While some see real estate as an opportunity for making large financial gains, others find the hefty capital outlay, long-term outlook, high transactional costs and market volatility quite a challenge and a lot more complicated than investing in stocks and bonds. Although the past few decades have witnessed a surge in its popularity, seasoned investors will tell you that buying real estate is much more than just finding a place to call home. For those too cautious or cash strapped to take the plunge in an actual property, real estate funds offer an attractive balance, as they enable investors to participate in the ownership of real estate, yet with a small capital outlay over a diversified and liquid portfolio that is tradable in the equity capital markets.

Asia is spearheading the trend

Since the turn of the century, growth in Asia has far exceeded that of the western countries. In the quarter century up to 2013, the six Asian nations now in the G20 saw their share of world gross domestic product grow from 20 percent to 31 percent, while the four European Union countries in the G20 saw their share fall from 20 percent to 12.7 percent.1 The expanding economies and rising purchasing power in Asia have naturally led to a higher propensity to save and invest, and much of this investment is being channelled into the property market. This is evidenced by the escalation of property values in major cities in Asia.

During the 2008–2009 economic downturn, property prices and interest rates fell dramatically the world over, and Asia was no exception. However, immediately after the crisis, money poured into Asian countries in search of better returns, and, more often than not, found its way into the property market.

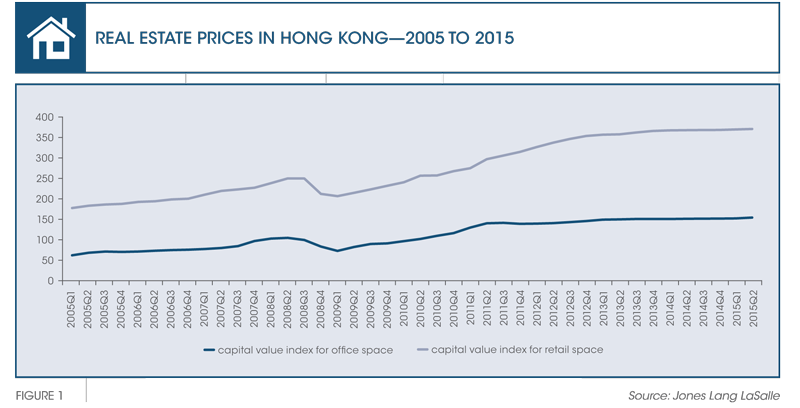

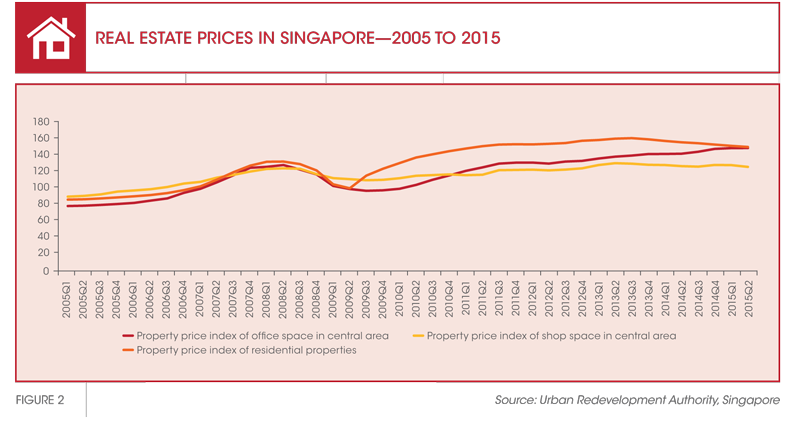

Local and international investors with sufficient cash reserves and financing means took advantage of the low prices and interest rates, and invested in Asian property for the long-term. As a consequence, property prices in Hong Kong, for example, have more than doubled in the last ten years, and the same trend is also observed in Singapore (refer to Figure 1 and Figure 2).

In countries such as China, the rising economy and growing affluence of its people have led to higher demand for different types of properties, including residential, commercial, and retail. With access to cheap liquidity, we are also seeing a growing number of investors from China investing in properties around the world, particularly in gateway cities of Australia, the United States and the United Kingdom. In 2014 alone, Chinese global property investment hit US$15 billion, and four out of the top 20 insurance companies in China had significant offshore investments.2

In general, real estate investing is very popular in Asia. It requires capital, patience, and a sense of being very down-to-earth as owning a roof over one’s head is more important than anything else. These are traits that fit well with the virtues inherent in many Asian cultures, where it is considered preferable to own a property rather than paying rent to outsiders. Very often, buyers look to invest for the next generation as a form of inheritance. The popularity of property investments has also risen because they become a form of passive income for ageing couples, who can rely on rental income and gains from capital appreciation, after retirement.

Opportunities for the risk-averse investor

Despite its attractiveness, property investment usually requires a huge capital outlay, which may not be accessible to most individual investors. In addition, properties are also typically mid- to long-term investments. While the general consensus is that property prices always go up, there are instances where property may not perform as well as expected. In Singapore, for example, the ten-year Urban Redevelopment Authority (URA) property price index from 2005 to 2014 returned an average 6.1 percent per year (excluding rent and dividends) versus 5.3 percent per year for the STI index.3 However, while Singapore property prices may have tripled between 1989 and 1996, from 1996 to 2014 the return was less than even one percent per year. In fact, from 2013 to 2014, property lost 1.5 percent while the STI returned 3.1 percent per year.

In addition, since the 2008 global financial crisis, investors—both individual and institutional—have exhibited a general distaste for a high debt-to-equity ratio, as the crisis taught the market not to be over leveraged and susceptible to situations where liquidity may dry up quickly and at short notice. And as investors become increasingly risk averse, their investment and funding periods also appear to have shortened. In fact, many investors, particularly institutional investors, have started to shift their property exposure from direct property holdings to real estate investment trusts (REITs) and other real estate funds.

REITs are an attractive investment vehicle for the smaller, more risk-averse investor, as they enable them to own a share in properties of different types and classes. The key benefits of REITs are that they allow investors to participate in the ownership of real estate with a small capital outlay. Moreover, REITs offer flexibility, as they can be traded easily in equity capital markets.

Another key advantage of REITs is that they typically comprise a geographically diversified portfolio of properties, thereby spreading the risks for investors. These funds are professionally managed, and for the individual investor, the cost of monitoring REITs is much lower than managing a property itself, making them highly attractive investment instruments. REITs are also a good hedge against inflation.

As an investment option, REITs inspire trust and confidence among investors on account of their governance structure. In a REIT structure, assets are held under a Trustee, who is responsible for holding the properties in trust for unitholders. The Trustee exercises due diligence and care over the REIT, and the REIT manager safeguards the interest of unitholders. In Singapore, for example, representatives working for REIT funds are licensed by the Monetary Authority of Singapore, and have to undergo examinations and other on-going educational requirements to ensure that the REIT is managed by knowledgeable professionals.

REITs in Singapore, known as S -REITs, are subject to additional regulatory requirements and continuous mandatory disclosures, so corporate governance is essentially a non-issue. In fact, according to a recent ACCA-KPMG survey, Singapore ranked third in the world for its corporate governance requirements, after the United States and the United Kingdom.4

Currently, S-REITs enjoy the added advantage of tax transparency as long as more than 90 percent of the taxable income is distributed. As at end July 2015, there were more than 35 listed REITs and property business trusts in Singapore, with a combined market capitalisation exceeding US$50 billion, which is close to about seven percent of the total market capitalisation of the Singapore stock exchange (SGX), and is testimony to their popularity as an investment vehicle.

Impact of changing regulations

Prior to the 2008 global financial crisis, property markets in many parts of the world flourished due to the availability of cheap and almost unlimited credit. There was also limited understanding of the complexity of financial instruments used in these investments. After the crisis, many countries rushed to tighten financial monitoring rules and regulations, and today there are a plethora of regulations in place, from Basel III to the Dodd-Frank Act. In the coming years, regulatory obligations and their corresponding compliance costs on companies will only increase.5 In the financial sector, Basel III is expected to place increased capital requirements on banks. At the same time, given the slowing economic growth in the post-crisis world coupled with the changing regulatory landscape and increased risk aversion, the cost of debt is expected to increase as a result of a possible hike in interest rates by the U.S. Federal Reserve (the Fed). This too may squeeze the funding streams available to the real estate sector.

Are we moving toward the next property bubble in Asia?

Many would say that the property bubble in Asia is on its way to bursting, especially in China and Singapore. Since end-2008, according to research from Nomura, housing prices across Asia have, for the most part, tracked those in the U.S. during its bubble years. This is the result of the flight of money from the West after the crisis, a large part of which saw its way into Asian property markets.

This is why we see some Asian governments stepping in to control over-leveraging and curb property speculation in their respective countries. In Singapore, the Total Debt Servicing Ratio (TDSR) framework, stamp duties, resale levies and a whole slew of other control measures have deterred property speculation by both locals and foreigners, and to a large extent, these have been keeping property prices from rising further over the past couple of years.

In China, the property market has been a growth drag, rather than driver, since early 2014. The property and construction boom post-crisis has brought about a massive oversupply of real estate, particularly in cities that are not within Tiers 1 and 2. From January to June 2015, investment in property development slowed to 4.6 percent, a third the pace of the same period in the previous year.6 To stop property prices from sliding further, the Chinese government has been loosening measures to encourage homebuyers to upgrade or buy a new property for self-occupancy. These measures have brought about a temporary respite as evidenced by the sharp rise in home sales since April this year. That said, the sluggishness is mostly seen in cities in Tiers 3 and below. The investment opportunities for real estate in Tier 1 and 2 cities remain high, with the rapid development of more sophisticated transportation infrastructure.

There have also been several repercussions of the recent devaluation of the Chinese yuan. The engineered fall in the yuan will reignite criticism of China’s tight control over the yuan’s exchange rate. China’s currency move could prove challenging for the Fed. The U.S. dollar has been strong this year, which has resulted in dampened exports and has kept U.S. inflation below the Fed’s target. China’s currency devaluation puts further upward pressure on the dollar, and this could get aggravated if and when the Fed decides to raise interest rates.8 This will have an impact on capital markets globally as we have seen in recent market swings. In the property sector, S-REITs and developers with significant geographical exposure to China will most likely be impacted in terms of foreign exchange translation in asset valuations and earnings. Thus far, China’s surprise lowering of the yuan reference rate has negatively impacted property funds with China exposure, as some of them do not hedge their incomes and balance sheets. However, falling interest rates that are likely to follow will support asset valuations over time. The various forces at play, along with the uncertainty of when the Fed raises rates, make it difficult to predict how property markets in Asia will evolve.

The various forces at play, along with the uncertainty of when the Fed raises rates, make it difficult to predict how property markets in Asia will evolve.

Future investment opportunities: Looking into the crystal ball

There are still many opportunities for real estate investment in Asia, but two things are important—location and sector. New growth countries like Malaysia, the Philippines and Vietnam have significant potential given their growing domestic demand and stage of economic development. Moreover, in some countries, the government has taken several initiatives to boost the real estate sector. In Vietnam, for instance, the real estate sector has grown considerably since the government allowed foreign ownership of real estate in the country over the past couple of years. In 2015, foreign investment in real estate reached US$111.4 million, accounting for 9.3 percent of the US$1.2 billion foreign investment in Vietnam.9 In the Philippines, the 2015 outlook for the property market remains optimistic, backed by continued demand for business process outsourcing services, political stability and positive economic growth indicators.

There are still many opportunities for real estate investment in Asia, but two things are important—location and sector.

However, the biggest risks in these countries are always the political risks, where policies related to investment and real estate development may change overnight, making long-term planning a difficult proposition. Moreover, rampant corruption, coupled with young and inexperienced legislative systems and financial markets in some countries, makes it more difficult for foreigners to navigate the real estate space without getting their fingers burnt. Thus, foreign investors are more likely to invest in properties in countries that have greater political stability and lower risks. Hence, Singapore continues to be an attractive location to do business, live, work and play—and this is evidenced by its high rankings in several global reports on the ease of doing business, quality of living and competitiveness, among others, including being ranked number three in PricewaterhouseCoopers’s Cities of Opportunity.10

Which sectors show the greatest potential for the future? One of the popular sectors is logistics. According to the research company CBRE, in the third quarter of 2013, transactions of the order of US$3.1 billion were reported in Asian industrial and logistics assets, a year-on-year increase of 75 percent.11

Most existing logistics facilities throughout Asia are fairly basic in nature, and also in short supply. At the same time, the distribution strategies of international and domestic manufacturers have become more sophisticated. As a result, there is a growing demand for facilities that are able to offer more complex services, and to cater to the needs of third-party logistics providers who have now become the major drivers of demand for new logistics facilities.12 In addition, as e-commerce takes off in this region, demand is growing for new inward-focused infrastructure to serve domestic consumer demand. As a result, logistics has become one of the most sought-after sectors for real estate investors in all markets as investors continue to seek higher yields.13 A case in point is RRJ, one of Asia’s largest private equity funds, which has invested US$250 million into Shanghai-based warehouse developer, Yupei, betting on China’s growing demand for logistics services.14

As quantitative easing tapers off in the U.S., we expect it to snare some of the money that had gone overseas looking for higher returns.

To conclude, with six years of monetary easing in the U.S. and a continuous flow of capital out of the West, Asian property markets have become attractive destinations for global and local property investors. And this trend is expected to continue as stubbornly stagnant growth in the U.S. and Europe has forced monetary policy makers to prolong their easing policies. The growth in investment will be supported by new private real estate equity funds, an increase in institutional investors’ allocations for Asia Pacific, and growing activity by Asia-based institutional investors. Nevertheless, as and when quantitative easing tapers off in the U.S., we expect it to snare some of the money that has gone overseas looking for higher returns. Combined with conscious efforts on the part of some Asian governments to contain a property bubble, it could then put further pressure on Asian markets that are already witnessing sluggish housing prices.