One crucial factor that would differentiate winning businesses from the others is the equity of a strong brand. They must learn to compete globally, sustain competitiveness, and master customer loyalty by building customer-centric brands.

Geographical boundaries are no longer a barrier as companies across the globe compete with one another. For the greater part, companies from the West were entering Asian markets. The reverse process has already begun with Chinese and South Korean businesses gaining a firm foothold in lucrative Western markets in the same way that Japanese businesses had done before them. When these global business wars have been fought, there will emerge one crucial factor that would differentiate winning businesses from the others: the equity of a strong brand. In fact, the fast-changing business landscape has made branding a key success factor even for companies competing in their respective local markets.

The orientation of brand management has undergone substantial changes over the last decades to become an integrated and visible part of corporate strategy. Branding has evolved from being just an addendum to advertising campaigns, fancy ideas of the marketing department, or an optional function of the elite few, to being recognised as a boardroom discipline, which contributes to the top and bottom line of the company. It also aids in enhancing shareholder value by contributing to the market capitalisation of the company.

Research has shown that a large part of the market capitalization of companies listed on the global stock exchanges is made up of intangibles, of which brand equity is the important element.1 Another study examined the casual linkage between branding and creating shareholder value. By evaluating the risk factor of a portfolio of strong brands against the benchmark portfolio, the study concluded that the strong brand portfolio is much less risky than the benchmark portfolio.2 This proves branding’s contribution to a company’s financial health and performance.

Luxury brands such as Rolex are built on heritage, style, class, and energy. Rolex has been around for over a century and has maintained its high-end brand identity and attractiveness. Such longevity comes from constantly working on the brand and creating unique value that customers want. Equally, we have brand bubbles like Nokia that were highly successful but did not survive the test of time. Nokia’s leadership in the mobile phone industry was displaced by Apple’s iPhone; the key difference being the smart phone technology that Nokia had, but did not prioritise effectively. Despite its smart engineers and proactive marketers, why didn’t Nokia figure this out? Why did the company miss the writing on the wall? The need to follow market trends closely and be open and amenable to change cannot be overestimated. Often, arrogance and complacency become the lethal enemies of strong brands.

Principles of successful branding in Asia

Experience, skills, and resources have been the key success drivers for Western brands maintaining their value and operating globally, especially when they expanded into uncharted Asia. Some of the key principles for their success are:

Culture: Strong brands like McDonald’s, Carrefour, and Walmart have learnt to see Asia as a mosaic of markets and cultures (as opposed to a homogenous market) and have worked towards becoming culturally knowledgeable and culturally sensitive. McDonald’s does not sell beef burgers in India and ensures that it offers menu items that appeal to local tastes, while also strongly holding on to its brand entity. In China and South Korea, Walmart worked around attracting customers who were used to buying daily groceries from traditional wet markets. These companies took the time to understand the culture, history, spending and buying habits, and tastes and preferences of consumers in each market.

Consumers: Nike acknowledges the differences in consumer mindsets between Asia and the West, though one would find it hard to understand why this would be so for a category like sportswear. In China, faced with fierce resistance from local player Li-Ning, Nike fought back by getting into the minds of consumers to best cater to their needs. Nike started out in China by getting close to rural areas with a grassroots strategy that eventually allowed them to gain traction and brand awareness in larger cities. It learned about Chinese consumers by observing them in soccer fields, baseball pitches, and local playing fields. HSBC is another example of a firm that has had similar success in Asia by being the local bank that understood local cultures, habits, and preferences from customers in diverse Asian markets. HSBC’s roots in Hong Kong worked to its advantage.

Brand positioning: While localisation is important, many retail brands in the West have successfully established themselves in Asian markets by staying true to their brand’s core values. Sometimes, it works just being yourself, and brands like Louis Vuitton and Ikea have proven this to be true. Similarly, Coca-Cola, a company that represents the American culture and free spirit that becomes an aspiration for consumers’ the world over, views its Western origin as a competitive advantage.

Market: An attractive product offering and a unique brand positioning must be accompanied by a strong and robust distribution model. Taking into account the different levels of urbanisation and the difficult- to-access consumers in remote areas, Procter & Gamble has developed an enviable distribution network that relies on local partners. The same strategy was used by Volkswagen when it entered China by creating a local partnership.

Delivering on customer centricity

Looking at the successes of these global brands, two questions naturally comes to mind: How can a company create a client-centric brand? What does it mean for a brand to be successful globally?

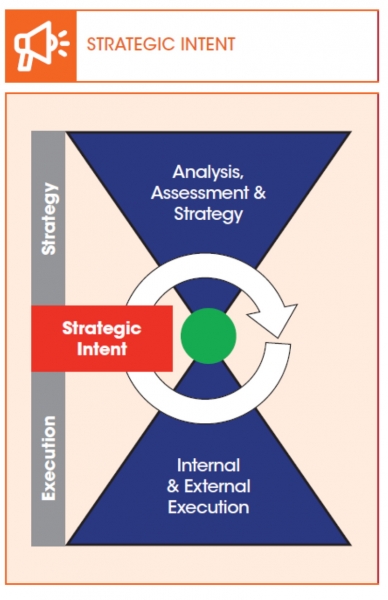

STRATEGIC INTENT

Before a company can identify the drivers of enhanced customer experiences, it needs to define its strategy, brand, and target customer. A distinct, strong, and differentiated strategic intent will include knowing:

- Who your customers are

- What they want

- What you will give them

- What you communicate to them

- How you will service them

- How you will make money

Once all parameters of strategy have been identified, the board’s role is to plan the internal and external execution of the strategy. This requires striking a balance between the company’s internal and external focus; among people, time, and resources; and between risk and rewards. It is easier to strategise on expanding markets, geographies, and product lines and solutions, but it is harder to make tough decisions on what lines to drop and what geographies to exit from. As Professor Michael Porter said, “The essence of strategy is choosing what not to do.”

A brand must be built on authenticity and must be able to tell a convincing story that target consumers can relate to. The Jim Thompson Company from Thailand is a well-known Asian brand with great potential to become a strong international lifestyle brand. The brand is primarily built on three pillars. The first is the legend surrounding the founder Jim Thompson, an American soldier who settled in Thailand and his eventual mysterious disappearance. The second is the unique blend of Eastern tradition and heritage with Western contemporary designs based on traditional Thai symbols and patterns. And the third is the elevation of the brand from a cottage industry product to a fashion and lifestyle concept. By developing the brand on these three pillars, Jim Thompson has been able to maintain its differentiation and build a strong brand. The brand is perceived to be highly authentic, and of high quality and a strong heritage.

COMMUNICATING THE BRAND MESSAGE

Having a strong brand message must go hand in hand with the ability to consistently communicate and live up to that message. Since 1973, Singapore Airlines’ primary message, ‘A Great Way to Fly’, has been consistently conveyed in exclusive print media and also in selected TV commercials of very high production value to underline the quality aspects of the brand. All communication messages are conveyed through the iconic Singapore Girl in different themes and settings. When Singapore Airlines launched its comfortable SpaceBed seats in business class, it ran a 60-second commercial of a highly emotional and mythical character to underline the aspiration of the brand and the Singapore Girl, and to set the airline brand apart from the competition. Singapore Airlines chose to focus on one aspect of the experiential brand strategy–in-flight hospitality and warmth featured by the Singapore Girl—rather than communicate all the brand benefits through its messages: a dangerous trap that many brands often fall into in their efforts to communicate all at once. This has led to a focused and consistent message for Singapore Airlines for almost half a century, a great achievement for any brand.

LEARNING FROM CUSTOMERS

Developing a customer-centric brand requires learning how customers feel about your company and brand. In an effort to inspire and design more personalised, human-oriented vehicles, the now Chinese-owned car brand, Volvo, created a Facebook app called ‘You Inside’, which asked drivers to share how they used the space inside their cars. By uploading images of items inside their cars, describing how they were organised, and sharing profile information about their lifestyle, the app inspired a number of subtle innovations for later Volvo models and, more importantly, resulted in a notable boost in customer appreciation and overall brand affinity.

Lindsay Owen-Jones spent over 30 years with L’Oreal as its CEO and chairman of the board. He was notoriously obsessed with customer insights and spent a significant proportion of his executive time on the road visiting, interviewing and observing global L’Oreal consumers in their natural environments. These insights, along with Owen-Jones’ visionary leadership, were the two main drivers of his success, and the secret behind the global rise of L’Oreal.

When the Fullerton Hotel opened in Singapore, the cleaning lady observed than one particular customer, an elderly lady from Hong Kong, had telephone books stacked up in front of her bed. She patiently put them back during the customer’s stay every month. She wondered why that was so and notified the manager. They realised it was because the hotel beds were very high. The hotel then made steps out of Indonesian wood, put it by the bed for the customer’s next stay, and put up a sign that read ‘Welcome back’. Such small efforts have huge impact and create total loyalty.

INNOVATION

Complacency is not an option for even the strongest of brands. Innovation, be it in its products, processes, or experiences, is the hallmark of all leading companies. Consumers the world over are constantly looking for something new and are willing to pay a premium for it. A prime example of this is when LG Household & Health Care introduced Frostine, the luxury chilled cosmetic, in South Korea. Since the ingredients required cold storage, LG also introduced a specialized cosmetics fridge called an Icemetic Cellar, which was the first of its kind. Despite the exorbitant price tag, LG’s overall cosmetic sales recorded a 300 percent growth in a single month after its launch. Similarly, when Sulwhasoo’s Dahamsul Cream, a super-premium anti-ager with caviar ingredients, debuted on the home shopping channel, it sold more than 2,000 sets within 40 minutes and was frequently sold out for six consecutive months following its launch.

As a competitive necessity, Amorepacific, the Korean cosmetics company, invested heavily in research and development while staying true to its roots with an ongoing focus on natural ingredients. In 1966, it was the first company to use ginseng, a common ingredient in Asian traditional medicine, as a base for cosmetic products. In 1979, it was the first in the industry to cultivate a tea garden, an initiative that later spearheaded the world’s first skincare line based entirely on green tea.

ADAPTABILITY AND AGILITY

To create a globally competitive customer-centric brand, adaptability and agility are two key factors. Nespresso built a global brand by reinterpreting how consumers connect to and consume coffee. It created an entire new category, as the brand adapted to the home environment and brought a professional feel to coffee consumed at home.

Greater customer centricity needed in Asia

There are very few Asian brands on the global stage. This is partly because a large part of Asia’s economic development, until now, has been attributed to low-cost advantages and outsourced manufacturing. While Asia’s cost advantages have enabled home-grown Asian companies to gain market share, low cost alone no longer provides a significant long-term advantage. The intense cut-throat competition in global industries has resulted in tremendous pressure on margins, forcing companies to look for additional measures to survive and grow their businesses.

THE TURNAROUND OF LEGO: CONSUMER INSIGHTS FOLLOWED BY INNOVATION

Through the late 1990s and early 2000s, Lego’s attempts to combat the rise of video games by becoming a lifestyle brand led the Danish company to become over-diversified and nearly bankrupt. The Lego company is fully owned by the original founder family, and the chairman of Lego, Kjeld Kirk Kristiansen, decided to change its course significantly. Kristiansen brought in global management consulting firm McKinsey & Company to help facilitate a new successful business strategy for Lego. The McKinsey team comprised a young Danish consultant, Jørgen Vig Knudstorp. He quickly caught the watchful eye of the ambitious chairman and the board, and Knudstorp was hired into the internal strategy team of Lego along with other McKinsey colleagues.

When Knudstorp was appointed CEO of Lego in 2004, he pledged to get closer to Lego consumers who had lost their connection with the once-famous brand. Knudstorp realised that Lego needed to better understand the phenomenon of play and creativity among both adults and children, as the art and skill of play and creativity are the core competencies of Lego. The new CEO dispatched ‘anthro-teams’ (teams of anthropologists) across Germany and the U.S. to observe customers in the comfort of their own homes, shop with them, and listen to their stories.

Lego researchers found that their consumers were very different from what was previously understood from focus groups. Having been invited to participate in controlled playtime or to test prototype products, focus group participants were not playing the way they would at home, but were drawn to the newer systems they thought they should be playing with, thereby giving Lego false positive results. Previous research results and insights were highly biased.

The most vital insight from Lego’s embedded anthropologists was what made Lego so beloved. Users play with Lego bricks not only for the freedom to experiment but also to achieve mastery of their building skills. Lego is a medium rather than a toy. From a pile of simple, interlocking, coloured Lego bricks, any exciting adventure could easily be created. Thus began Lego’s return to making Lego bricks for people who loved them for what the Lego brand stood for. By going ‘back to the brick’, refocusing on core Lego products, and divesting the business units that are not essential to their customers’ core values, the Lego company began its return to profitability and valuable brand equity.

High-quality service and innovation are by far the bigger sources of competitive advantage compared to low-cost operations.

To break out of this shell and see the emergence of strong Asian brands globally, customer centricity must become the core of Asian brand strategy. Three aspects of branding are clear. The first is that the role of branding has grown beyond the narrow definitions of marketing. The second is that, for a company to fully realise the potential of a brand, it must create an environment and support system that would enable the brand to fulfil its multiple roles. The Asian boardroom and executives need to step up to the challenge and let marketing take centre-stage in their companies. And finally, understanding consumers is the key to future strategy, improved design processes, marketing effectiveness, and financial profitability. A constant dialogue with customers and paying attention to their needs is the next frontier for Asian companies that will enable them to compete globally, sustain competitiveness, and command customer loyalty.

The branding implications are very strategic and influence the very nature of business. Such a function cannot be left to middle-level marketing executives who would not understand the holistic perspective and appreciate the greater role branding plays in the larger scheme of things. The CEO, in consultation with his senior management team, should provide consistent teeth to the branding function. Only then would the corporate board have the necessary information to decide on such strategic issues.

Samsung, Hyundai, Amorepacific, and Singapore Airlines are prime examples of Asian brands that are customer-centric and brand-driven, but many more Asian companies need to follow. It would be the strong initiatives from CEOs and corporate boards that would anchor and sustain brands in the highly competitive global market.

Martin Roll

is the founder and CEO of Martin Roll Company which consults on strategy, business development, branding and marketing. He is an advisor to several global boards, a Distinguished Fellow at INSEAD Business School and Former Senior Advisor to McKinsey & Company

References

1. Martin Roll, “Asian Brand Strategy”, 2015, Palgrave Macmillan.

2. Ibid.