Transforming industries, enriching lives and propelling progress.

The digital sector has emerged as the leading driver of innovation and growth across the world. There isn’t a single business sector, or aspect of human life, that hasn’t been touched by the digital revolution we have seen in recent years. This has been driven by two major factors. Firstly, Internet penetration has increased rapidly, with two-fifths of the world’s population now online. Secondly, developments in technology have made smartphones and tablets more powerful and, equally important, more affordable. Access and affordability are particularly significant for emerging markets.

This is where the Association of Southeast Asian Nations (ASEAN) bloc has an opportunity to leapfrog to the forefront of this technology wave. It has the potential to enter the ranks of the top five digital economies in the world by 2025. The implementation of a proper digital agenda and strategy could add US$1 trillion to ASEAN’s GDP over the next decade. At current GDP levels, that is an impressive 40 percent growth to its overall output by 2025.

The opportunity

ASEAN is a ten-nation bloc with a combined population of more than 600 million, 94 percent of whom are literate. Further, 50 percent of ASEAN’s population is under 30 years of age, and 90 percent of these people have access to the Internet. This is the group that is technologically savvy and most likely to contribute to the growth of the digital economy—by using the Internet for anything from shopping and banking to hailing a taxi and booking a hotel, or even finding a partner with the fast-growing number of dating apps.

With the bloc’s combined economy currently valued at US$2.5 trillion and projected to grow 6 percent per annum over the next decade, this segment of users (30 years and below) is likely to see their income levels rise, giving them more disposable cash. The continued developments in technology would open up even more avenues for them to spend this extra money.

The impending implementation of the ASEAN Economic Community (AEC) could boost the growth of the digital sector even further. The AEC will see the region become a single market with free movement of goods, services and skilled labour, and free flow of capital.

This is likely to open up new growth opportunities for businesses, which in turn will create more jobs. That means more people will be making money, some of which will be spent to fuel economic growth in the region.

Additionally, governments across the region have been making efforts to build information and communications infrastructure. Their investments in such projects have been growing at a compound annual growth rate of 15 percent over the past five years, with US$100 billion invested in 2015 alone.

The hurdles

However, the region will have to overcome various roadblocks to fulfil its growth potential. The first is limited broadband access in rural areas. A vast population, especially in countries like Indonesia, Thailand, the Philippines and Vietnam, lives in rural areas where Internet connectivity remains relatively poor.

Second, a large number of consumers in the region, especially in countries like Indonesia, still lack access to proper banking facilities. This limits their ability to make payments online and hinders the growth of the sector. Even among those who have access to banking services such as credit and debit cards, there is a reluctance to conduct transactions and share their financial details online. Except for Singaporeans, ASEAN citizens are 10-30 percent more reluctant to share their financial information for an online purchase compared to the global average.

Third, current regulatory frameworks are not harmonised between local and international players, which is hurting business. For example, in Malaysia, Government Sales Tax, GST, is not imposed on international transactions, disadvantaging local players. Meanwhile, Indonesians are subjected to one of the highest import tariffs for manufactured goods in the region. Even within ASEAN, varying taxes and duties are imposed on online purchases.

Finally, except for Singapore, Malaysia and the Philippines, none of the ASEAN member countries have a comprehensive digital strategy in place. Until policymakers can develop a comprehensive plan to tap into the digital economy, they are unlikely to notice or tackle the hurdles they face. As a result, these obstacles won’t be overcome and the region may not achieve its full potential.

DIGITAL STRATEGIES—SINGAPORE, MALAYSIA AND THE PHILIPPINES Singapore has announced a masterplan, iN2015, aimed at navigating the nation’s transition into “An Intelligent Nation, A Global City, Powered By Infocomm”.1 The blueprint sets out clear objectives and targets including: • To be #1 in the world in harnessing infocomm to add value to the economy and society • To realise a twofold increase in the value-add of the infocomm industry to S$26 billion • To realise a threefold increase in infocomm export revenue to S$60 billion • To create 80,000 additional jobs • To achieve 90 percent home broadband usage • To achieve 100 percent computer ownership in homes with schoolgoing children Malaysia’s digital strategy, called Digital Malaysia, also sets out tangible outcomes and targets.2 It aims to: • Raise Malaysia’s ICT contribution to 17% of gross national income from 9.8% in 2012 • Raise its position in the Digital Economy Rankings to the top 20 from 36th position in 2012 • To be within the top 10 economies in the World Competitiveness Yearbook, from 16th position in 2012 Malaysia has also announced a Digital Malaysia 354 Roadmap that represents three ICT focus areas, five sub-sectors and four Digital Malaysia communities. The DM354 Roadmap will focus on Big Data Analytics and education, amongst other sectors. The Philippines’ digital strategy focuses on improving Internet connectivity across the country by reducing the geographical digital divide and ensuring affordability. It has set clearly defined targets on this front including:3 • Universal broadband access for all public schools by 2016 • All central business districts to have broadband coverage with average download speeds of 20 mbps by 2016 • Broadband access with average download speed of at least 2 mbps for 80 percent of household customers throughout the country by 2016 At the same time, the Philippines is also focusing on upgrading and improving government ICT infrastructure and procedures to allow for integrated government operations. |

The solutions

The first thing that policymakers across the region need to do is to develop a comprehensive digital strategy, not just at the country level, but for the entire region. In terms of specific steps, they should look at the following areas to address both the supply- and demand-side challenges:

TRIGGER A BROADBAND REVOLUTION

Policymakers should prioritise universal broadband access by improving the business case for investing in digital infrastructure in rural areas and promoting digital literacy and awareness of the benefits of a digital society. Telecom operators in ASEAN have been investing heavily to meet the rapidly growing demand for data traffic and connectivity. Over the next four years, up to US$46 billion will need to be invested in just the six major ASEAN economies alone–Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam. However, some of these investments don’t come with a commensurate increase in revenue due to the growing competition from over-the-top players.

It is important to ensure that this issue is addressed quickly. This can be done by releasing an additional 700 MHz of spectrum, which will help to ensure that telecom operators have the scale to make their investments profitable in the long run. At the same time, it is also important to have healthy industry economics to further encourage operators to invest in infrastructure, especially in rural areas. This can be done by limiting the number of mobile operators to four per country.

ACCELERATE INNOVATION IN MOBILE FINANCIAL SERVICES

ASEAN needs to reduce its reliance on physical cash to enable wider and deeper participation in the digital economy. For this, the region’s regulatory frameworks would need to be revamped to enable greater innovation in financial services and transactions, taking advantage of the widespread use of smartphones in the region.

There are three sets of regulations that are critical to foster mobile financial services: first, industry-friendly and practical sector-specific regulations to nurture mobile financial services; second, horizontal regulations relating to cybersecurity, privacy, data protection and e-signatures that are valid across sectors; and third, clear and simple regulations around digital payments that are harmonised across ASEAN to facilitate cross-border trade and remittances.

Forward-looking countries are moving towards fully digital banks. However, in many ASEAN countries, the debate is still focused on bank-led versus operator-led models. Policymakers should allow for creation of digital-only banks and aim to scale up existing mobile payment systems. This will help to improve financial inclusion across the region.

Countries across the region can look at Australia as an example. It has been one of the fastest adopters of technology in the banking sector. Nearly 80 percent of the population has a debit card, and mobile banking has been gaining popularity. Australia ranks sixth in the world for its share of non-cash payment, with 86 percent of all transactions now being cashless. The opportunity on this front is huge. In Europe—the fastest growing region in the world for financial technology (Fintech)—the market for such services grew 215 percent in 2014, to US$1.5 billion. A large part of that was made possible by rules that permit the establishment of digital-only banks.

DEVELOP SMART, CONNECTED CITIES

Across ASEAN, 34.5 million people are expected to migrate to cities by 2025, increasing the urban population by 25 percent. This influx will intensify existing pollution and traffic levels, as well as the demand for energy. To address these challenges, ASEAN’s political leaders, like their counterparts elsewhere, will need to create smart cities, either greenfield or brownfield. Recent studies have shown that connectedness can add an additional 0.7 percentage points to GDP growth.

China has allocated more than US$300 billion to make 600 cities smarter. India recently announced plans to build 100 smart cities across the country, some in partnership with Singapore. If ASEAN pursues the right approach, it has the potential to create 35 smart cities by 2025. The first cities to become smarter are likely to be the largest metropolitan areas in ASEAN, where the challenges posed by rapid urbanisation are at their most intense. ASEAN governments should target cities that have a population of more than one million. This threshold is good enough to be cost effective for governments to make the smart city push. It is also important to note that, in the long run, efficiency gains achieved through making a city smart outweigh the cost of technology.

ASEAN governments can support the development of smarter cities through policy enablers—like taxation incentives for operators and service providers—that encourage the adoption of the latest connected technologies, such as smart meters and Big Data for smart policing, as well as monitoring and regulating traffic. Governments should also look at providing tax incentives for investments in Machine-to-Machine and Internet of Things technologies. If key smart city technologies are standardised across ASEAN, implementation will be quicker and more cost-effective.

ENHANCE TRUST AND SECURITY

As ASEAN aims to become a borderless digital community and everyday services move online, the risk of a security or data privacy breach will increase. For businesses too, data privacy compliance is a critical issue. Failure to comply can have reputational and financial consequences.

As such, it is important to have a resilient cybersecurity regime encompassing not just local but regional-level efforts to control cross-border incidents. Such a framework will boost public confidence in e-commerce and cross-border data transfers. ASEAN leaders should consider creating a world-leading agency to fight cybercrime. However, regulations need to be balanced and proportional, so that they don’t deter businesses from developing electronic and mobile commerce platforms.

ASEAN countries should move towards creating a national electronic identification (ID) system in each country for delivery of critical government services. Once national ID systems are in place, the next step is to digitise personal data as part of the implementation plan, so that key services can be performed seamlessly and conveniently, without the need to key in information repetitively. Lastly, these national systems should allow for cross-border identification within ASEAN, resembling the European Economic Area’s adoption of national ID cards as a travel document, entitling the bearer to the right of free movement.

ENCOURAGE ENTREPRENEURSHIP

To enhance the vibrancy of the digital economy, the region’s policymakers should work to stimulate creative investment in new Internet companies that can offer disruptive solutions and deliver unique value to consumers. These new companies should be given the freedom to innovate–but when they are at scale, they should be held to the highest standards of corporate governance and be expected to follow the same rules as conventional telecom operators with respect to interoperability, emergency calls, etc.

National regulators governing sectors such as media and telecom, as well as related ministries, should work together on this front. Some ideas for collaboration include: providing tax breaks for start-ups that are innovating and need the flexibility to keep costs low; encouraging free flow of labour in strategic sectors; employment laws to encourage the hiring of new economy skills; and government grants and subsidies (by setting up special funds) for innovative new players.

FOSTER TALENT

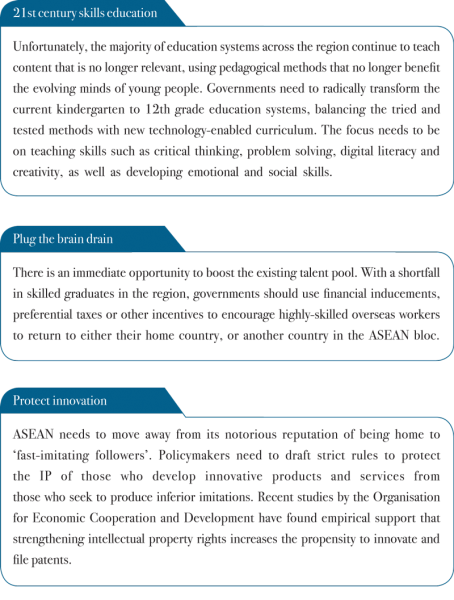

ASEAN leaders should look at a holistic policy approach to ensure there is a steady supply of skilled manpower for innovation to flourish in a sustainable manner. This will require attracting leadership, workforce development and IP protection, among other factors. The region’s leaders should look at new policy frameworks in the following areas to nurture talent:

In short, ASEAN leaders need to collaborate to establish regulations that encourage greater deployment of local and national infrastructure, capital and talent. However, they should ensure that this does not jeopardise future business cases through extensive interventionist actions. Policymakers need to strike the right regulatory balance, coupled with fair and appropriate regimes that will encourage innovation, but not at the expense of local developers or providers.

If ASEAN can implement these policies effectively, the region can be propelled into the vanguard of the digital revolution, making the member economies more competitive and enriching the lives of its citizens. Realising this opportunity should be a top priority for the AEC.