How large organisations can leverage the digital advantage for innovation.

The digital world has permeated our lives in more ways than we would like to admit. Every day we hear of new apps that promise to make our life better, ranging from delegation of personal tasks to guiding us through downtown peak-hour traffic snarls and managing our personal budgets. Companies like Airbnb, Uber and GrabCar have creatively and radically changed how the service industry operates. We read using Amazon Kindle and Google Books, listen to music streamed from Spotify, and subscribe to Netflix or iflix to watch our favourite television programmes and movies. And these only begin to scratch the surface of what’s available out there.

In their book Exponential Organisations, Salim Ismail, Yuri van Geest and Mike Malone discuss the rapid change in technological capabilities and computing. They focus on how much new software has built-in intelligent processes to create constant improvements through continuous feedback, how the Internet of Things is creating an information-connected nervous system of the world and how everything and anything can now be tracked, measured and act as a catalyst for change.1

Meanwhile, a recent article in Forbes talks about how digital technology is bringing search and information costs crashing down. Quoting Ronald Coase’s paper on ‘The Nature of the Firm’ (1937), it argues that the purpose of a firm is to minimise transaction costs, especially search and information costs.2 Therefore, combined with the ability to easily scale up operations, reach a much larger market segment and work with greater transparency, trust and empowerment, the digital economy has the potential to transform business landscapes and make new businesses feasible and lucrative.

As we delve deeper into the who’s who of the players in the digital economy, we realise that many of the oft-quoted companies in the digital space began life as start-ups. Hardly ever, or never, do we hear of this genre of companies emerging from a resource-rich, or high market cap, publicly listed company. The levels of investment and valuation that these companies are receiving have outpaced many of their competitors and industry incumbents. But should the digital advantage be solely the domain of the start-ups and unicorns? And what are the implications of this for large corporations and institutions? While not being ones to espouse that large organisations should behave like start-ups, we consider how they can benefit from inculcating the dynamism and agility of start-ups to spur innovation and re-invigorate themselves through embedding digital elements and paradigms in their strategy.

Combined with the ability to easily scale up operations, reach a much larger market segment and work with greater transparency, trust and empowerment, the digital economy has the potential to transform business landscapes and make new businesses feasible and lucrative.

The digital economy: Evolution or revolution?

Former CEO of Barclays, Antony Jenkins, recently discussed how a series of Uber-style disruptions could impact the banking industry: “The incumbents risk becoming merely capital-providing utilities that operate in a highly regulated, less profitable environment and is a situation unlikely to be tolerated by shareholders.”3 He was elaborating that the new wave of tech-savvy start-ups that can do things better, faster and cheaper than the big banks will disrupt traditional businesses like lending, payments and wealth management. He warned of the impending pressure incumbent banks face to implement new technologies at the same pace as their new set of rivals. Similar thoughts have also surfaced in many articles about the ‘Uberisation’ of the economy and the ‘Uberisation’ of everything, where very few sectors or industries appear safe from disruption.4

Asian organisations appear to be well poised to adopt a digital approach to engaging their employees, considering that Asia has the largest population of Internet users in the world.5 The Digital Evolution Index published in the Harvard Business Review categorises Singapore, Hong Kong and South Korea as ‘Stand Out’ countries as they have displayed high levels of digital development in the past and are pegged to continue on an upward trajectory.6 Following the ‘Stand Out’ countries are the ‘Break Out’ countries, which have the potential to develop strong digital economies. Asian countries in this category include Malaysia, Thailand, Vietnam and China.

As the digital tsunami is embraced in the personal space, organisations, however, seem to lag behind in creating a similar ecosystem. While a few organisations may have the Internet of Things in place, the Internet of Talents is clearly absent from many. Silos—divisional or functional—are as strong as ever. Hierarchy and power distance still prevail and real-time performance tracking remains obscure.

Considering the rapid change in market dynamics, organisations need to constantly ensure that their businesses are agile enough to proactively innovate on all fronts. Gone are the days when the strategy team or top management had all the answers. The digitally empowered organisation of today leverages the collective intelligence within the entire company to identify key areas of focus and seeks out fresh solutions to the challenges faced. But are our companies not leveraging the masses of talent they have at their disposal?

Socially styled tools, which systematically harness insights and ideas from within the four walls, should be provided to digital-ready employees to contribute and be heard. Innovation management software, such as those offered by Hype and Spigit, function to simultaneously democratise decision making and increase transparency, both of which ultimately impact cultural issues such as hierarchy and silos within the organisation. More importantly, digital platforms become crucial to enhance employee engagement, attract talent and ultimately, increase employee retention.

As the digital tsunami is embraced in the personal space, organisations, however, seem to lag behind in creating a similar ecosystem.

Innovating innovation

Should organisations wait to be ‘Uberised’ before they start looking for new sources of growth and value creation, or should they be starting now? Further delays could mean a loss of opportunities and first-mover advantage. We believe that organisations don’t have to abandon everything that they are currently doing. Instead, they need to explore how they could harvest the current digital paradigm to find better ways to innovate—in short, innovate innovation itself. Organisations need to rethink why they are innovating, who is responsible and accountable for innovation, where and how they should innovate, and how the innovation budget should be allocated and managed.

WHY IS THE ORGANISATION INNOVATING?

It is a given that an organisation needs to innovate to ensure sustainable growth, profitability and high performance. How it achieves this depends on the organisation’s overall goal, operating paradigm and long-term vision. The rationale for innovating can range from maintaining market position, entering a new market, gaining access to unique resources or materials, meeting regulatory requirements, acquiring talent, and enhancing brand value to simply meeting the expectations of diverse stakeholders.

Innovation management software, such as those offered by Hype and Spigit, function to simultaneously democratise decision making and increase transparency, both of which ultimately impact cultural issues such as hierarchy and silos within the organisation. More importantly, digital platforms become crucial to enhance employee engagement, attract talent and ultimately, increase employee retention.

WHO IS RESPONSIBLE AND ACCOUNTABLE FOR INNOVATION?

Innovation can’t be left to a few within the company. In the past, innovation was assumed to be the role of R&D, engineering or marketing. Recent years have witnessed the rise of the Chief Innovation Officer and the setting up of innovation units. This is seen in Singaporean and Malaysian banks such as DBS Bank and Maybank, respectively, as a means of dealing with the threat of Fintech start-ups and the rise of competition from current tech giants such as Alibaba’s Alipay, Tencent’s WeBank and Apple Pay. While organisations benefit from having champions who have the presence and power to help drive and integrate their innovation strategy, innovation process and innovation culture—they alone cannot be responsible for driving the entire revitalisation.

One of the core objectives of these champions is to get as many employees as possible to contribute to innovation. In our HR InnovAsian Report 2014, a study of innovation practices within Asia, we reveal that only 10 percent of respondents from IT and Finance and Accounting, and 20 percent of respondents from HR strongly agree that they are involved in innovation within their organisation.7 Meanwhile a lack of leadership and clear direction on where to innovate are seen as the biggest barriers to innovation.

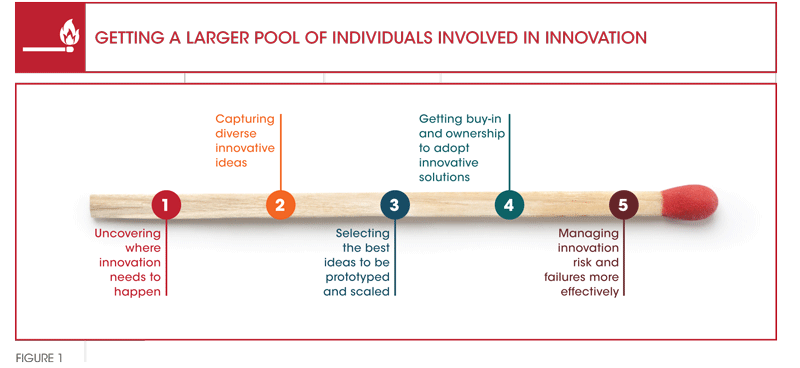

We believe that many employees do want to be involved in helping their companies innovate. However, the challenge lies in getting everyone involved in the innovation process in a cost effective and productive manner. This is where organisations can tap the digital readiness of employees by providing them with a digital innovation platform to capture competitive threats and innovation opportunities from across all levels, functions and divisions. Silos and hierarchies can be broken down and innovative performance can be tracked and rewarded. Analytics can be applied to predict which area the organisation should be focusing on. Meanwhile, gamification elements can be applied to engage users of the digital platform. Employees are typically already familiar with these tools as they are conversant with the various social media platforms.

While organisations benefit from having champions who have the presence and power to help drive and integrate their innovation strategy, innovation process and innovation culture—they alone cannot be responsible for driving the entire revitalisation.

WHERE SHOULD THE ORGANISATION INNOVATE?

In many organisations the typical focus of innovation efforts is in the creation of new services, products or technology. We believe that the rise of the digital economy opens up new areas for innovation, ranging from innovation in leadership and management, HR, IT, procurement, legal, and even finance.

The digital economy is not about technology alone, but relies on trust and empowerment between the service provider and its customers. Airbnb works because of the trust that exists between the property owner and the person staying in the property. In an organisation too, management needs to build the necessary tools and communication channels to develop trust and empower employees. Leadership support and trust are collectively deemed the most important element for employees to be innovative in the workplace.8 At Logica, a U.K.- based IT and management consultancy company, CEO Andy Green launched a company-wide initiative assigning one person from each department (finance, HR, and so on) to be an ‘innovation catalyst’, documenting new ideas discussed at meetings and following up on them.

HR plays a critical role in making innovation happen and driving company growth. According to a report released by the World Economic Forum, “Talent, not capital, will be the key factor linking innovation, competitiveness and growth in the 21st century.”9 It is easy to understand why HR is instrumental in helping to unleash innovation in an organisation. Talent runs an organisation—it is essentially the gears and brains of the organisation. In the InnovAsian study mentioned earlier, 550 human capital practitioners in three countries (Singapore, Malaysia and Indonesia) disclosed that the areas they found needed the most urgent innovation are employer branding, performance management and career progression/succession planning. HR thus needs to move away from focusing on an administrative role to transitioning to a more strategic role of driving innovation within the organisation.

Supply chain and procurement can be involved in exploring new suppliers that can significantly expand the capability of the organisation’s technologies or reach, or help source new value chain partners and ways to develop new solutions. Procurement should not befocused purely on procedures or streamlining processes. With the advent of open innovation and crowdsourcing, procurement should play a leading role in ensuring that processes are in place to manage these external collaborations.

Thomson Reuters, for instance, wanted to improve its Web of Knowledge online tool through customer-driven product insights. For this, it turned to Innocentive, a company that crowdsources innovation solutions, to create an open call for ideas, followed by a challenge to develop the winning solution. The challenge garnered over 900 participants with almost 200 submissions. The winning solution, which involved improvements in data visualisation and an elegant app, was tested, scaled and implemented quickly without a heavy demand on in-house resources. The breadth of this project would not have been possible had Reuters undertaken the traditional process of procuring solutions.

While the legal department plays an important role in protecting the organisation’s internal intellectual property (IP), it should also look into devising guidelines that would make it feasible and easy to collaborate with external parties. Ogilvy & Mather, one of the largest international advertising, marketing and public relations agencies in the world, set up innovation units in Singapore and Beijing in 2014. Known as K1ND (OneKind), each innovation unit works more closely with external parties, co-invests with its clients on product development, and shares IP that has been created.10 Hence, legal needs to find ways to make such collaboration easier, faster and more efficient.

The finance department allocates budgets for innovation projects to take-off, or ideas to be prototyped. Traditionally, employees view finance, the purse strings of the organisation, as more of a hindrance to innovation. Oftentimes, finance’s focus on compliance, risk reduction, and maximising shorter term returns seems to limit an organisation’s ability to explore and innovate.

Professional global accounting bodies have begun to outline and educate on a range of accounting approaches that incorporate a wider range of financial measures that are pertinent to innovation by way of measuring and recognising intangibles. Integrated Reporting (IR), for example, aims to improve the quality of information that companies provide to investors, making it more holistic and meaningful.11 With IR, there is an incorporation of intangibles and various kinds of capital (intellectual capital, human capital, etc.), in addition to just traditional financial capital (such as profits), in the company accounts.

An expansion of the responsibility of the finance department would help the company manage and take on risks in innovation. This would see it set aside funds for prototyping and innovation experiments, as well as outline reasonable criteria for an exploratory, innovative project to obtain progressive funding. It would also aid staff leading innovation projects to build a clearer and more convincing case for boards/investors, with an impartial but not risk-averse view in providing risk projections and accounting of the various forms of return on investment in innovation, and not just direct traditional financial metrics.

IT now forms the basic infrastructure for the lines of communication within any organisation in the same way a country designs and lengthens the reach and efficiency of its roads and highways. A powerful function, IT can facilitate innovation in many ways. The role that IT can take on includes development, acquisition and deployment of platforms to make innovation happen better within and outside the organisation, by enabling more productive and focused internal and/or external collaboration.

This would include providing mobility solutions and platforms that work across various types of devices such as smartphones and laptops, by recognising that talent is increasingly in disparate locations. On-the-go 24/7 cloud-based services can now also be employed to manage risks and costs, while ensuring adequate reliability in piloting new digital innovation tools or services. In addition, IT plays a crucial role in harnessing the tech community in developing new solutions as well as spearheading manageable, lower risk pilot projects for prototyping.

HOW SHOULD THE ORGANISATION INNOVATE?

The familiar approach for large organisations to innovate is to build proprietary capabilities within the organisation. However, with the advent of platforms and tools, innovation can be opened to the outside world to allow a fresh injection of ideas from a varied cohort. Open innovation and collaborative innovation are new practices that can be adopted by organisations. The key is to prepare the structure (procurement policies, legal frameworks, etc.) and mindset of the people, to be able to assimilate such innovation, and then launch it quickly.

Of late, the banking sector has adopted this in a big way. Barclays has begun sponsoring start-ups and working with blockchain technology—the technology that underpins Bitcoin—to try and improve payments services to customers. Closer to home, Singtel, through its wholly-owned subsidiary, Innov8, has set aside an initial fund of S$200 million to focus on investments in technologies and solutions that could potentially lead to quantum changes in network capabilities, next generation devices, digital content services and enablers to enhance the customer experience. Innov8 works closely with innovators, developers, government agencies, R&D labs, and capital providers to bring these technologies and solutions to the various markets where the Singtel Group operates. Across the causeway in Malaysia, Maybank Group embarked, just last year, on a search for 20 start-ups from the ASEAN region. The successful start-ups will undergo a three-month on-boarding and pilot testing phase within the Group that is intended to validate the feasibility of adoption and implementation of their ideas.

The destination, not the journey

We are not so sure if disruptive technology allows businesses the luxury of enjoying the journey rather than the destination, to quote Ralph Waldo Emerson. It’s probably more of a ‘fasten your seat belts’ moment. The digital economy continues to grow rapidly in tandem with the economic landscape in which businesses operate; and in many cases, it is indeed shaping the economic landscape. Many organisations run the risk of being disrupted and losing their competitive edge should they maintain existing traditional methods of conducting business. This challenge should thus be seen as an opportunity to explore new areas of growth. Adopting the digital paradigm and the ‘Uberisation’ concept will enable organisations to expand their engagement with all stakeholders, empowering them to tap into a vast number of ideas that are relevant to both, business growth and sustainability.

Suraya Sulaiman

is Executive Director of Innovation Culture and Capability at Alpha Catalyst Consulting

Azim Pawanchik

is Managing Director of Alpha Catalyst Consulting

References

1. Salim Ismail, Yuri van Geest, and Mike Malone, “Exponential Organisations: Why new organisations are ten times better, faster, and cheaper than yours (and what to do about it)”, Diversion Books, 2014.

2. Greg Sattel, “The One Thing that Marketers don’t seem to Get About the Digital Economy”, Forbes, January 15, 2016.

3. Oscar Williams-Grut, “Ex-Barclays CEO: Banks are about to have an ‘Uber moment’–and it’s going to be painful”, Business Insider, November 26, 2015.

4. Sunny Freeman, “‘Uberization’ Of Everything Is Happening, But Not Every ‘Uber’ Will Succeed”, Huffington Post (Canada), April 1, 2015.

5. Internet World Stats, “World Internet Usage and Population Statistics”.

6. Bhaskar Chakravorti, Christopher Tunnard, Ravi Shankar Chaturvedi, “Where the Digital Economy Is Moving the Fastest”, Harvard Business Review, February 19, 2014.

7. Suraya Sulaiman, Azim Pawanchik and Aina Zahari, “The HR InnovAsian Report 2014”, Alpha Catalyst Consulting, June, 2015.

8. Ibid.

9. World Economic Forum, “The Human Capital Report 2015”, 2015.

10. Elizabeth Low, “Can you really institutionalise innovation?”, Marketing, April 30, 2015.

11. Martin Brassell and Benjamin Reid, “Innovation, intangibles and integrated reporting: a pilot study of Malaysian SMEs”, Association of Chartered Certified Accountants, June 2015.