When e-commerce giant Alibaba went public on the New York Stock Exchange in September 2014, its market capitalisation rocketed to roughly US$219 billion—a sum greater than any record previously set by its American contemporaries, Facebook, eBay and A mazon. It was a historic event that led many to believe that China’s digital economy was echoing the Middle Kingdom’s own meteoric rise onto the world-stage.

China ranks high in digital connectivity. In 2015, almost half of the country’s population, or 649 million people, were online. Its fast-growing Internet economy generates about US$100 billion annually and is predicted to reach US$277 billion by 2017.1 And for every popular site in the rest of the world, there is a Sino-doppelganger lurking behind the Great Firewall of China: Taobao, Youku, Sina Weibo, WeChat and Baidu being among the most well-known.

Within China, local Internet players hold more than just a home-team advantage. Global dot-com companies operating in Internet search, e-commerce, news and social media, particularly U.S. and Japanese companies such as Google, Rakuten, Facebook, and Twitter (among 3,000 others), are blocked under the Chinese Communist Party’s Internet censorship policy.

Yet Chinese Internet companies face stiff competition from local rivals. Rapid innovation and improvement are essential for survival, perhaps even more so than what is experienced in the ‘outside’ world. Weibo and WeChat both incorporated certain functionalities well before their respective western developers, Twitter and WhatsApp. This environment has vigorously accelerated the development of China’s digital landscape. The question is who is imitating whom…And where will the next wave of disruptive innovation originate? This article examines three key categories: search engines, online market space, and online payments.

For every popular site in the rest of the world, there is a Sino-doppelganger lurking behind the Great Firewall of China: Taobao, Youku, Sina Weibo, WeChat and Baidu, being among the most well-known.

Online search market

In the early- to mid-1990s, the global search engine market witnessed a surge of competition amongst a number of players, including Yahoo, Netscape and AOL. The situation changed with Google’s entry into the market in 1998—its disruptive search algorithm stood out from the crowd, offering faster and more accurate search results. Google grew exponentially, quickly becoming the world’s leading search engine company by the mid-2000s. It is now the dominant search engine in most countries. However, four large markets remain outside Google’s reach—Russia, South Korea, Japan and China.

In 2000, Google started offering its search engine in Chinese. This was in direct competition with Baidu, which had been founded a few months earlier in late 1999, by China-born entrepreneur Robin Li. Baidu understood the local Chinese market far better than Google, and quickly took the lead. In 2004, Google bought a 2.6 percent stake in Baidu for US$5 million. In 2006, Google changed its business strategy in China by rolling out its own search engine, Google.cn, and sold its stake in Baidu for around US$60 million. Yet Google soon found that it was difficult to navigate China’s complex regulations and culture, eventually exiting in 2010.2 By August 2014, Google had a mere 0.34 percent market share in China’s search market,3 as compared to a 36 percent share in 2009.4

NEWCOMERS IN CHINA’S SEARCH MARKET

Google’s exit gave Baidu an opportunity to dominate the search engine market in China, but this was short-lived. In 2012, Qihoo, a local software company known for developing antivirus software, pushed out a search engine, so.com, and soon became a major competitor to Baidu. In its first year of business, Qihoo captured an impressive 10 percent market share, which subsequently rose to nearly 30 percent in 2014. During this time, Baidu’s market share declined to 59 percent. Qihoo’s impressive growth lay in its Internet browser, 360, which had 357 million monthly active users and its proprietary built-in search.

Another key player in the search market in China is Sogou, which was backed by the Chinese Internet megazord, Tencent. Sogou gained an 11 percent market share by 2014,5 and along with Qihoo’s so.com, terminated Baidu’s monopoly on search, driving the industry to new competitive heights.

BAIDU LOOKS AHEAD

While the situation in the PC-based search market is becoming increasingly competitive for Baidu, the company leads in mobile search applications. Baidu invests heavily in marketing efforts to consolidate its position across the mobile ecosystem, and has ensured that its mobile applications come pre-installed on most smartphones sold in China. Between 2012 and 2013, Baidu had paid pre-installation fees of US$350 million to smartphone manufacturers, and plans to continue investing in this space over the coming years.6 By the end of 2014, Baidu had garnered 80 percent of China’s mobile search market.

In 2014, Baidu hired Andrew Ng, the chief scientist who previously headed Google’s Artificial Intelligence projects. The company intends to invest US$300 million in its new artificial intelligence lab and a development office over the next five years.7 This has sent a clear signal that the company is committed to investing in innovation with the goal of international expansion, stating that half of its revenue will come from outside China by 2020. As part of its international growth strategy, Baidu made a foray into Brazil in 2014, where Google maintains a 98 percent market share.

Baidu also invested significantly into big data analytics and other new technologies, such as cross-screen optimisation, cloud computing, location-based services, and online to off line services, providing innovative marketing solutions to its clients. A case in point was the launch of the Mini-Self Campaign with Coca-Cola in November 2013. This campaign leveraged largely on Baidu’s extensive outreach to customers through its image editing app. Baidu’s image editing app allowed participants to design a photo which showed them as a ‘mini-self’ standing by a Coca-Cola Mini bottle, and this photo could be shared via social media. By the end of the first month, the number of participants had reached 1.4 million, and Coca-Cola Mini sales had grown by 30 percent.8 Another example was a campaign for McDonald’s. This campaign was a location-based service that allowed customers in the vicinity to get a free ice-cream at their nearest McDonald’s outlet through a Baidu Map. The scheme was an immediate hit—site traffic for Baidu Map reached 20 million people, while user coverage touched 70 million through social media channels.9

Baidu is committed to investing in innovation with the goal of international expansion, stating that half of its revenue will come from outside China by 2020.

Online marketplace

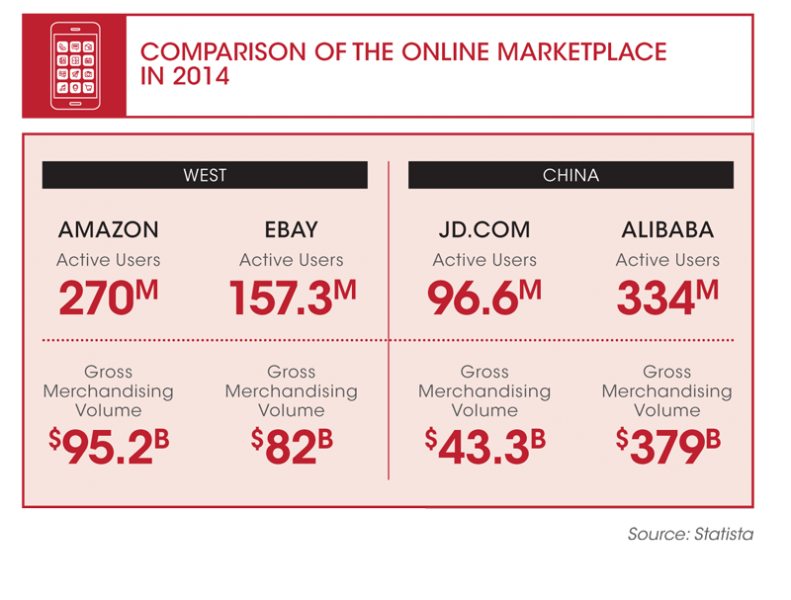

Online marketplaces offered alternative shopping avenues that were fast, cheap and convenient for both merchants and customers. According to eMarketer’s December 2014 report, worldwide retail e-commerce sales would exceed US$1.3 trillion in 2014. It also forecast that the U.S. e-commerce market would hit US$349 billion by the end of 2015.

However, the largest business to consumer (B2C) player in the U.S., Amazon, has witnessed decelerating revenue growth and is working to make its business turn profitable. Another consumer-to-consumer (C2C) player, eBay, was highly dependent on its online payment business—PayPal, which accounted for nearly 50 percent of its revenue.10

ONLINE MARKETPLACES IN ASIA PACIFIC

While the e-commerce market was undergoing turbulence in the U.S., the situation was quite different in Asia Pacific, especially in China. In fact, the value of B2C e-commerce sales in Asia Pacific surpassed those in North America in 2014, making it the largest regional e-commerce market in the world. In 2014 alone, B2C e-commerce sales reached US$525.2 billion in Asia Pacific, compared with US$482.6 billion in North America.11 Within Asia Pacific, China accounted for more than 60 percent of the value of these transactions, and was estimated to overtake the U.S. as the largest B2C e-commerce market in terms of spending by 2016.12

In the early days of online marketplaces, foreign players such as Amazon and eBay made a foray into China’s market through acquisitions, and grabbed a significant share of the market. In 2004, Amazon acquired Chinese online book seller Joyo.com for US$74 million, which was later transformed into Amazon China.13 Similarly, eBay acquired the once-popular Chinese e-commerce site, EachNet, and commenced its operations in China. The similar start also brought the same end for both companies—neither could adapt to the Chinese business environment.

The value of B2C e-commerce transactions in Asia Pacific surpassed those in North America by 2014, making it the largest regional e-commerce market in the world.

THE BIRTH OF THE ALIBABA EMPIRE AND JD.COM

Alibaba was one such local e-commerce company, which grew to become the market leader in both B2C and C2C markets in China. Founded by Jack Ma in 1999, Alibaba was initially positioned as a business-to-business (B2B) hub that linked Chinese suppliers to foreign merchants. However, the company soon swiftly expanded into C2C (Taobao), B2C (Tmall) and payments services (Alipay), and became a market leader in the respective segments within a span of five years or less.

Taobao, for example, was founded in 2003 to compete with eBay in China. The platform served both sellers, who could list their products, and customers, who could buy products, on the platform. With 500 million registered consumer accounts and 800 million listed products, Taobao grew to account for a staggering 90 percent share of China’s C2C market by 2014.14 Its B2C arm, Tmall.com, which held roughly 50.6 percent of market share, partnered with highend international brands such as Lamborghini, Apple, Zara and Lenovo to target affluent middle-class consumers in China.15 Another B2C giant in China was JD.com, appropriating 23.3 percent of China’s B2C market. The company entered into a strategic alliance with rival Tencent to accelerate its initiatives in mobile marketing and mobile commerce spaces.16

ONLINE SHOPPING AS A LIFESTYLE

Despite the short ten-year history of China’s online marketplaces, its dynamic local players have significantly surpassed western markets in terms of influencing consumer shopping behaviour and outreach. Online shopping has become the norm for Chinese consumers, leading Ma to comment, “In other countries, electronic commerce is a way to shop, in China it is a lifestyle.”17

Forty percent of China’s online shoppers read and post reviews on products—double the number of those in the U.S.,18 and it has become apparent that mobile commerce is an obvious trend when it comes to enhancing the shopping experience. In 2015, revenues from mobile commerce in China were forecast at more than US$41.4 billion, representing eight percent of global e-commerce transactions.

Innovative sale strategies from leading players have led to China’s surge in e-commerce transactions. In 2009, Alibaba created the concept of ‘Singles Day’. Taking place on the 11th of November each year, Alibaba offers steep discounts on the products they sell. This has been an outstanding success, and in 2014, Alibaba reported record-breaking sales of US$9 billion on Singles Day, delivering more than 500 million parcels to shoppers.19 Alibaba’s success and cross-border expansion attracted the interest of its local rivals, including Tencent and JD.com, both of which plan to offer discounted deals on Singles Day for the first time in 2015.

Online marketplaces also boosted other industries such as transportation and logistics. In addition, they helped bring China’s flourishing retail industry to rural areas that previously lacked bricks and mortar retail due to limited transportation and communication access. Seventy percent of the areas in China where online sales were booming were the rural, less developed parts of the country.20 It was believed that as Internet penetration increased, China’s rural areas would show even greater potential for revenue growth for online marketplaces.

“In other countries, electronic commerce is a way to shop, in China it is a lifestyle”, commented Jack Ma, founder of Alibaba.

Online payments

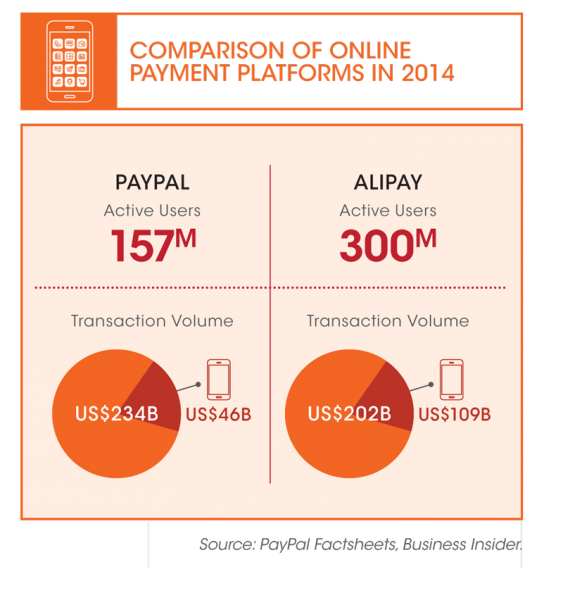

The growing online sales market requires a payments system that could build trust for buyers and sellers as well as one that could be managed by a fair and safe third party. Online payments companies acted as such a third party. PayPal, one of the world’s largest online payments companies, was founded in 1998 and was one of the forerunners in this business. In 2014, PayPal had 157 million active accounts in 203 markets.21

In China too, the online payments industry was growing tremendously. The volume of transactions rose to more than US$300 billion by the end of 2014, from US$2.47 billion in 2007.22

ALIPAY, AN INTEGRATED ONLINE PAYMENTS PLATFORM

Similar to other business segments, China also had its own online payments companies that dominated the market. These were Alipay and Tenpay, owned by Alibaba and Tencent, respectively. Alipay had a market share of 48.7 percent, followed by Tenpay, which ranked second with 19.4 percent of the market in 2013.23

Alipay had several features and functionalities that set it apart from western payments platforms. For instance, its users could transfer money from Alipay to any bank account within just two hours; they could pay credit card bills and utility bills at no extra charge; and they could buy bus tickets and top up mobile phones using Alipay. In addition, Yu’e Bao, Alipay’s mutual fund, enabled users to earn interest on the spare cash that lies idle in Alipay accounts. Alipay was the payment method of choice for almost every major website in China. Compared to PayPal, a company which had a bigger international presence, Alipay provided more integrated services that covered people’s needs comprehensively, as well as maintained strong user stickiness.24 Tenpay, on the other hand, focused only on the mobile gaming market.

MOBILE PAYMENT

Looking ahead, mobile payments are on the rise world over, with major players such as Alipay and PayPal offering mobile payments services to their users. In fact, Alipay became the largest mobile payments platform, recording mobile transactions of US$150 billion in 2013.25 In 2014, mobile payments accounted for 54 percent of all its transactions.26 In addition, the company had launched a new solution through which users could make payments in brick-and-mortar shops. Once retailers were registered with Alipay, users could make a payment using the Alipay app on their phone via a barcode scanner.27 To further boost its usage, Alipay is planning to use soundwave technology to enable offline payments. This new feature is expected to be available at vending machines at train stations, shopping malls and schools.

With Alipay’s dominance in China’s online payments market, the next item on Alibaba’s agenda will be to enter foreign markets including the U.S. and Europe. However, the differences in policies, as well as shopping and payment behaviours, are seen as potential hurdles that the company needs to consider in order to compete with PayPal in the global market.

Learners turned leaders

The global digital landscape may have inspired a generation of Chinese entrepreneurs such as Jack Ma and Robin Li, who started off with learning and imitating business models and digital solutions developed in foreign markets. However, having gone through nearly two decades of evolution, the Chinese digital market has developed sophisticated preferences of its own and local Internet players have had to innovate and improve well beyond the cloning that took place at the beginning.

However, just as the Great Firewall of China has served as a nascent-industry incubator of sorts for Chinese companies, it has also made international expansion that much more difficult. Nonetheless, leading Chinese Internet firms are large, flush with cash and, more importantly, have proven themselves as innovators. But will these companies ever expand internationally and become globally competitive, or are they doomed to stay Sino-centric? Should Facebook and Google be worried? And will we start seeing western clones of Chinese originals?