A white space for digital banks.

The proliferation of financial technology firms (fintechs) has led to several interesting developments, one of which is the growth in the wealth management industry for the mass affluent market. Fintechs offering robo-advisor services have opened new frontiers in wealth management, resulting in possible applications for digital banks.

Changes in banking regulations in the wake of the 2008 Global Financial Crisis (GFC) forced many global banks to pivot from a high capital-intensive wholesale and investment banking business to capital-light wealth management activities. This invariably led to intense competition for assets under management (AUM) and wealth advisors, which further drove up the cost-income ratio and impinged on banks’ operating margins.

Does this mean that a ‘pivot strategy’ trades off a lower capital requirement for a higher cost-income ratio? And in the process, does it blunt any improvements on an enterprise return on tangible equity? This article provides a brief history behind this development and explores how newly established digital banks can avoid this pivot strategy trade-off trap experienced by many global banks. It further suggests that wealth management for the underserved masses and emerging affluent customer segment presents a white space for digital banks, and by exploiting the advances in robo-advisor technology, digital banks can potentially offer a viable wealth management proposition.

HEIGHTENED REGULATORY DEMANDS IN POST-GFC WORLD

The GFC occurred not long after the introduction of Basel II, which in itself was meant to be a significantly more comprehensive risk supervision framework than Basel I1, introduced almost two decades earlier. In the aftermath of the GFC, it became eminently clear to supervisors and policymakers that the risk supervision framework under Basel II did not adequately address ‘tail risks’ (of low probability and high impact events) and their systematic impact on the financial system. Hence Basel III and a slew of regulations were introduced by supranational and national bodies to close off the gaps believed to be in existence. These moves massively raised the standards of banking prudential management and financial conduct of the industry. A significant portion of the enhanced regulatory effort was directed at controlling financial instruments and derivatives traded in the over-the-counter (OTC) markets2, which was the mainstay of the investment and wholesale banking business of global banks.

Some of the better-known regulations, in addition to Basel III, that were introduced in the developed West, included the Dodd Frank Act & Volcker Rule (US), European Market Infrastructure Regulation (EU), Markets in Financial Instruments Regulation (EU), and the Margin Reform Regulation (US and EU). Invariably, many parts of these regulations found their way to the major financial centres in Asia, either because those Asian central banks are members of a supranational body such as the Bank for International Settlements (BIS), or they were considered best practices that should be customised to suit their local context.

Collectively, these regulations demand that banks set aside more capital resources for assuming market, liquidity, and credit risks. Additionally, to implement the enhanced standards, banks must invest heavily in staffing risk, control and compliance teams, and implement new processes and systems. This plethora of regulations imposed on the banking industry has severely crimped the profitability of banks. The higher levels of capital and increased cost of operations in a deleveraging post-GFC world have also meant that while revenues are declining, costs have seen a steep and inelastic increase.

GLOBAL UNIVERSAL BANKS: PIVOTING TO WEALTH MANAGEMENT

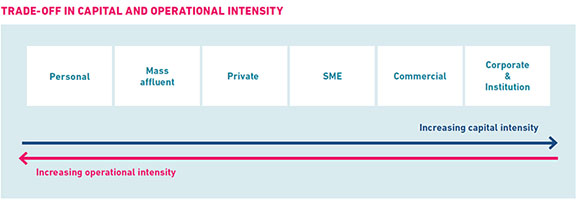

Global universal banks categorised as Systematically Important Financial Institutions (SIFIs) bore the brunt of this post-GFC development. “Universal banking” is a term often used to describe the full continuum of customer/client segments that a bank caters to, and is commonly broken down into the following six segments: Personal, Mass affluent, Private, SME (Small and Medium Enterprises), Commercial, and Corporate and Institution. These six segments have differing banking product needs, and conversely, the various banking products place different demands on the operational capacity and risk capital of a bank (refer to Figure 1).

Figure 1

Traditionally, the main challenge to a retail bank arising from serving the left extremity of the customer continuum is operational efficiency, measured by a business’s cost- income ratio. Because of the low value of the ticket size versus the high fixed costs associated with having to maintain a physical branch network and staff, this business inherently has a high operating leverage and must rely on scale to achieve profitability.

On the other hand, at the extreme right of the continuum, wholesale banking of corporate and institutional clients involves high-value tickets and does not need to rely on an extensive branch network. Thus, a wholesale banking business typically has a much lower cost-income ratio compared to retail operations. However, there are trade-offs. Because of the complexity of the products and the long-term nature of their credit exposure, more risk capital is required by regulation. For instance, while a long-term financial derivative transaction may appear to be highly profitable, when seen through the lens of ‘revenues less costs’, the capital required to be set aside for assuming market, credit and liquidity risks could be very high, causing the transaction’s return on capital to be low.

The client segments that reside between the two extremities of the continuum will have varying demands on the operational capacity and risk capital of a bank. Typically, demands on operational capacity decrease as we move from the left to the right of the continuum while regulatory capital demands increase.

In sum, the post-GFC regulatory landscape has placed massively higher demands on both the operational capacity and capital of a bank. It is anecdotally estimated that the amount of regulatory capital required to support the same wholesale banking balance sheet today is 2.5 times higher than what it was in 2008. This is assuming a like-for-like comparison is possible.

This has invariably resulted in a squeeze on the return on tangible equity (RoTE), a key measure of profitability for banks. Equity analysts have estimated the long-term cost of equity capital for a bank to be 10 percent. As can be observed, market capitalisations of global banks that have failed to consistently achieve a RoTE of at least 10 percent trade below their book values. For example, two SIFIs, Credit Suisse and Deutsche Bank, have tried to reshape their business models in the past decade with limited success. Despite the occasional bouts of optimism, the two firms have struggled to push their RoTE above single digits and their stock prices have stayed below book values over much of the same period.

GLOBAL BANKS’ PIVOT STRATEGY

Faced with an existential threat to their business model, and the need to improve their RoTE, many global banks have adopted a strategy of pivoting their business model away from the right extremity to the left of the continuum, albeit in various forms. Invariably, many of these global banks have chosen private banking/wealth management as their focus. Private banking is often viewed as a business adjacent to wholesale banking, given the nature of the clientele and the core competencies involved.

Wealth management, which is the core business of private banking, is lighter on regulatory capital requirements. Even with Lombard lending facilities, which refers to a form of credit extended to clients against securities and eligible collateral pledged to the bank, wealth management provides a good return on risk weighted assets (RWAs). However, private banking is traditionally a high touch business with a high cost-income ratio. Because of its high touch nature, the business is difficult to scale up without a corresponding increase in the number of advisors and ancillaries. Therefore, it is not unusual for the business to focus on high value accounts at the expense of the smaller accounts to achieve short-term profitability.

At first blush, it would seem that a pivot strategy trades off a lower capital requirement for a higher cost-income ratio. Does this also mean that this trade-off washes through the financials and offers no discernible improvements to the enterprise RoTE?

ENTER THE DIGITAL BANKS AND FINTECHS

The rapid ascent of digital banks and fintechs in the decade following the GFC has started to change the competitive landscape of the banking industry. With naturally low overheads, such as minimal staff and no physical branch network, and the willingness to embrace advances in technology, digital banks are starting to bank the underserved customer segments that many traditional banks today find uneconomical (that is, the left end of the continuum). These digital banks typically start by accepting deposits and offering loans. With time, some of them may move the client base up the value chain through cross-selling, with the aim of building customer ‘stickiness’.

Wealth management, with its lower capital requirement, represents a white space for digital banks. However, because of the pivot strategy adopted by many global banks, wealth management has become what analysts describe as a ‘crowded trade’ in the banking industry. The intensity of competition for clients, AUM, and advisors continues to ratchet up, further driving up costs.

To be able to fully tap this white space, digital banks must find a wealth management proposition at a fraction of the cost offered by traditional banks that can meet the demands of the currently underserved customer segments. And this is where robo-advisors enter the game.

Over the past decade, several fintechs have been able to exploit the greatly reduced cost of computing power to develop robo-advisors that produce investment portfolios that are customised for the individual client. Instead of advisors or relationship managers, robo-advisors rely on algorithms (mainly rule-based, sometimes enhanced by Artificial Intelligence) to advise an investor based on an assessment of the investor’s goal, risk appetite, knowledge, experience, and other key attributes.

Leveraging on modern portfolio theory, robo-advisors can construct customised discretionary portfolios to optimise expected returns at a given level of risk or minimise risk at a given level of expected returns. This is achieved at a fraction of the cost of traditional discretionary portfolio management offered by banks today. Traditionally, to be economically viable, discretionary portfolio management is only availed to high-net-worth individuals (HNWIs) with sizeable AUM. Providers of such services may charge about 1.5 percent per dollar of AUM. This is in addition to the fees embedded in the constituent funds. Taken in total, the effective cost to the investor could be closer to three percent. On the other hand, robo-advisors typically charge a 0.5-percent management fee and may use low-cost passive exchange-traded funds (ETFs) to construct portfolios. Taken in total, the effective cost to the investor is typically below one percent. Fees are an important consideration as the return that truly matters to an investor is one that is net of fees.

One such fintech was Bento Invest, a business- to-business (B2B) firm that was acquired by the Grab Financial Group in 2020. As a B2B fintech, Bento provided a ‘white label’ robo-advisor service to institutional clients like banks, securities, and insurance companies. Under a ‘white label arrangement’, the institutional client, say a bank, would continue to face its end-client base, but would use the fintech robo-advisor as the engine to manage the client’s investment portfolio. Leveraging on the work of Henry Markowitz, the 1990 Nobel Prize laureate for Economics, Bento developed a robo-advisor that was able to create an ‘efficient frontier’ that optimised a portfolio’s risk versus expected return for a given investment universe. Once the client’s risk appetite and investment horizon were determined, a customised portfolio could then be created on the efficient frontier. Because the portfolio optimisation process was machine- and data-driven, the cost of management was significantly reduced, making it commercially viable for Bento’s institutional client to provide this service to retail customers. Thus, discretionary portfolio management services which have hitherto been available only to high-net-worth private banking clients can now be made accessible to the underserved customer segments.

However, for the independent business-to-consumer (B2C) robo-advisor fintechs, it may be a different story.

Like any consumer business, brand recognition is paramount. Furthermore, it has proven to be difficult to convince end-customers and investors to move away from well-capitalised and highly regulated banks and financial institutions to lightly regulated robo-advisor fintechs with a relatively short operating history.

Take the example of betterment.com, a successful US-based early-mover robo-advisor, whose evolution best characterises this conundrum. While it is still the largest independent B2C robo-advisor, its AUM is dwarfed by the robo-advisory portfolios of Vanguard, a US asset management firm, and Charles Schwab, a US stockbroker. Both Vanguard and Charles Schwab are well-established financial firms with very strong client franchises but were relative latecomers to the robo-advisor game. Yet, despite their late adoption, they could still leapfrog betterment.com.

Another early B2C robo-advisor entrant, UK-based Nutmeg, was acquired by US banking giant JP Morgan in June 2021. At the point of its acquisition, Nutmeg had an AUM of just under US$5 billion and was still unprofitable. This again demonstrates the challenge for independent B2C robo-advisor fintechs when competing against financial institutions with established franchises and recognised brands.

SERVING THE MASS AFFLUENT MARKET

Acknowledging the difficulty and high cost of customer acquisition, several fintechs, betterment.com included, now seek growth through a B2B business model and partner with firms that have established franchises.

On that corollary, the digital banks in Asia, many of whom are owned by parent firms with strong brand names and established customer franchises in domains such as e-commerce; technology, media and telecommunications; finance; and insurance, make good partners for existing fintechs. Three of the four digital banking licences issued by the Monetary Authority of Singapore in 2021 were awarded to applicants with Grab/Singtel, SEA, and Ant as their parent companies respectively.

Independent robo-advisors looking to grow via a B2B business model will find it compelling to partner with these digital banks. Likewise, digital banks can avoid the escalating costs faced by global banks in their pivot strategy while moving up the value chain of a capital-light wealth management proposition. One approach these digital banks could take would be to ‘white label’ the robo-advisor services from B2B fintechs to produce low-cost model portfolios, using ETFs to meet the needs of retail investors. For the mass affluent with higher AUM per capita, digital banks may find it commercially viable to construct portfolios customised to the individual’s risk appetite and investment goal, again leveraging on ‘white label’ robo-advisor capabilities.

For B2C robo-advisor fintechs with a recognised brand, digital banks may also consider a ‘joint labelling’ approach to partnership. Here, both parties enter a symbiotic relationship: the digital bank leverages on the credibility and expertise of the fintech and, in return, the fintech relies on the distribution capabilities of the digital bank. Careful product development and selection of the target customer segment will reduce the risk of market cannibalisation for both parties.

Alternatively, digital banks could follow in the footsteps of JP Morgan and Grab Financial–acquire the fintechs and integrate them into the banks, instead of trying to develop this capability organically.

CONCLUSION

In a little over a decade since appearing in the US, the use of robo-advisors is starting to gain acceptance within the mainstream investment industry. In 2020, robo-advisor funds accounted for about US$766 billion3 of the US$49 trillion professionally managed AUM in North America3. Some analysts have opined that robo-advisor funds have now reached a tipping point and will soon enter an accelerated growth phase, with predictions of US$1.9 trillion in AUM by 2025.4

Judging from the evolution of the industry in the US, it is reasonably safe to predict that the use of robo-advisors will gain acceptance in Singapore and presumably in Southeast Asia (SEA) over time. The current lack of viable offerings for the mass and emerging affluent customers in investment and portfolio management augurs well for the future of robo- advisors. Rather than for robo-advisor fintechs to gain market share through expensive customer acquisition, a more compelling alternative is to seek partnerships with established firms with existing franchises. In SEA, the digital banks would appear to fit this criterion comfortably.

Lee Guan Liu

is a career banker and financial leader with 30 years of stewardship experience in a global financial institution. He is also an adjunct faculty member of Lee Kong Chian School of Business at Singapore Management University

Endnotes

1. The Basel Accords are a series of sequential banking regulations (Basel I, II and III) set by the Basel Committee of Bank Supervision (BCBS). The BCBS is the primary international body that sets the standards for the prudential regulation of banks. It is also the platform for central banks and bank supervisory bodies to cooperate on banking supervisory matters.

2. The OTC market is a decentralised market where participants, mainly financial institutions, trade financial instruments and derivatives amongst themselves without going through an exchange. The OTC market was largely unregulated before the GFC.

3. Statista, “Global Assets under Management in Selected Years from 2008 to 2020, by Region”, August 25, 2021.

4. Statista, “Assets under Management of Robo-advisors in the United States from 2017 to 2025”, August 21, 2021.