Policymakers need to be equipped with tools to analyse economic developments and make sound policy decisions.

Asia is the most dynamic region of the global economy. High rates of economic growth are leading to rapidly rising living standards. Technological innovation—ranging from mobile banking to automation, robotics and cryptocurrencies—is transforming the way that economies function. And integration, both economic and financial, is making countries increasingly dependent on one another.

And while these changes have no doubt contributed to Asia’s dynamism, they also bring challenges. A key challenge is for policymakers to adapt to this evolving environment, build on recent successes, and continue to lay the foundation for strong, sustainable and inclusive growth throughout the region. Meeting this challenge requires policymakers, at all levels of government, to be equipped with the know-how and capacity to formulate and execute appropriate economic and financial policies. This in turn requires a programme of capacity development geared towards addressing the challenges. Capacity development consists of technical assistance that helps governments put in place, or enhance the effectiveness of, institutions and policies; as well as training that helps strengthen the skills of government officials to analyse economic developments and formulate appropriate policies.

Asia encompasses economies from across the development and population spectra. High-income countries like Japan, Korea and Singapore share economic and financial ties with low-income countries such as Myanmar and Lao PDR. And global giants such as China and India with populations exceeding one billion sit alongside small states such as Palau and Tuvalu, with populations of less than 25,000. Capacity development activities in Asia, therefore, must take into account this diversity and the challenges therein.

Strong growth, but not without challenges

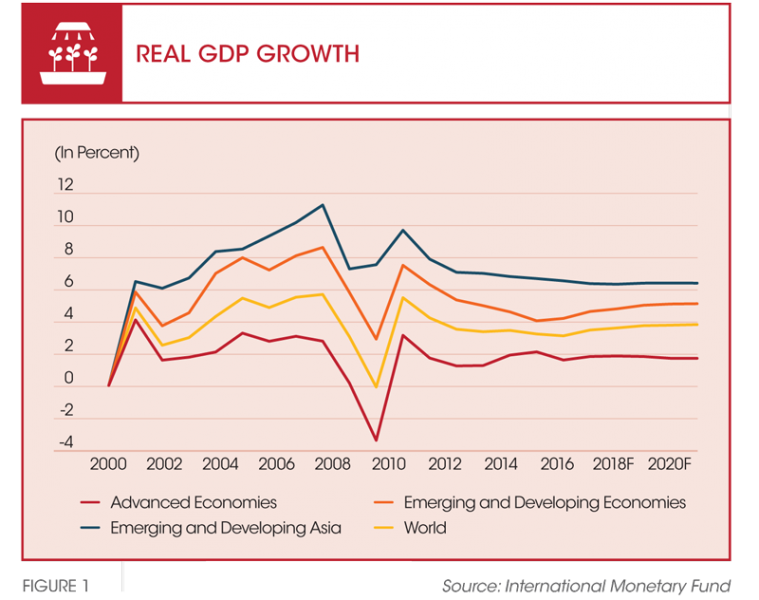

According to the International Monetary Fund (IMF), Asia continues to lead global growth and its economy is projected to expand by about 5.3 percent this year (refer to Figure 1).1

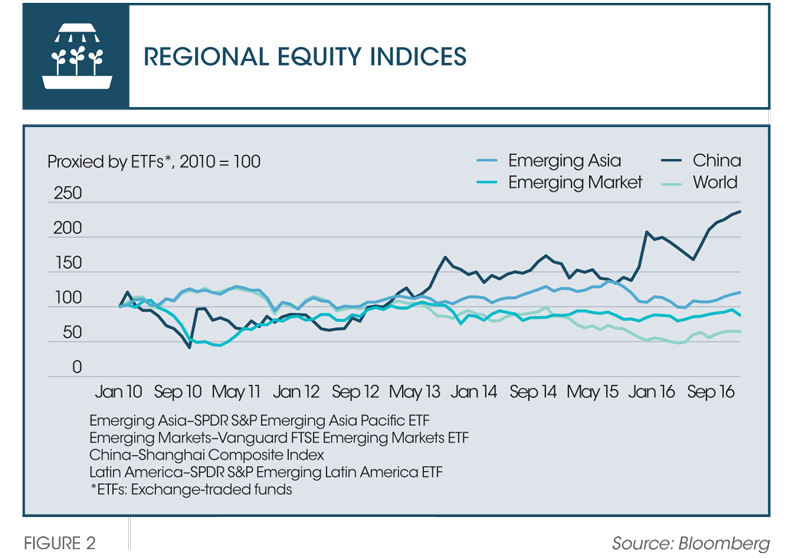

Asian financial markets have been resilient—despite volatile capital flows, stock markets are buoyant and capital flows into the region have resumed (refer to Figure 2). And Asia’s exports are set to benefit as global growth recovers. But despite Asia’s role as the global economic powerhouse, the region’s economic growth has been slowing since 2010.

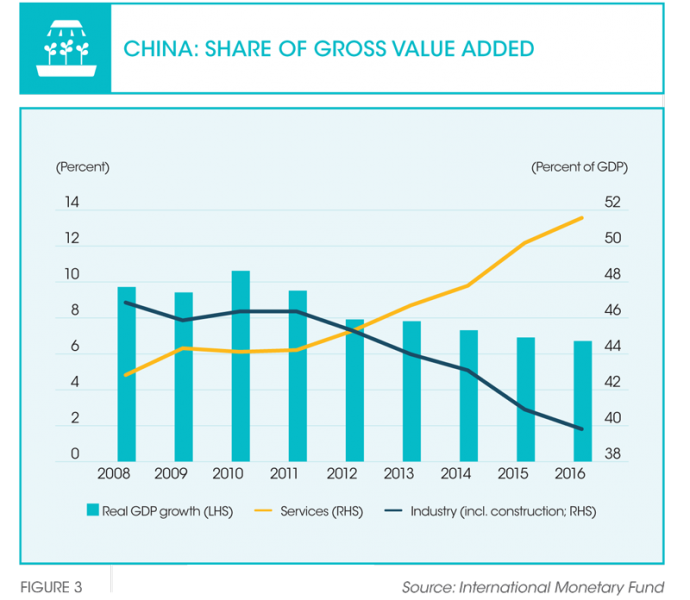

A key reason for the growth slowdown revolves around China’s transition to a more service- and consumption-based economy from a manufacturing- and investment-based one (refer to Figure 3). The country’s slower growth, while good for the region in the medium term, creates risks to short-term growth. Countries that are more exposed to China’s manufacturing and investment-related sectors, or to regional value chains, are likely to be most affected. At the same time, China’s rebalancing from investment to consumption will continue to create opportunities for exports of services, including tourism, and labour-intensive, low-cost production from other Asian countries.

On top of regional headwinds to growth, Asian economies are also grappling with higher interest rates—notably driven by monetary policy tightening conducted by the U.S. Federal Reserve Board—and continued sluggish growth in advanced economies. Since many Asian economies are highly open to international trade and finance, they are particularly sensitive to these global developments. A possible shift toward protectionism in major trading partners is also perceived as a substantial risk to the region.

Climate change and natural disasters are an important challenge for the Small States and Pacific Island countries. The cyclone in Fiji in 2016 and the earthquake in Nepal in 2015 showed that natural disasters can severely disrupt economic activity in those economies.

Over the longer term, Asia’s slowing productivity growth, ageing population and rising income inequality could weigh on economic prospects, giving rise to concerns about the so-called ‘middle-income trap’—a situation in which countries are unable to continue to raise living standards once they have reached a level of per capita income of 30 to 40 percent of that of advanced economies. In addition, technological change will continue to transform economies and financial sectors, creating opportunities, such as expanding access to financial services; as well as challenges, like replacing low-skilled jobs with automation. This consequently disrupts economic development patterns that rely on the migration of labour-intensive industries from countries with higher production costs to those with lower costs.

In terms of macroeconomic policy, Asian policymakers are aiming to strike a balance between supporting growth and reducing vulnerabilities. Slower growth and, in some cases, low inflation, suggests that there is scope for fiscal and monetary policy support in many countries. At the same time, macroprudential policies—which aim to address risks to the financial sector as a whole—should be used to safeguard financial stability. Thus, while each country will need to find the right mix of policies for its individual circumstances, a comprehensive and consistent set of policies can contribute to sustainable and balanced growth.

Building capacity to meet challenges

Given the outlook and challenges for Asia, policymakers need to be fully equipped with the tools to analyse economic developments and make sound policy decisions. Capacity development is therefore essential, although there are differences in requirements based on the level of development of countries.

MIDDLE-INCOME COUNTRIES

Emerging market countries (also known as middle-income countries) in Asia are looking to strengthen institutions and analyse risks—both of which are essential to maintain strong, sustainable and inclusive growth. Many of these countries are highly integrated into the regional and global economy and financial markets. Thus, while they benefit from trade and financial ties with Asia and the rest of the world, they are also susceptible to global and regional shocks. Specifically, Asian emerging market countries are looking to improve financial sector regulation and supervision, strengthen the conduct of monetary policy, and enhance fiscal policy implementation.

The Asian financial crisis of the 1990s and the global financial crisis in 2008/09 underscored the importance of sound financial sector policies, notably regulation and supervision. Building capacity in these areas has been a priority for policymakers in many Asian countries. After the Asian financial crisis, countries like Indonesia, South Korea and Thailand undertook substantial reforms, including to their banking systems, to put them on a sound footing. This was one of the factors that enabled economies in Asia to weather the global financial crisis relatively well. The crisis also brought macroprudential policies to the fore. Thus, technical assistance, which provides specific advice on macroprudential policies or the institutional framework for them, has been important. Similarly, training on the implementation of these policies has been widely delivered in the region.

As Asian countries moved away from managed exchange rate regimes, they have increasingly looked to strengthen the conduct of monetary policy. For many countries, including Indonesia, South Korea, the Philippines and Thailand, this has meant moving to an inflation targeting regime or inflation targeting ‘lite’ regime. Inflation targeting (as well as inflation targeting ‘lite’) requires central banks to have the tools and mandate to conduct monetary policy with a view to achieving an inflation target. Technical assistance and training in this area helps ensure that government and central bank officials are able to forecast inflation, manage liquidity, and understand how interest rate decisions taken by the central bank are transmitted to the broader economy (for example, through deposit rates or bank lending) in order to implement a forward-looking monetary policy.

Asian policymakers are seeking ways to increase public investment in infrastructure, health and education. These investments are critical for countries to continue to raise living standards and avoid the ‘middle-income trap’. Creating fiscal space to increase spending in these areas often requires reforms and changes to budget implementation, including reductions in less efficient types of public spending and increases in tax revenue collection. This would make greater spending possible while still keeping fiscal deficits and public debt in check. For this reason, Asian officials are seeking to build capacity in the area of fiscal policy management by bolstering revenue administration, improving the equity and efficiency of tax systems, strengthening budget implementation, and advancing subsidy reform.

LOW-INCOME AND FRONTIER MARKET COUNTRIES

The capacity development needs of low-income and frontier market countries in Asia differ somewhat from those of emerging markets. Many of these countries are in a process of transition towards more market-based economies. Thus, they are focused on the fundamentals of institutional capacity to enable effective policy implementation in the core areas of monetary, fiscal and financial sector policies. This often involves technical assistance and training to develop skills for designing macroeconomic frameworks, with special attention to the issues facing low-income countries.

On monetary policy, low-income and frontier market countries in Asia such as Cambodia and Lao PDR are grappling with issues including dollarisation, building central bank credibility, and developing interbank markets (which are essential for the transmission of monetary policy to the wider economy). Often, there are structural impediments to the conduct of monetary policy as well, including thin liquidity in foreign exchange and other markets, segmented banking systems, and bank lending that is not always market-based. Technical assistance and training is therefore geared to building capacity to address these issues as reforms are implemented.

On fiscal policy, many low-income and frontier market countries in Asia are seeking to improve budget execution, tax collection and fiscal forecasting. Technical assistance tends to focus on country-specific advice to improve fiscal implementation, often in the area of public financial management and tax administration. Training in the fiscal area generally focuses on the fundamentals of fiscal policy design and methods for fiscal forecasting. Indeed, many low-income and frontier market countries in Asia—including Cambodia, Lao PDR, Mongolia, Nepal, Timor-Leste and Vietnam—have sought to develop capacity in the areas of tax administration, treasury management and budget planning.

Finally, on financial sector policies, low-income and frontier countries are seeking to improve financial regulation and supervision in underdeveloped, yet often rapidly growing, financial sectors. For many of these countries, the banking system, like the rest of the economy, is transitioning towards a more market-based system. And some countries, notably Cambodia, Lao PDR, Myanmar and Vietnam, face the added challenge of managing financial development and financial integration (with the rest of Asia or the rest of the world) at the same time. Technical assistance and training is therefore focused on strengthening regulatory and supervisory skills across all key agencies.

The IMF’s contribution to capacity development in Asia

Capacity development is one of three mandates of the IMF, along with policy advice (regular economic ‘health checks’ of all member countries and the global economy) and lending. Building human and institutional capacity within a country helps governments implement more effective policies, leading to better economic outcomes. Between May 2015 and April 2016, low-income and developing countries received about half of all IMF technical assistance (versus about 40 percent for emerging market and middle-income countries), while emerging market countries received the largest share of IMF training (just over half).

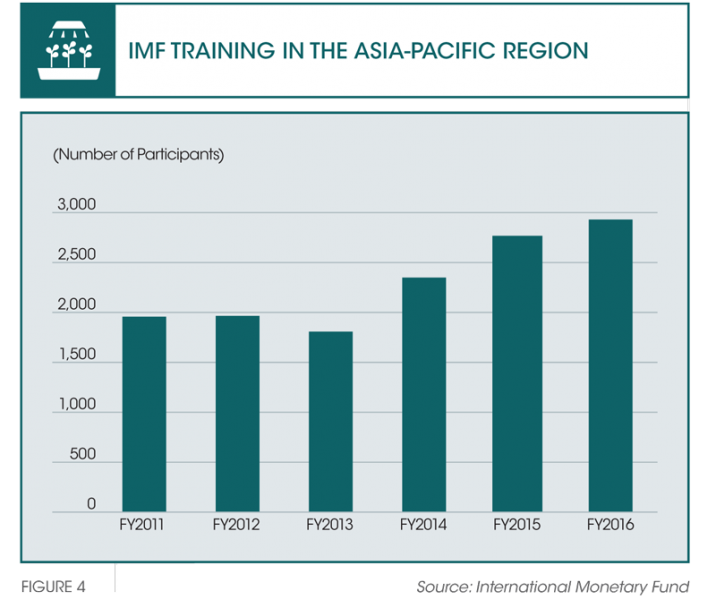

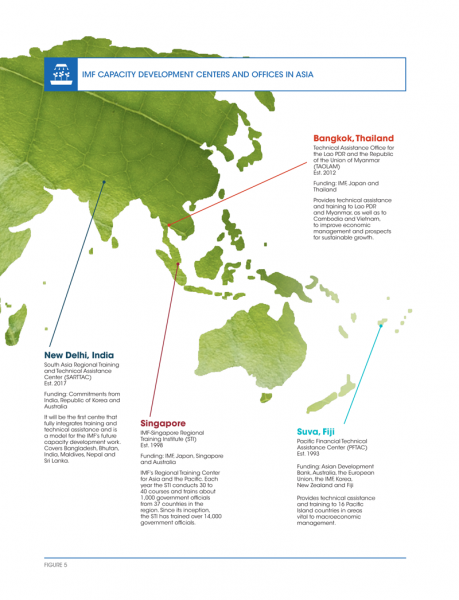

The IMF provides technical assistance to countries in its areas of core expertise: macroeconomic policy, tax policy and revenue administration, expenditure management, monetary policy, the exchange rate system, financial sector stability, legal frameworks, and macroeconomic and financial statistics. Training is delivered to government officials in a number of areas, including macro-financial linkages, monetary and fiscal policy, balance of payment issues, financial markets and institutions, and statistical and legal frameworks. Within Asia, the IMF delivers technical assistance and training through Regional Technical Assistance Centers, Regional Training Centers, or technical assistance offices (refer to Figures 4 and 5). The IMF’s Office of Asia and the Pacific, located in Tokyo, Japan also holds workshops and seminars for government officials in the region.

Through these centres and offices, the IMF has helped countries strengthen capacity across a wide range of areas. The Pacific Financial Technical Assistance Center has supported the Pacific Island countries, such as Cook Islands, Fiji, Kiribati, Nauru, Palau, Samoa, Tonga and Vanuatu, to strengthen domestic revenue mobilisation and facilitate inclusive growth by promoting fairer, more efficient taxation. It has also supported Fiji and Vanuatu in upgrading their macroeconomic and projection frameworks and using them in policy analysis.

Training has been adapted to the evolving needs of the region. In addition to the training offered at its facility in Singapore, the IMF-Singapore Regional Training Institute has stepped up its delivery of in-country training customised to the needs of its course participants. Recent examples include the delivery of a one-day workshop for parliamentarians from Myanmar, a course on macroeconomic diagnostics for Indonesian officials, and another on monetary and exchange rate policies for officials from Cambodia, Lao PDR, Myanmar and Vietnam.

The Technical Assistance Office for the Lao PDR and the Republic of the Union of Myanmar (TAOLAM) has helped Cambodia, Lao PDR, Myanmar and Vietnam through a programme of country-specific technical assistance and training. For example, with TAOLAM’s support, Myanmar has reformed its central bank and foreign exchange market, developed monetary policy tools, set up a large taxpayer office, begun modernising tax collection and expenditure management, strengthened the anti-money laundering regime, established a macroeconomic monitoring group, and built a statistics programme.

A strong foundation, but more work needs to be done

In many countries, macroeconomic policy frameworks have been upgraded and policy implementation has been sound. Going forward, the region will face new challenges. Some of these challenges will arise from the significant economic transition underway in China, while others will reflect global economic and financial developments. And over time, homegrown challenges—such as population ageing and income inequality—will also come to the fore.

To meet these challenges, policymakers will need the skills and tools to implement macroeconomic and financial policies prudently and nimbly. For all countries in the Asia-Pacific region, continued efforts to strengthen capacity in the areas of monetary, fiscal and financial sector policies will help support reform agendas aimed at making economic growth both sustainable and inclusive. Asian emerging market countries will also need to continue to boost capacity to analyse risks in today’s rapidly evolving global economic environment, including the use of cutting-edge tools and models to capture complex economic and financial interlinkages. Low-income and frontier economies will need to continue to focus on enhancing capacity in the fundamentals of macroeconomic policymaking, such as by developing macroeconomic frameworks to assess policies and outcomes.

Capacity development activities can help these countries design and implement economic policies that foster stability and growth by strengthening their institutional capacity and skills. Stability and growth are essential for Asian economies to continue to raise living standards and build on their economic success to date.

Reference

1. International Monetary Fund, “World Economic Outlook Update”, January 2017.