appropriate use of cryptographic protocols ensures data security. The key characteristics of the blockchain technology are given in Figure 1.

Blockchain applications in business

Blockchain offers decentralisation of control, where authority and trust are distributed across the network. This offers an opportunity to break organisational, economic and regulatory control in transaction processing. The following are examples of blockchain applications.

Crypto-currency: Bitcoin is a cryptocurrency that is accepted across country borders. Anybody having a blockchain wallet can make payments using this currency if the bitcoin is legally acceptable in that country. While bitcoin is the most popular crypto-currency, examples of other crypto-currencies in the market include namecoin, litecoin and peercoin.

Distributed ledger: Some of world’s largest banks have formed the blockchain consortium, R3, to collaborate on a distributed ledger for faster, secure, efficient and transparent financial transactions. Nine member banks formed the consortium in September 2015. In just one year R3 has grown to over 50 members worldwide.

International payments: Digital currencies like bitcoin eliminates the need for central banks and fluctuating exchange rates, giving it a universal appeal (similar to gold). In June 2016, U.K.’s Santander Bank introduced blockchain for international payments using a pilot mobile app. The governments of the U.K., Israel and Korea have invested in blockchain technology as a substitute system for international monetary settlements.

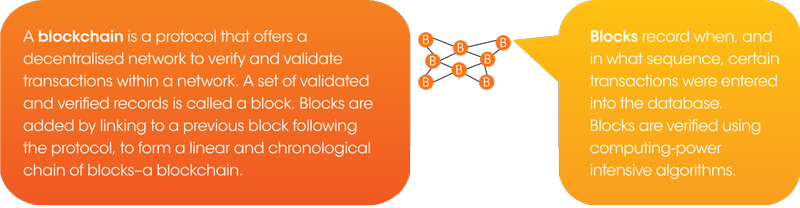

Payment settlements: Blockchain is an effective tool for transaction reconciliation and settlement across parties in the payment chain. A blockchain-based ledger records payment transactions and secures them with cryptographic algorithms and keys. The decentralised control and authority feature of the blockchain technology is used to eliminate the need for a central clearing house as a mediator among banks, financial institutions and other players. Figure 2 illustrates how the settlement processes work before and after the implementation of blockchain technology.

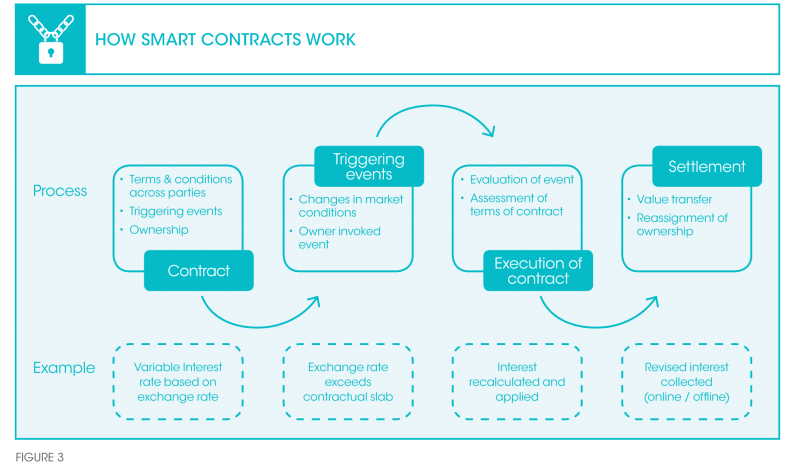

Smart contract: Contracts are stored on the blockchain with defined rules to manage their value and ownership. It allows the governance of contracts between parties, eliminating the need for an arbitrator. Technically, a smart contract is a computer programme that is invoked by pre-defined events. Blockchain technology makes smart contracts trustworthy by eliminating the controller and making the programme transparent, efficient and cost effective (refer to Figure 3). Blockchain startup, Symbiont, for example, has used blockchain technology to implement smart contracts in the U.S. to help businesses with their operational and legal procedures.

Smart identity: Blockchain technology can be used to store identity records digitally, thereby maintaining security and privacy. User education, experience and events data are stored for faster identity verification. Banks can store customer data on blockchain and attach it to customer identity. For example, the Shocard platform certifies and stores identification documents using the blockchain technology. Users can securely retrieve records and prove identity whenever they need.

Collateral ledger: Blockchain technology enables the posting of collateral in the form of initial and variation margin by escrowing cash on cash ledgers, or assets on asset ledgers, to a distributed collateral ledger. The ledger allows the sharing of collateral information for better evaluation of borrowers’ financial and asset positions, auditability and transparency, and the elimination of ‘double spend’ (this is done by verifying each transaction added to the blockchain to ensure that the inputs for that transaction was not spent previously).

Information sharing: Blockchain offers a mechanism for information sharing and collaboration. This technology can be used for the storage of records and access-based retrieval from anywhere. Chimera created a platform for sharing alarms and notifications in an Internet of Things network. La’zooz implemented a real-time seat blocking and ride sharing application based on the blockchain technology. BitHealth, Factom, Bitproof.io and Blockparti are other implementations of the blockchain-based record sharing.

Smart property: Blockchain can be used to register ownership of digital content and transfer or sale of rights. It thus serves as a platform for registering intellectual property rights.

Blockchain and loan quality management for Indian banks

‘Permissioned’ ledgers, smart contract and smart property applications of the blockchain technology can be leveraged to create a decentralised system with distributed control that increases transparency and trust in the management of loans across banks. Since the banking system contains private and confidential data, blockchain technology for this domain entails decentralisation and distributed processing at the bank level. Each bank can become a participant in the blockchain network. Bank employees can act as miners or nodes in the network responsible for distributed consensus. Altruistic and rational nodes distributed in the network ensure a fair and trusted system.

Identity verification of borrowers is faster and more efficient with the use of smart identity in the blockchain network. Loan approval necessitates consensus from all participants of the network. Shared information provides access to richer information for well-informed decision making and consensus, thus eliminating the scope of ‘double spend’. Smart contracts regulate the loan through its lifecycle, eliminating the possibility of incongruent reporting of loans and unreported loans. Shared control in the review of past loan records, verification of financial information, and shared consensus assures efficient governance and transparency in underwriting.

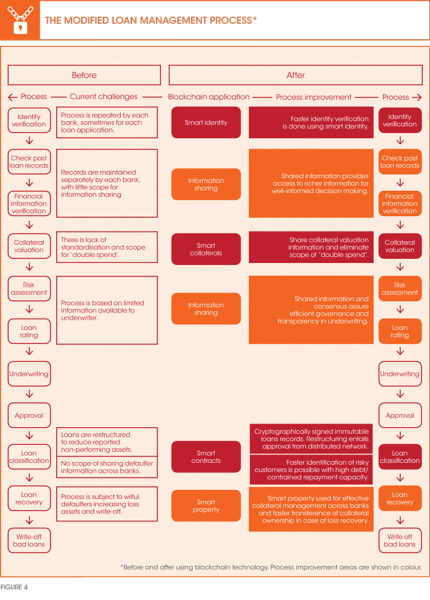

Approved loans are cryptographically signed and immutable. Loan restructuring entails the approval from the distributed network, providing stringent control on data, classification and reporting. The use of smart contracts in post-approval loan classification provides for transparent loan asset classification. It allows faster identification of risky customers with high debt and/or constrained repayment capacity, as creditors’ identities and activities are visible across the network. This in turn reduces the risk of loss of assets. Smart property helps in effective collateral management across banks and faster transference of collateral ownership in case of loss recovery. Figure 4 illustrates the typical processes involved in handling loan applications in the Indian banking context, and how those processes can be improved using the blockchain technology.

Limitations and future considerations

Blockchain holds the promise to address the thorniest issue plaguing the Indian banking system at present, that is, bad loans. Conceptually, the blockchain technology provides a solution to the problem of bad loans by offering a fair resolution to the slips in the asset management process. However, on a practical front, some challenges remain. The implementation of blockchain calls for a thorough technological and regulatory evaluation, increased societal awareness, immense collaboration and insight, stringent planning and sound technical expertise.

Banks deal with customers’ private information and sensitive financial information, necessitating stringent data protection norms. Indian banks are guided by the Reserve Bank of India’s guidelines on data protection and governance. Information security awareness is low in the Indian banking system, which exposes banks to data security threats and cybercrimes. One of the most critical information security challenges in Indian banks is the threat to confidentiality and integrity of information when shared with external parties.

By tradition, banks are not culturally oriented to use distributed and decentralised data storage and processing. The regulatory framework for information security and cybercrime in India is weak and ambiguous. Given this background, Indian banks are naturally expected to be apathetic towards adopting new technology involving data sharing and decentralised control. Awareness of blockchain needs to be built across the board to combat inherent inhibitions.

On the technology front, the blockchain technology is yet to be tested for scalability, capacity and performance needs of large datasets involved in the Indian banking system. Suitable cryptographic and consensus protocols for data access and control that fulfil the needs of the system need to be developed. Protocols and governance mechanisms for access and smart contracts need to be established for the implementation of multi-party systems with high financial risk exposure. This requires significant investment in research for improving blockchain technology.

Blockchain is a contender for the next biggest technology disruption since the advent of the Internet, promising dramatic changes in data protection, consumer empowerment, as well as creation of trust and transparency. It has an inherent capability to overcome threats to information confidentiality and integrity in a shared environment, thus assuaging the possible perceived impediments. The technology heralds inter-bank collaboration to overcome issues in asset management and paves the way for more informed decision making, effective policy implementation and governance of loan management processes.

Blockchain also has the potential to become the de facto medium for value exchange. With its foundation in cryptography, the technology promises to surmount threats to data security on a shared platform. Faster and richer information access, combined with democratised control and high interoperable shared and secure platforms with ‘permissioned’ access and distributed contact management scripts, are perfect ingredients for a disruptive innovation in asset management across the banking industry.

India can thus script yet another leapfrog success strategy through the adoption of the path-breaking blockchain technology to overcome imminent issues in NPL, improve the overall health of Indian banking, recover lost investor confidence and rejuvenate India’s industrial and economic growth.