A drive for growth in the sharing economy.

In mid-2016, Anthony Tan, the CEO of Grab, an on-demand transportation-app company serving Southeast Asia, was locked in a high stakes struggle to win the hearts and minds of drivers, passengers and regulators alike. Valued at an estimated US$1.5 billion, Grab (known among consumers as ‘GrabTaxi’) had become one of Asia’s most successful start-ups.

Grab was launched in 2012 in Malaysia as a third-party taxi e-hailing mobile app. By 2015, the app had 4.4 million downloads and averaged seven bookings per second. Today, the app has over 13 million downloads and serves 30 cities across six countries. Its functionality too has expanded over time to include an array of locally suited transportation booking options beyond just taxi services, such as car-pooling and ride-sharing.

However, the company’s long-term success is far from guaranteed. Technological and social changes are afoot. The sharing economy, of which Grab is a part, is hyper-local, social and mobile and, above all, extremely competitive. Uber, Grab’s main rival, is present in more than 60 countries; and according to a 2015 TechInAsia article, holds a technological edge over Grab. The question many analysts (and consumers, for that matter) are asking is: How can Grab ensure that it continues to retain its drivers and riders in the face of this competition?

The origins of Grab

Tan, along with co-founder Tan Hooi Ling (no relation), established MyTeksi in Kuala Lumpur in 2011, which was later branded as GrabTaxi outside of Malaysia. At that time, Malaysia’s taxi industry was experiencing serious issues surrounding safety, non-compliance with rates, intimidation of passengers and poor service. In a 2015 TechInAsia talk, Tan said, “We started GrabTaxi because the taxi system in Malaysia was a mess. Drivers weren’t making enough money and hated their jobs. Women couldn’t go around safely. We needed to do something about it.”

Grab’s beginnings were quite modest, with Tan going door-to-door asking Kuala Lumpur’s biggest taxi companies to try his product. It was not until Tan approached a fifth, smaller taxi company operating a fleet of 30 taxis that he got an opportunity to try out the app1–and in June, 2012, the company launched its on-demand taxi hailing smartphone application in Kuala Lumpur.

In August 2013, Grab expanded into Manila. In May 2014, Grab launched ‘GrabCar’ in Malaysia and Singapore, a real-time Uber-like ride-sharing service for private vehicle owners and passengers. Similar to GrabCar, ‘GrabBike’ was launched in November 2014 in cities such as Ho Chi Minh and Jakarta, where motorbikes and scooters were the predominant form of transportation. In these locations, drivers wore Grab’s signature green helmets, while also having one on hand for passengers.

By the end of 2015, Grab had raised US$680 million in disclosed funding from 10 investors.2 In early 2016, the tech unicorn was rebranded as ‘Grab’, hosting an even wider array of service offerings. By then, over 250,000 drivers operated in the Grab network, which spanned 30 cities across six countries in Southeast Asia.3

Business model

Improving the safety and accessibility of transportation, along with improving the lives of passengers and drivers, was core to Grab’s mission. The company aimed to make travelling easier and safer for passengers. It also sought to increase the incomes of taxi drivers through usage of the app, which enabled the drivers to connect with passengers more easily, quickly and efficiently than simply searching for fares or responding to taxi company dispatches.

Grab’s business model aimed to solve the supply-demand disparity by building a platform that efficiently matched underutilised, distributed capacity to demand. Such platforms, which were part of the newly emerging ‘sharing economy’, also included mechanisms to ensure payment and delivery of services, along with the verification of identity and reputation rankings, in order to better establish trust between unknown parties. All this was accomplished via smartphone related technologies.

Digital platforms like that of Grab were highly scalable and reduced operating costs for both sharers and facilitators. In effect, the company had outsourced its labour and productive assets and, instead of being a taxi company, was a facilitator of collaborative consumption, offering alternative services in a traditional industry.

Grab had outsourced its labour and productive assets and, instead of being a taxi company, was a facilitator of collaborative consumption, offering alternative services in a traditional industry.

|

THE SHARING ECONOMY Although the term ‘sharing-economy’ has been around since the early 2000s, it was not until the aftermath of the Great Recession in 2007-08 that the term gained widespread popularity. In 2011, Time declared it one of 10 ideas that would change the world. Early evidence suggests that this was not an exaggeration. In 2013, consulting firm PricewaterhouseCoopers estimated the size of the sharing economy to be around US$15 billion, and projected that it will grow to US$335 billion by 2025. The sharing economy encompasses five key sectors: peer-to-peer lending and crowdfunding, online staffing, peer-to-peer accommodation, car sharing, and music and video streaming. However, this is not to suggest that only five sectors constitute the sharing economy; its true scope and potential remain undefined. Companies like Airbnb and Uber are among the most globally recognised operators in this space, connecting people and organisations willing to rent their assets or provide temporary services to consumers, such as lodging and transportation. Sharing is facilitated by algorithmically matching individuals rather than an open market like eBay, where buyers hunt down and bid on goods and services. Revenues for these kinds of companies are typically generated through a percentage fee of sorts. Interestingly, the actual provider of the good or service being consumed is not an employee of the company. For this reason, Airbnb is not a hotel operator and Uber is not a taxi company. Anyone with a smartphone can thus become an ad-hoc taxi driver, bed-and-breakfast owner, or equipment rental agency whenever they have the spare time, unproductive resources and inclination. |

Strategic partnerships

The Japanese telecom company, SoftBank, is Grab’s largest investor today with US$250 million in venture funding. SoftBank also has stakes in other transport network companies, such as Lyft in the United States, Didi Kuadi in China and Ola in India—all of which (including Grab) consider Uber as their main competitor in their respective markets.4 Together, these companies have formed a strategic partnership to rival Uber’s global footprint, while remaining independent companies focused on their respective regions. Thus, while each company handles mapping, routing and payments through a secure application programming interface in their own markets, customers are able to access the entire partnership network using their local app, providing a seamless, more global experience beginning from the first quarter of 2016.5

In December 2015, Grab signed a Memorandum of Understanding with the Singapore-based telecom conglomerate, Singtel Group, to use Singtel’s mobile wallet services to pay for rides on the Grab app.6 This option will soon be made available on an integrated open platform with other major regional telecoms associated with Singtel, such as AIS (Thailand), Globe Telecom (the Philippines) and Telkomsel (Indonesia). This partnership will thus expand Grab’s payment options beyond cash and credit into digital currency, which is becoming increasingly popular as a means of payment for the unbanked and underbanked across the world.

The agreement has strong synergistic potential. For example, Singtel has a combined customer base of 500 million people through its own operations and that of its associate companies. It is also a majority owned company of Temasek Holdings, a Singapore government-owned investment firm, which has stakes in Grab through its other wholly owned subsidiary, Vertex Venture Holdings.

Connecting with the community

Grab also engages in numerous initiatives designed to create positive social impact. In 2015, the company launched GrabSchool, a programme that aims to develop life skills and foster a spirit of entrepreneurship among the children of Grab’s drivers.

In March 2016, Grab announced that it would provide a first-of-its-kind free personal accident insurance that would cover all GrabCar and GrabBike passengers in the region, from the first dollar. It also implemented other safety initiatives, such as installing CCTV cameras in the cars of women drivers who are at greater risk of violence.

At a higher level, Grab collaborates and works closely with local and municipal governments to improve transportation related issues such as congestion, which many Southeast Asian cities are notorious for. In early 2015, Grab announced a data sharing partnership with The World Bank’s Open-Traffic project to provide real-time data streaming that reported service volume, location tracking and historical journey times. This has promising potential to help governments, that can plug into the platform in order to better model traffic, examine historical data, understand congestion patterns and plan infrastructure, as well as improve emergency response and disaster preparedness.7

The regulatory front

There is concern that companies in the sharing economy, of which Grab is a part, could become monopolistic, with value-extraction and private, sensitive information becoming concentrated in the hands of a few, depending on and proportional to the extent of their network effects. Exploitation is another concern, as “what began as a peer-to- peer idealistic and egalitarian movement has, in some eyes, become a ‘commodifier’ of other people’s resources”.8

Public policies that govern the sharing economy have yet to catch up, and any regulation that exists is still nascent and varies widely across countries, and even within countries at the municipal level. As such, these companies are often exempt from numerous tax codes, licensing regimes, safety compliance and labour laws because they are viewed as facilitators for individuals to provide peer-to- peer services to each other, rather than the actual providers. Because of such issues, or perceived issues, companies operating in the sharing economy are attracting the attention of regulators, who in turn are facing mounting political pressure from incumbent businesses and labour groups, which has resulted in several high profile public relations disasters.

Increased regulatory compliance is potentially a major threat for companies like Grab, as it can increase operating costs, making the business model untenable.

Hyper competition

What makes sharing economy models like Grab work is that they have incredibly low fixed costs (because they are asset light) and high scalability (because they depend on cloud-based mobile app technology). However, this also means that the barriers to entry are quite low. This increases competition, which drives down price. Margins are razor thin, and a company must quickly achieve network effects and volume in order to survive in the sharing economy.

Uber and other ride sharing apps offer compelling substitutes for Grab services, as does public transportation in some markets. Private taxi companies are also substitutes and often have their own e-hailing apps. However, Grab (and Uber) have third party taxi e-hailing functions in the app (as well as private vehicle hire amongst other services) that can incorporate taxi drivers as well. The threat of new entrants can be tempered by network effects. For example, the effectiveness of the app is only as good as the number of drivers using it, who in turn are attracted by having a large user base to serve. Strengthening one’s network and solidifying customer stickiness is thus key to business success.

GRABBING DRIVERS AND RIDERS

The real concern comes from the bargaining power of buyers (riders and drivers) who can effortlessly switch between mobile ridesharing apps. The competition for both drivers and riders can become incredibly intense.

Customer switching costs and brand loyalty tend to be far lower for companies peddling on-demand access as end-users need only download a new app. Convenience, reliability and instant gratification are the prime drivers to gaining customers.

Grab must therefore be enticing enough for them to stay, but as competition increases, the fare price drops, thus creating a double-edged sword. Unless a monopoly is achieved, companies like these are forced to keep expanding into new markets with more and more services in order to stay abreast of commoditisation.

Beyond Grab

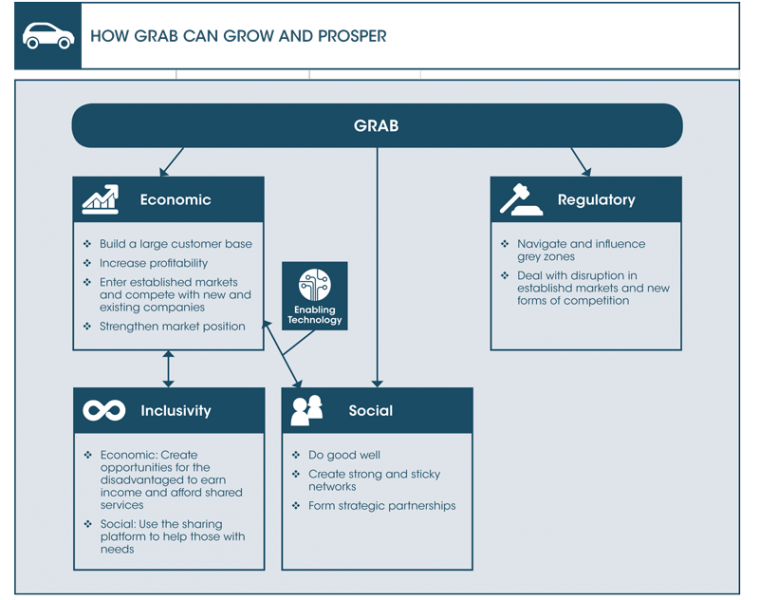

As competition intensifies, Grab may explore avenues of differentiation through its unique social enterprise identity to establish trust and loyalty with its customers and drivers. The company’s social mission to improve the lives of those in the community is a broad mandate. For example, its engagement with the government and the community can, to some extent, help to position a competitive advantage within the ecosystem, thus improving the customer-stickiness factor.

But simply funding any ‘feel good’ initiative is not good business. Grab needs to leverage its capabilities, core product and expertise towards a triple-bottom line—and in doing so, work towards solving real-world problems that are aligned with the company’s mission. At the same time, it must stay ahead of technological, regulatory and social trends that seem to all be experiencing accelerating change.

While Uber is backed by high profile investors like Google and Baidu, Grab too is well funded and eager to strengthen its technological capabilities. Moreover, the company’s local roots may prove to be an added competitive advantage in navigating Southeast Asia’s complicated and highly fragmented markets, no doubt fraught with regulatory uncertainty in the on-demand transportation industry.

Grab’s strategy of addressing socioeconomic inclusivity and government engagement has so far proven to be a winning recipe—and indeed, offers a template for navigating new frontiers and opportunities for growth in emerging markets. This is particularly salient for disruptors wishing to avoid incumbent and public backlash. In addressing challenges in the transportation industry, Grab’s strategy thus far has created a viable roadmap for innovative business models that take into account new avenues of value creation.