Significant investment and cooperation between ASEAN members is required to shore up reliable and affordable access to petroleum1.

Although the people of ASEAN consume energy at a rate of half the global average per person, the energy demand in these countries—Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam—has collectively increased more than two-and-a-half times since 1990.2 Moreover, the International Energy Agency (IEA) projects overall energy demand in ASEAN to increase by an additional 80 percent by 2035, assuming a three-fold increase in economic output as the population of ASEAN countries approaches 750 million.

According to the IEA, the transportation and industry sectors will be among the main drivers for increasing demand, where energy consumption is expected to grow by 88 percent and 90 percent respectively over the next 15 to 20 years. Most of this demand will probably be met by a combination of coal, natural gas and oil—of which oil will continue to be the more strategic resource, given that the transportation sector cannot easily substitute other primary fuels into its energy mix.

Evolution of oil demand

Under these growth assumptions, oil demand in the ASEAN region is expected to increase to 6.8 million barrels per day (mb/d) from a current consumption rate of 4.4 mb/d. This would make ASEAN, which is already a net importer of 1.9 mb/d, the fourth largest importer after China, India and the European Union.3 However, it is worth noting that there is quite a bit of disparity in import volume among ASEAN members, which makes coordinated policy efforts difficult—and a lack of such coordination hinders their ability to compete with increased product demand from neighbouring countries.

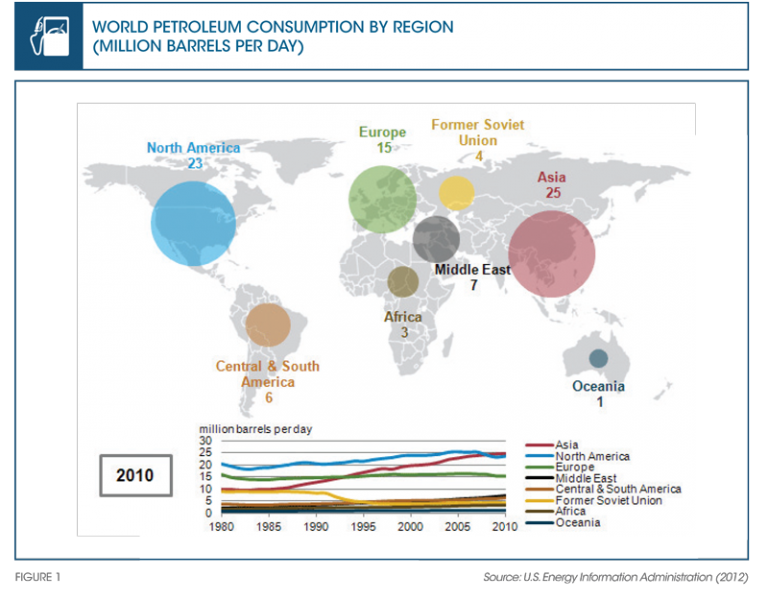

China is absolutely Asia’s largest consumer of oil, burning some 10.8 mb/d or about 12 percent of global demand. The second largest consumer is Japan, but as a maturing economy, its demand for oil will slowly diminish. India, ranking third at 3.7 mb/d, has been experiencing a steady annual demand increase of 3 percent, which will no doubt accelerate with economic expansion.4 In all, Asia will account for about two-thirds of increased global demand for oil by the end of 2015 (refer to Figure 1).

This rise in demand is now shifting supply routes to different demand centres across Asia. Last year, producers in the Americas began selling crude to refiners in Northeast Asia, despite persistently cheap oil prices from increased Saudi production, Asia’s dominant supplier. Just recently, U.S. and Latin American oil was shipped to refineries in China, South Korea, Japan and Taiwan for the first time in over a decade.5

Oil demand in ASEAN is expected to increase to 6.8 million barrels per day by 2035.

Securing supply

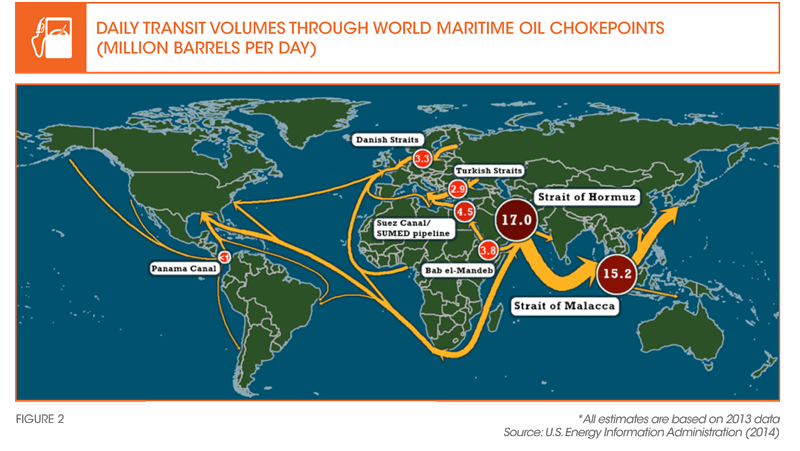

The growing number of suppliers is potentially beneficial for price stability and access to oil in Asia since it reduces dependency on Saudi production and diversifies supply. However, the characteristics of crude differs depending on where it originates. Most refineries in Asia are configured to process Middle Eastern crude, which can be refi ned through simpler and cheaper methods in comparison to heavier variants from the Americas. This puts ASEAN countries at increasing risk of becoming captive buyers (refer to Figure 2).

Growth in new refining capacity in Asia has been sluggish, and worldwide capacity has actually declined slightly in the past few years.6 This creates the potential for downstream bottlenecks in regional supply. China and India have thus invested in additional sophisticated refining capabilities to handle more flexible inputs. For instance, one of the largest and most versatile plants in the world is Reliance Industries’ Jamnagar Refinery in Gujarat, India. Such flexibility and scale also permits a stronger bargaining posture with producers. With the exception of Singapore, other ASEAN countries lack the expertise to refine crude oil other than that which is available domestically or imported from the Middle East, usually from Kuwait or Saudi Arabia. And in terms of upstream domestic production, Southeast Asia faces dwindling reserves. But because ASEAN is obviously more fragmented than China and India, a shared petroleum infrastructure investment and policy is more complicated.

UPSTREAM WOES

Though formerly a net oil exporter, Indonesia became a net importer in 2004. The country is now a mature producer, as its productive fields have peaked. Oil output is on the decline and new developments will require more technically challenging extraction methods such as deep-water drilling and enhanced oil recovery (EOR) techniques for mature fields. Nonetheless, Indonesia remains the largest producer in ASEAN and its abundant coal reserves open the possibility of coal-to-liquid production in a pinch.

Malaysia, ASEAN’s second largest producer, has seen steady declines since 2003. Its demand is expected to overtake production by the end of the decade. The government aims to slow this decline by offering tax incentives to attract investments into marginal fields and EOR developments.

Brunei, though rich in resources for its size, has insufficient reserves to meet rising regional demand. And Thailand, with its limited production, is experiencing an ever-widening gap in net oil imports. There are a few undeveloped, yet marginal fields in the offshore areas of Cambodia, Myanmar and Vietnam. Other potential offshore and deep-water exploration opportunities exist in the region, but these are in contested areas such as the South China Sea. And even if these areas were developed, it would likely not be enough to meaningfully offset declining upstream yield. By 2035, oil production across ASEAN will have fallen by a third to 1.7 mb/d.7

Petroleum security in ASEAN must therefore be more downstream facing.

FOCUSING DOWNSTREAM

The Vietnamese Government has decided to further secure its supply and limit its reliance on imported refi ned product by developing additional refining capacity. Take for instance, the Nhon Hoi refinery project, a 400,000 barrels per day (bpd) facility being financed through a joint venture between Vietnamese partners—the state-controlled Thai company PTT (formerly known as the Petroleum Authority of Thailand) and Saudi Aramco, which is contracted to supply the crude feedstock.8

Myanmar, which still imports 80 percent of its refi ned product, is proposing to invest in several new docking, refining and storage facilities. One of these is being developed by the Chinese state-owned company, Guangdong Zhenrong Energy, which plans for a 116,000 bpd refinery and a 150,000 tonne crude oil dock with additional warehousing and logistics facilities.9

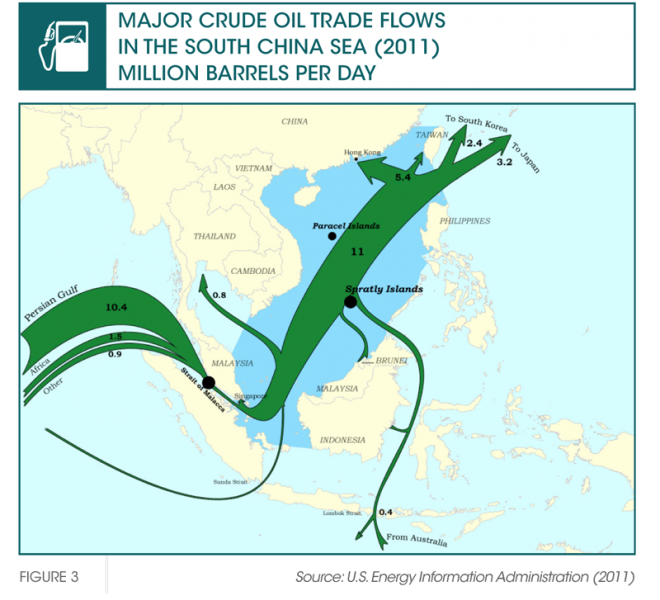

Also, in January this year, China National Petroleum Company’s US$2.5 billion investment into a 2,400 km crude oil pipeline came online, which links the deep seaport at Kyaukpyu in western Myanmar to Kunming, Yunan in south-western China. This pipeline runs parallel to a natural gas pipeline that came online last October. And although 10 percent of the gas is slated to remain in Myanmar, all of the pipeline’s 440,000 bpd of crude capacity goes direct to Kunming, where a new refinery is currently being built. This is key to China’s own energy security as it by passes the Straits of Malacca, through which 80 percent of its current imports pass. In return, Myanmar expects to receive US$53 billion in royalties after 30 years.10 Although these investments are certainly welcome, they do not reduce dependency on the Gulf, nor address competing demand interests in the region (refer to Figure 3).

Captive buyers

Perhaps ASEAN members could avoid Saudi dependency and count on the global market for oil to ensure access and stable supply. The logic here is that oil would go to the highest bidder, and an integrated global market could alleviate regional disruptions—such that a price hike anywhere would mean a price hike everywhere. In this manner, there would always be an opportunity to purchase crude at a competitive price. ASEA N members could even strengthen their trade position through a more united bargaining posture. Unfortunately, this kind of thinking is mistaken.

NOT QUITE FUNGIBLE

Regardless of what conventional wisdom dictates, oil is not a fungible commodity. Fungibility requires a free market for trade, and in this respect, the market for oil faces profound government intervention in say, disparate domestic protection and environmental policies. Moreover, there is extraordinary diversity in the types of crude oil traded, which requires different means of processing at varying levels of sophistication. At the same time, even a versatile refinery cannot instantaneously switch between crude variants or different combinations of blends. In each iteration, the plant would need to be recalibrated, often with inefficient results.

There are also physical limitations to moving large quantities of crude. And most of ASEAN’s crude imports pass through a sea lane that is subject to a highly sensitive chokepoint: the Straits of Malacca. While pipelines are expensive to build, they are a more efficient means of transporting oil than by ship. Pipelines also provide stickier prices and increase access reliability, as production is essentially held captive. In fact, only about half of all oil in the world is shipped by tanker, which is often loaded at the endpoint of a pipeline, thus incurring additional costs. And when it comes to waterborne oil trade, Saudi Arabia is by far the largest, lowest-cost producer of light sweet crude. It is the most influential determinant of price and that price is decided by policies deemed most beneficial to the Saudi Kingdom. Moreover, Saudi Arabia strategically imposes destination and resale restrictions. Importers are not free to resell to the highest bidder. All of these factors result in more fractured and regionalised markets for oil commodities. In fact, oil markets have now become more regionalised than ever before.11

Oil markets have now become more regionalised than ever before.

A call for cooperation and investment

ASEAN countries must avoid becoming complacent in light of the persistently low petroleum prices caused by ramped up Saudi production of light sweet crude and its price influence on waterborne trade. They should instead take advantage of the low price environment to push through policy reform that strengthens their petroleum security with an emphasis on investment, collaboration and subsidy reduction.

Investment in downstream and upstream infrastructure is needed to meet increasing levels of demand. More must be done in terms of maximising recovery efforts in mature fields, and also developing new prospects. This kind of investment is expensive and often requires private sector expertise and technological knowhow. Thailand’s recent political wrangling over revising its petroleum concession laws (in place since 1971), are not encouraging. Under a proposed new ruling, the Royal Thai Government would receive 80% of the profits derived from private sector investment—up from the 67% it enjoys today.12 This sends a dangerous signal, especially since profit margins are already much thinner when it comes to advanced extraction techniques and developing new, more difficult fields.

ASEAN as a whole also needs greater flexibility in terms of refining capacity so as to take advantage of more diverse forms of crude. Reduced regulatory uncertainties across the board through long-term policy agreements and increased transparency would help attract private investment into the region’s petroleum infrastructure—as without such assurances, private investors are far less willing to spend billions on advanced refineries and technically challenging fields.

The ASEAN countries should also work together to further scale back fossil fuel subsidies, especially in the transportation sector. Petroleum consumption subsidies alone cost these governments around US$34 billion a year.13 Reducing these subsidies would go a long way towards spurring downstream investment. It would also make continued reductions in oil import tariffs, both within and outside ASEAN, more attractive.

The adoption of unified fleet emission standards could further increase efficiencies. Understandably, these are sensitive policy areas, as these subsidies were originally introduced to alleviate the burden of transportation fuel costs on lower income consumers, and intended to decrease the cost of doing business. But at this point, such policies do more harm than good by distorting demand and creating waste. More efficient fuel consumption would help in reducing government budget deficits and create more resilient economies by alleviating potential supply disruptions and lowering carbon intensity. Member countries must continue their transition from oil as a means to generate electricity, which accounts for about 10% of generation. ASEAN countries should work together to develop other power options such as increased use of renewables, natural gas (which it is rich in), more cross-border gas pipeline interconnections, and greater grid transmission integration. Perhaps the ASEAN Economic Community will provide such a forum to make these reforms possible and pave the way for ambitious investment and coordination in the region’s energy security.

If not enough is done, the increased reliance on Middle Eastern crude, as domestic production declines while overall demand across all of Asia increases, could become a serious economic drag on ASEAN countries in the future.