Is China moving to a new normal?

In recent years, there have been concerns about the slowing down of the Chinese economy. One question frequently asked by economists, analysts and business leaders is whether or not China is bracing itself for a hard landing. Or is the dragon settling into a new normal after nearly four decades of exponential growth?

The engine sputters

At the end of the Marxist era, economic reform and trade liberalisation initiated by Deng Xiaoping in 1978 gave the Chinese economy the impetus for growth and laid the seeds for a strong export-led manufacturing base. Combined with low-cost labour and heavy investment in infrastructure and basic industry, the economy rapidly gained momentum on the strength of a low-cost, low-tech manufacturing sector. Between 1980 and 2000, the country averaged an annual growth rate of 9.8 percent.1

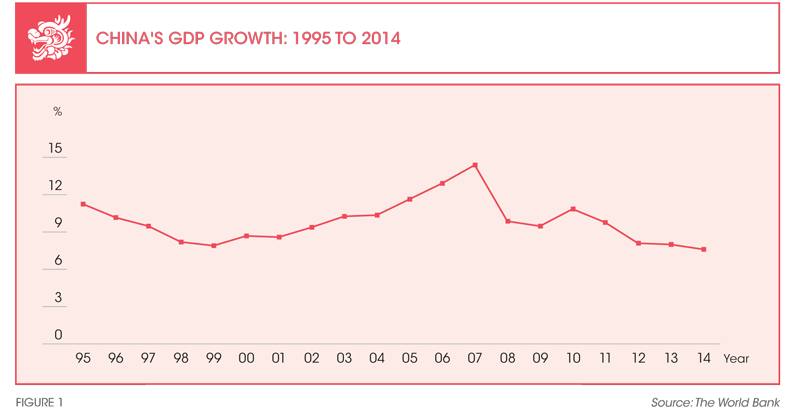

With China’s subsequent accession to the World Trade Organization in 2001, exports further propelled growth in manufacturing, bestowing upon the country the status of ‘factory of the world’. GDP growth too picked up, averaging 9.9 percent between 1995 and 2011, and peaking at 14.2 percent in 2007, just prior to the subprime crisis (refer to Figure 1).

In fact, the growth in manufacturing was nothing short of spectacular. While in 1980, China was the seventh largest manufacturing nation, by 2011, it had overtaken the U.S. to become the world’s leading manufacturer. Today, China accounts for a quarter of the world’s manufacturing output. Together, with strictly enforced one-child and hukou policies, China emerged as a nation with a hardworking, yet unskilled or semi-skilled, workforce.

However, China’s investment-led, labour-intensive, manufacturing-focused growth has recently shown signs of weakening. Since 2012, the growth rates have been hovering around 7 percent, and analysts forecast further declines in the next five years.

Growth rates by themselves are not so much a cause for alarm–with an economy the size of US$11 trillion, even conservative growth estimates of six to six and a half percent mean that China will leave its impression on the global economy. However, other factors such as rising labour costs, declining productivity (albeit still higher than say, India), overcapacity in manufacturing, obsolete technology and environmental issues are signs that need to be understood in the light of the evolving growth model. As the world’s own consciousness grows, China has to work hard to shrug off the image of being the world’s sweatshop—manufacturing low-quality goods or knock-offs with little heed to intellectual property (IP), labour laws and the environment.

Shifting gears

China today is a nation of two economies, the old and the new. As it transitions, the old socio-economic structures and policies that supported the growth model over the past 30 years will need revisiting. New trends are emerging that point to a rebalancing of the economy in favour of an innovative, high-end manufacturing and service-oriented economy, one that leverages skilled labour and technology with an eye to sustainable development.

For the new paradigm to be realised, policy makers will have to make an honest assessment of where the nation is faltering, take some bold initiatives to improve the legal and regulatory structures, as well as focus on upgrading industry to allow for a freer flow of labour within the country. China’s geopolitical positioning is yet another consideration as global business becomes even more integrated through technology, and the new growth model will force China to rethink its trade partnerships.

Although many steps have already been taken in this direction, the question is whether or not China will be successful in creating a new growth engine and a cleaner global image, and if so, how will it arrive at a new normal?

Demographic dividend–from ‘quantity’ to ‘quality’

China’s economic boom relied on an abundant, cheap, unskilled, yet productive labour force, and a low dependency ratio resulting from a young population. High fertility rates in the 1960s and 1970s provided a vast pool of labour well through to the 21st century, with the impact of the one-child policy felt only recently.

China has to work hard to shrug off the image of being the world’s sweatshop—manufacturing low-quality goods or knock-offs with little heed to intellectual property, labour laws and the environment.

In 1978, wages in China were three percent of those in the United States.2 However, wages have been rising steadily in recent years, eroding company profit margins and resulting in Chinese manufacturers losing out to countries offering cheaper labour, such as Vietnam and Indonesia. Today, the average factory worker in China earns US$27.50 per day, compared to US$8.60 in Indonesia and US$6.70 in Vietnam.3

Meanwhile foreign investors are voting with their feet. In 2001, Chinese factories produced 40 percent of Nike’s shoes while Vietnam only produced 13 percent. By 2013, China’s share had dropped to 30 percent with Vietnam winning the contracts and raising its share of Nike’s production to 42 percent.4

A Boston Consulting Group survey revealed that, in 2012, 37 percent of U.S.-based manufacturing companies with annual sales greater than US$1 billion were, “…planning or actively considering moving their production facilities from China to America.”5 In 2015, Nokia production lines were shut down in Dongguan and moved to Vietnam, with 9,000 workers retrenched. Japanese electronics majors such as Panasonic, Sharp and TDK are also moving their factories back to Japan; while clothing retailers Gap and H&M have decided to take their business to Myanmar; and Uniqlo and Samsung are actively looking at India and ASEAN to expand their operations.

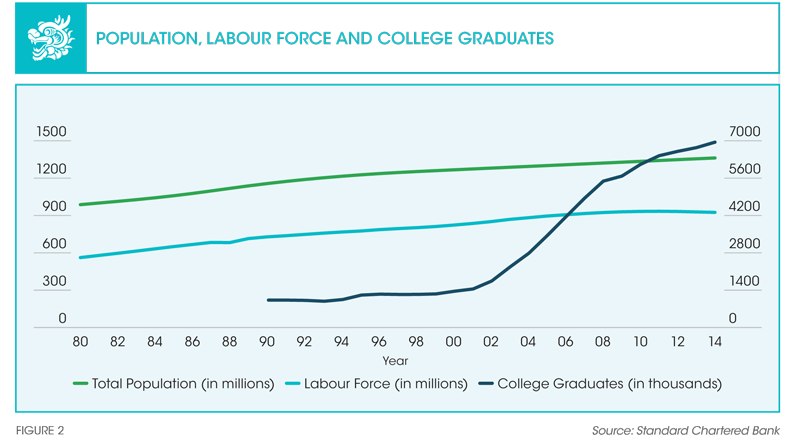

But while the supply of unskilled labour is diminishing, leading to a loss in competitive advantage in the traditional manufacturing sectors, China today has a rapidly expanding educated and skilled workforce that is capable and keen to work. Between 2000 and 2015, the number of college graduates rose from one million to seven million and China currently leads the world in its annual cohort of science and engineering PhDs–30,000 in 2015 (refer to Figure 2).6 And more Chinese students are going abroad to get their first degree.

China’s new demographic dividend is based on quality, not quantity. And industry is reinforcing this trend. As the nation weans itself from the reliance on traditional manufacturing, new jobs will be created, complementing high-tech industries. The rapidly expanding services sector is poised to become the main driver of economic growth and employment in the near future, and it will need a well-educated, globally-aware, management-savvy workforce. Subsectors such as transportation and logistics, and wholesale and retail trade are already leading the way.

Labour mobility is a key factor in developing an efficient and motivated labour force, and China’s current hukou system needs to be revisited to facilitate freer movement of workers and faster urbanisation. The social benefits of the hukou presently do not extend to migrants, and this has strongly disincentivised rural-urban migration. With the exception of major cities like Beijing, Shanghai, Guangzhou and Shenzhen, the next tier of cities is unable to provide opportunities for the new crop of graduates. Seamless movement of labour would thus be an important step in facilitating the establishment of the new growth model.

From ‘innovation sponge’ to ‘global innovation leader’

China today invests US$200 billion annually in R&D, more than any other nation in the world.7 A total of 4,854 million new start-ups were registered between March 2014 and May 2015, averaging seven companies per minute!8 Half of these were technology companies. Understandably, not all will turn into multi-million dollar businesses and it is a fact that most will perish within the first 12 months. However, the trend is clear: the Chinese are no longer waiting to mimic western businesses, but are becoming entrepreneurial themselves, and developing new technologies and business models to forge ahead as innovation leaders.

Silicon Valley may be better at technical innovation, but Chinese companies have certainly learnt to innovate on the factory floor. The ‘innovation sponge’ has undoubtedly created several global leaders like Alibaba, Baidu and Tencent. While these companies may have taken their business ideas and innovations from the West, they have however judiciously adapted their business models to fit their customers’ needs, as Alibaba did when it promised 24-hour deliveries to its customers in any part of China. Many of these companies have also proven to be more successful than their western counterparts.

China today invests uS$200 billion annually in R&D, more than any other nation in the world. A total of 4,854 million new start-ups were registered between March 2014 and May 2015, averaging seven companies per minute.

The strength of Chinese companies is further evidenced by the fact that now, more and more venture capital exits are via mergers and acquisitions, while ten years ago, the only way to cash out from an investment in a Chinese start-up was to wait for it to go public on an international stock exchange.

Although IP fraud continues to be a concern for MNCs operating in China, Chinese companies are becoming much more IP conscious because their own innovations are at stake. A total of 820,000 patent applications were filed in 2013.9 And if the industry itself has become more conscientious, then regulations can’t be far behind.

From ‘Made in China’ to ‘Made by China’

In the 1980s and 1990s, most factories set up in China were owned by firms from Taiwan or western countries. But now, China is looking to design its own products rather than manufacturing for someone else.10 Kirk Yang of Barclay’s bank articulates this new trend as moving from ‘Made in China’ to ‘Made by China’.11

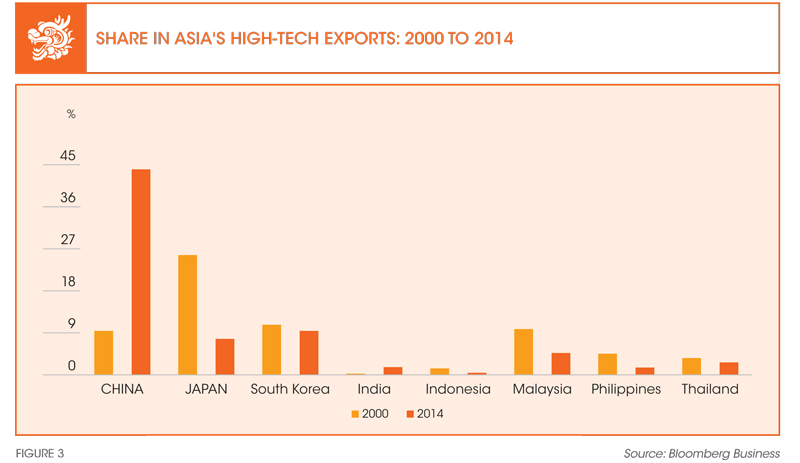

To secure this significant move, China has to tap into new sources of growth that will help the nation move up the global value chain. In May 2015, premier Li Keqiang unveiled ‘Made in China 2025’, a ten-year national plan to transform China from a manufacturing giant to an innovative global manufacturing power. The plan, inspired by Germany’s 2011 ‘Industry 4.0’ initiative but much broader in scope, aims for a comprehensive upgrade in the quality, productivity and digitisation of Chinese manufacturing. It also calls for a strengthening of IP protection and building a strong national image and national brand recognition. Early signs are already visible. According to a report by the Asian Development Bank, between 2000 and 2014, China’s share in Asia’s exports of high-tech products exceeded that of Japan–while China’s share rose from 9.4 percent to 25.5 percent, Japan’s cascaded down from 25.5 percent to 7.7 percent (refer to Figure 3).12

So what does this mean for MNCs operating in China? In some ways, if the goals of the plan are achieved, China will come in direct competition with advanced manufacturing nations like the U.S., Germany and Japan. And given the growing interdependence of global production and consumption, all economies will likely benefit from the ability to collaborate digitally with Chinese manufacturers. It will also lead to greater business transparency and high-quality production at lower costs.

From ‘supply-led’ to ‘demand-led’ growth

A key challenge in China today is excess capacity, an outcome of its long-standing investment-led growth model. This took a particularly ominous stance after the 2008 global financial crisis, when the government doled out a ¥4 trillion (US$586 billion) economic stimulus plan, which saw its way primarily into fixed assets and construction. Combined with flagging international demand for exports and falling domestic demand for real estate, average capacity utilisation nosedived from 80 percent pre-crisis to 60 percent in 2011.13 The steel industry has been particularly badly hit, causing factories to shut down and retrench workers.

Policy makers must balance cutting capacity while maintaining growth. The solution lies in boosting demand, and taking a leaf from lessons learnt from western companies that have often faced disappointments in their attempts to ‘go global’, Chinese companies have prudently invested their time and resources in first understanding and catering to its increasingly affluent domestic market.

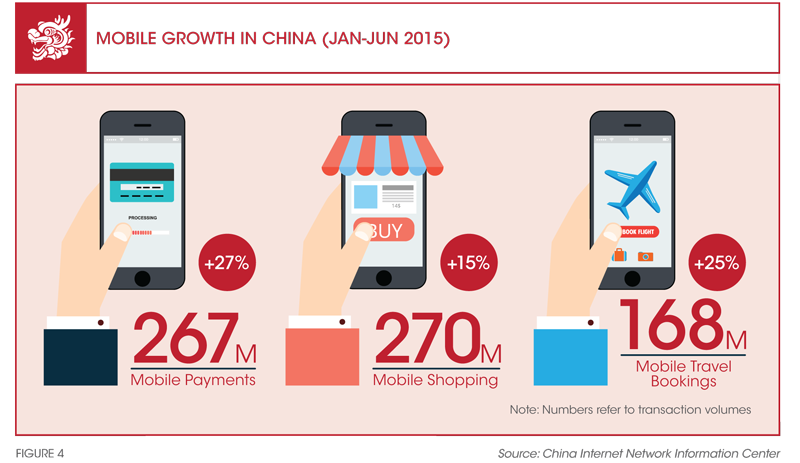

Chinese tech entrepreneurs, in particular, need not look beyond the border to achieve scale and grow their businesses. By June 2015, China’s Internet penetration had reached 48.8 percent, with 668 million users. Mobile netizens accounted for almost 89 percent of the total netizen population, with 28 percent of Chinese Internet users located in rural areas. Mobile payments, mobile shopping and mobile travel bookings have witnessed phenomenal volume growth in the last year or so (refer to Figure 4).14

Consumer-oriented Internet growth has already created a thriving e-commerce industry in China. Alibaba’s revenues from Singles Day, for example, touched US$14.3 billion in 2015, compared to US$6 billion the year before.15 With a total e-commerce spend of US$672 billion, online sales accounted for almost 16 percent of retail sales in China, compared to the U.S., which spent US$347.3 billion, accounting for just 7 percent of its total retail sales in 2015.

Companies are leveraging web technologies for more than just selling their wares. Xiaomi, the low-cost smartphone manufacturer, is relying on crowdsourcing to gain customer feedback, which in turn is fed into the company’s product development. Similarly, car manufacturers are leveraging web-based collaborative tools to cut costs, reduce design times and mitigate political risks.

Reinvigorating the Silk Road

However, despite its robust home market, Chinese companies cannot afford to turn their attention away from the opportunities of international trade and foreign investment. Together with manufacturing, trade has been a key pillar of China’s growth. In 2014, exports accounted for 22.6 percent of GDP while imports accounted for 18.9 percent of GDP.16 Over the years, China has negotiated bilateral trading positions with many nations, including Chile, Pakistan, New Zealand, Singapore, Peru, Costa Rica, Iceland, Switzerland, South Korea and Australia. In addition, codes of trading have been established between China and ASEAN member nations, and China is also showing active interest in the negotiation of the Regional Comprehensive Economic Partnership (RCEP) within the ASEAN+6 framework, which includes ASEAN, Australia, China, India, Japan, New Zealand and South Korea.17

With the growing number of trading blocs the world over, China is looking to reinvigorate the original Silk Road by developing multilateral relationships that go beyond trade in goods and services. Chinese foreign policy initiatives, such as the Asian Infrastructure Investment Bank (AIIB), the BRICS bank and the One Belt, One Road (OBOR) plan, support private investment projects outside China. Involving over 60 nations, OBOR is geographically the most expansive, stretching along the historical Silk Route from China to Central Asia on the one hand, and a maritime road via Southeast Asia into South Asia, Africa and Europe on the other. The grouping represents countries which together account for a third of the world’s total economy and more than half the global population.

Some opine that the AIIB and OBOR initiatives are a response to the Trans-Pacific Partnership (TPP), a trade agreement among 12 Pacific Rim countries spearheaded by the U.S., and that China is following an aggressive policy of forging bilateral and regional trade agreements to counter the trade impact of the TPP. The reasons though are probably both economic and geopolitical, the two being intrinsically related. China certainly has a lot to gain from joining the TPP in terms of tariff reduction and preferential market access–yet, so far, it has shown no inclination to join the TPP.

China’s industry is gravitating toward skill-based, technologyintensive, high-end manufacturing that is socially conscious and globally integrated.

Will China lose out by not joining the TPP? The answer depends on the time horizon under consideration. In the immediate to short term, China has consciously chosen not to join the TPP as it will find it difficult to comply with some of rules of the treaty. Chief among these are those related to human rights, the environment, IP protection and regulatory and legal

frameworks. For instance, the investor-state dispute settlement (ISDS) clause of the TPP gives foreign companies the right to international arbitration and opportunity of a fair trial in the event of a dispute with a local government. Currently, the corporate laws in China make it difficult to accept these terms. However, over the longer time period, we may find China taking conscious steps towards strengthening its regulatory and governance systems.

David Dollar of the Brookings Institution argues that initiatives such as OBOR and the TPP are complementary, not substitutable, “The kind of infrastructure financed by the Chinese initiatives [like AIIB and OBOR] is the “hardware” of trade and investment, necessary but not sufficient to deepen integration. TPP, on the other hand, represents the “software” of integration, reducing trade barriers, opening up services for trade and investment, and harmonizing various regulatory barriers to trade.”18

Settling into a new normal: from ‘growth’ to ‘development’

A new development model is now emerging in China that focuses more on the quality of growth, taking into account the nation’s changing demographics, technological progress, social and environmental consciousness, and geopolitical trade relationships. China’s industry is gravitating towards skill-based, technology-intensive, high-end manufacturing that is socially conscious and globally integrated. Stakeholders should not only watch this space but be prepared to seize the opportunities within.

China’s traditional manufacturers need to adapt their products and processes to leverage the new skills and technologies that have become available. This will help them make better use of available resources, improve factor productivity, and move their product offerings higher up the value chain. Innovation is the new, most valuable factor of production today. China’s entrepreneurs are blazing new trails not only in tech innovation but also in breakthrough business models, where they are showing the world better ways of making and selling.

The aging yet better-educated workforce will look for opportunities that are concomitant with their skills and qualifications in China and abroad, as well as add to the global consumer base that has deep pockets and demands quality and service. MNCs investing and operating in China can also benefit from this trend if they acquiesce to the economic laws of comparative advantage and see the country’s industrial upgrade as an opportunity to collaborate rather than a threat to their national industries.

Regional trading blocs seem to be creating borders around otherwise borderless markets. Rather than see them as antagonistic, China should use its strong trading position to build upon its existing bilateral and multilateral trade relationships such that all participating nations are able to gain from the benefits of free trade and the seamless movement of labour and capital.

And finally, policy makers must acknowledge that the new order can survive only if it is backed by a strong legal and regulatory architecture that supports the development track.

A lot is at stake. The world is watching with trepidation, as the dragon is poised for its new dance.